Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Analysis: $90B Value Left in Marcellus, Another 25K Wells by 2035

The Marcellus Shale holds about $90 billion of remaining value, and the top 20 operators working in the play are expected to drill 25,000 wells there through 2035 at a cost of nearly $110 billion, according to research by the energy consulting firm Wood Mackenzie.

The firm said its researchers divided the play into 16 sub-play areas before using its proprietary well analysis tool. Their findings indicate that the Marcellus will have “a strong future of continued growth,” Wood Mackenzie said Wednesday.

“Although rig counts have fallen across the Marcellus since early 2012, we can see that improved efficiency and a renewed focus on the play’s core sub-plays have led to ongoing growth. Well results are improving, with estimated ultimate recovery [EUR] in the top areas increasing by approximately 10% since 2013, thanks to the use of longer laterals and high-volume completions.”

Taking into consideration the higher EURs, Wood Mackenzie raised its forecast for 2020 production by 42.9%, from 14 Bcfe/d to 20 Bcfe/d. The firm also estimated that the Marcellus will soon account for nearly 25% of total U.S. shale gas supply.

According to the firm, drilling and completion costs were typically ranging from $6 million to $9 million across the 16 sub-plays.

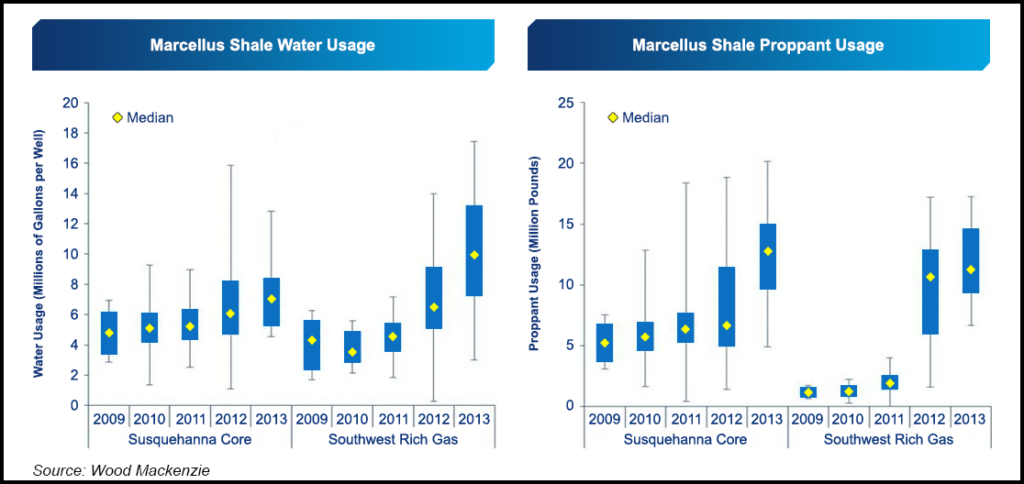

Two graphics released by Wood Mackenzie illustrated operators’ increasing use of water and proppant in two of the 16 sub-plays: the Susquehanna Core are and the Southwest Rich Gas area.

Water usage had increased substantially in the Southwest Rich Gas area. Operators there used a median average of about 4 million gallons per well in 2009 (with a range of 2-6 million gals/well), but by 2013 the median had increased to about 10 million gals/well (7-13 million gals/well). In the Susquehanna Core, median water usage increased from less than 5 million gals/well in 2009 to about 7 million gals/well in 2013.

The expanded use of proppant was also noteworthy in both areas. In the Southwest Rich Gas area, the median use of proppant increased from about 1 million pounds of sand per well in 2009 to about 12 million pounds in 2013. Susquehanna Core usage of proppant increased from about 5 million pounds of sand per well in 2009 to about 13 million pounds in 2013.

“Proppant usage increased by 58% between 2012 and 2013 alone,” Wood Mackenzie said. “This relatively recent practice, coupled with efficiency gains have led to flat, or increasing, well costs.”

The firm said its well analysis tool shows Citrus Energy Corp. drilled some of the largest wells in the Susquehanna Core, prior to its acquisition by Warren Resources Inc. in July (see Shale Daily, July 8). But Wood Mackenzie said Cabot Oil & Gas Corp. is still tops in the Susquehanna area in terms of drilling, acreage held and cumulative production (see Shale Daily, Aug. 19).

“Whilst the Susquehanna Core has so far produced the top-performing dry gas wells in the Lower 48, given its size, we believe there is limited running room and that most near-term growth will come from the liquids-rich sub-plays in southwest Pennsylvania and West Virginia,” Wood Mackenzie said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |