Bakken Shale | NGI All News Access | Permian Basin

Proposed Plains Oil Line Could Hurt Existing Pipe, Rail

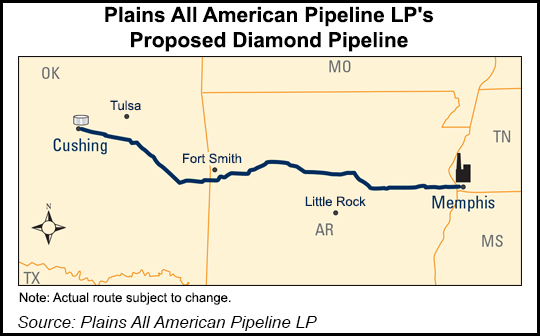

A proposal last month by Plains All American Pipeline to build the 200,000 b/d Diamond crude pipeline from Cushing, OK, to Valero’s refinery in Memphis (see Shale Daily, Aug. 22) could spell the end of existing Louisiana-to-Memphis oil shipments by pipeline and rail, according to two analyses of the proposed pipeline.

Analysts at Genscape Inc. and RBN Energy LLC separately speculated that the proposed direct west-to-east 440-mile, 20-inch diameter Diamond project could displace current pipeline shipments of crude in the 1.2 billion b/d Capline pipeline from Louisiana to Memphis and/or rail shipments to the St. James Hub in Louisiana.

The new Diamond line, which could carry light sweet crude from shale plays in various U.S. basins from the Williston to the Permian, is slated to become operational in late 2016. It is estimated to be a $900 million project.

“Other project details are pretty thin on the ground, and it looks like there will not be an open season to solicit shipper interest in the Diamond project because Valero is basically the only interested shipper for what amounts to a Cushing lateral pipeline to feed their Memphis refinery,” said RBN analyst Sandy Fielden in an analysis released Monday.

Fielden said that Plains has announced that it has a long-term shipping agreement with Valero, including storage and terminal services. In addition, Valero has an option until January 2016 to take a half interest in the Diamond pipeline.

Genscape’s Bridget Hunsucker in her analysis quoted a Valero spokesperson as saying the refinery is “looking forward to the development of the pipeline so that we can establish a direct route from Cushing to our Memphis refinery, opening another route to bring lower-cost North American light sweet rude to the plant.” Valero said that its Memphis refinery is supplied by a combination of rail and pipeline and it processes a “variety” of light sweet crudes.

In 2012, the Memphis refinery was receiving about 140,000 b/d of Bakken crude from North Dakota through a somewhat circuitous rail shipment to the St. James Hub and then pipeline transportation via Capline to Memphis.

“The transportation movement was profitable then, even with the expensive transportation costs, because of the deep discount of Bakken crudes to waterborne Gulf Coast crudes,” said Hunsucker, adding that the narrowing Bakken-by-rail margins could make it increasingly difficult to attract new rail shippers of crude to the Gulf hub.

The Diamond project would give Valero a low-cost alternative to supplies off the giant Capline pipeline, of which Plains is one of the major owners along with BP and Marathon Petroleum Corp., both the Genscape and RBN analyses noted.

“Since 2012, Valero’s Bakken volumes on Capline have likely made up a good portion of its daily flows,” Hunsucker said. Throughput volumes on Plains’ Capline interest averaged 151,000 b/d last year, an increase over the 2012 average throughput (146,000 b/d).

Hunsucker said Capline has “suffered” in recent years “as crude flows shifted to new markets to accommodate a glut of shale and Canadian crude in the center of the United States,” and she noted that the debate about reversing flows on Capline in light of the shale boom has continued.

Fielden concluded his analysis with the thought that a reversal proposal will be issued “sooner rather than later,” given the fact that Plains, with a major interest in Capline, has proposed the direct line from Cushing to Memphis, “suggesting they are looking to provide existing Capline customers with alternatives.”

Fielden said the estimated cost of getting Bakken crude to Memphis via rail and the Capline is about $15.50/bbl, compared to his estimated price for getting there via the proposed Diamond line of $9.85-10.85/bbl. That equates to nearly a half-million dollars in savings daily, Fielden said.

His analysis and the one from Genscape would argue for the already under-used Capline being a candidate for flow reversals. “A reversal would move more heavy Canadian crude to the Gulf Coast, but at the same time limit capacity to pipe growing Gulf Coast production to the Midcontinent should the need arise,” Hunsucker said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |