Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

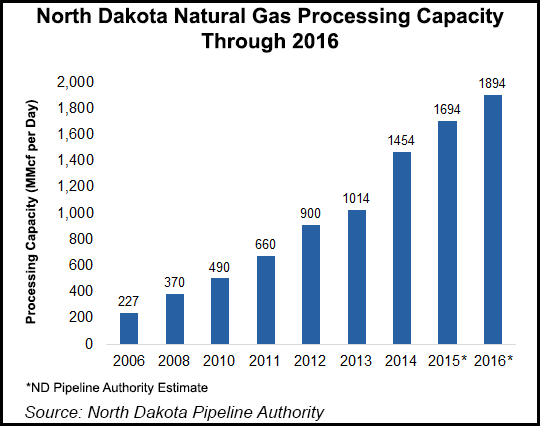

Gas Processing Capacity Rises in North Dakota

Closing in on 1 Bcf/d of gas processing capacity in North Dakota, Oklahoma-based Oneok Partners Inc. on Wednesday opened its new Garden Creek II processing plant, adding 100 MMcf/d of capacity in the Williston Basin.

This plant is one of several that are part of Oneok’s previously announced commitment to invest $7-7.5 billion in new plants through 2016 in the Williston Basin (see Shale Daily, July 31). CEO Terry Spencer reiterated the commitment to provide “essential natural gas and natural gas liquids [NGL] infrastructure in the Williston Basin.”

“Additional processing capacity is always great news; however, it will be difficult to immediately determine [Garden Creek II’s] impact given the lag in production reporting,” said a spokesperson for North Dakota’s Department of Mineral Resources (DMR), which includes the oil/gas division.

The impact on flaring will first be seen with the September oil/gas statistics, which will be released in November, the DMR spokesperson said.

Spencer said once he has board approval, he expects to announce additional Williston Basin gas processing capacity projects by the end of this year. Oneok is the Williston Basin’s largest independent operator of natural gas gathering and processing facilities.

Oneok’s gas processing capacity now exceeds 500 MMcf/d, according to Spencer, who added that will exceed 600 MMcf/d at the end of the year after the Garden Creek III plant is completed. “Increased natural gas processing capacity will lead to a reduction of natural gas flaring in North Dakota,” Spencer said.

The Tulsa-based company is now on track to build additional gas processing capacity in North Dakota to exceed 1 Bcf/d by the third quarter of 2016, or double its current processing capacity in two years. There are at least three other projects besides Garden Creek III’s additional 100 MMcf/d in the fourth quarter this year. The three are:

These will round out the previously mentioned investments of up to $7.5 billion through 2016, including $3.8-4.3 billion in gas gathering and processing projects, and about $3.2 billion in NGL projects. “Nearly $4 billion is for growth projects related to resource development in the Williston Basin,” Spencer said.

For Oneok Partners, the aggregate of these projects is projected to generate adjusted earnings-before-interest-taxes-depreciation-amortization of five to seven times the initial investments.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |