Infrastructure | Daily GPI | NGI All News Access | NGI The Weekly Gas Market Report

Deep Marcellus Points Win in Capacity Buildout, Morningstar Says

As pipelines scurry to develop takeaway capacity from the oversupplied Marcellus/Utica shale region, a Morningstar Commodities Research analyst said the consequences of development will be both bullish and bearish for prices, depending upon where one’s gas lands.

“As firms…expand pipeline takeaway capacity from the Marcellus and Utica shales, the most pressing question for producers, traders and end-users is: What is the impact on gas basis?” said Morningstar’s Jordan Grimes, senior commodities analyst for power and gas, in a report published Tuesday.

The slate of current takeaway capacity projects looks most bearish for Texas Eastern Transmission’s (Tetco) M3 point and Transco Zone 6 (non-NY), Grimes said. These locations are poised to receive more Marcellus gas. Look for “significant” downward pressure on prices in winter 2017-2018 when the Williams Transcontinental Gas Pipe Line Co.’s (Transco) Atlantic Sunrise (see Daily GPI, Aug. 26) and PennEast pipeline (see Daily GPI, Aug. 12) projects are due to come online, he wrote.

The “most bullish” outlook is for Tennessee Gas Pipeline (TGP) Zone 4 and Transco-Leidy, which are deep in the Marcellus and would benefit from more takeaway capacity to come, which “should put a bid on these basis points above current forwards,” he said.

“In total, we see an 8.2 Bcf/d increase in takeaway capacity heading east or southeast, 8 Bcf/d moving west or southwest, and 700 MMcf/d flowing north,” Grimes wrote. “Brownfield expansions and flow reversals will make up the majority of the increased takeaway capacity out of the Marcellus and Utica through 2016. Greenfield projects represent more than 10 Bcf/d in increased takeaway capacity in 2017-2018.”

New and proposed pipelines should increase takeaway capacity 18 Bcf/d by 2018 from the oversupplied Marcellus/Utica region to higher-demand regions, Grimes wrote.

It’s no secret that Marcellus production and now that from the Utica have been booming. The two put out more than 15 Bcf/d, with the Utica alone accounting for 1.27 Bcf/d, up from only 200 MMcf/d early last year, Grimes wrote. “Marcellus Shale production now represents 32% of U.S. gas production east of the Mississippi River, and that share likely will grow to nearly 40% in the next few years,” he said, citing U.S. Energy Information Administration (EIA) data.

On the demand side, fuel switching from coal to gas and the flexibility of merchant generators to turn to gas “…now accounts for the fastest-growing proportion of gas demand,” Grimes wrote. “Last August, gas demand from generators reached an all-time high of 84% of all gas demand in the Northeast from Ohio to Maine,” he said, also citing EIA data.

Based on independent system operator and company data, Morningstar projected that gas demand from power generators would increase by nearly 2.65 Bcf/d through 2017 in the PJM Interconnection, New York Independent System Operator and ISO New England. “The majority of this new gas draw comes from PJM generators, with 1,817 MMcf/d through 2017,” Grimes wrote. “With approximately 7,200 MMcf/d of increased takeaway capacity into the PJM region by 2017, we expect PJM to be flush with gas for these plants.”

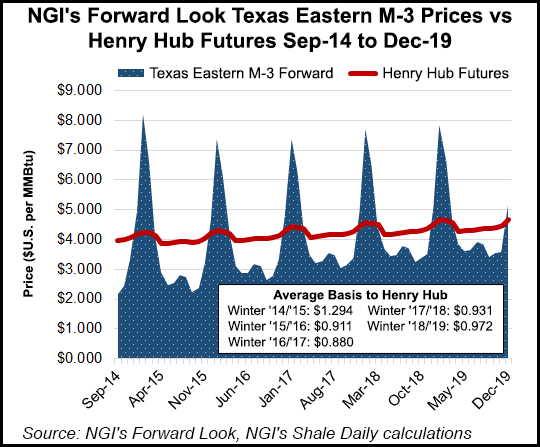

While expected capacity additions have been pushing down on winter TETCO M3 forward basis prices, it’s possible that the price depression may peak a year earlier than Grimes anticipates, according to NGI’s Forward Look.

“Currently winter forward basis at M3 is displaying a decline from the current winter ’14/’15 projection of plus $1.294 to plus $0.880 in winter ’16/’17 before recovering slightly to plus $0.931 three years out in the winter of ’17/’18,” said NGI Markets Analyst Nathan Harrison.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |