Markets | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

E&P Industry Said Generating 9.3 Million U.S. Jobs, 7% of Workforce

The U.S. natural gas and oil industry generates more than 9.3 million permanent jobs, or nearly 7% of the entire workforce, and provides close to $1.2 trillion in gross product (GP) a year, a study by an economic group has found.

The Perryman Group (TPG), led by Texas economist Ray Perryman, classified the numbers in a new study issued this month.

“When you include the ripple effects through the economy, oil and natural gas exploration and production supports nearly 7% of the U.S. economy,” said Perryman, who is based in Waco, TX. “While changing market conditions will lead to cycles in the industry, the oil and gas industry will be a driver of substantial economic activity for many years to come.”

Technology advances helped to bust open tight seams of gas and sand, and now are helping to boost oil reserves. The oil surge, economists said, also has been important to the recovery from the recent recession.

“While market conditions and price levels are currently less favorable to extensive natural gas exploration, there is nonetheless a significant level of investment in developing natural gas resources. Although direct employment in the industry is a small percentage of total jobs, the work is often well paying.

“Moreover, the ripple effects through the economy of this high value-added industry are large, especially in states which have a substantial concentration of support services.”

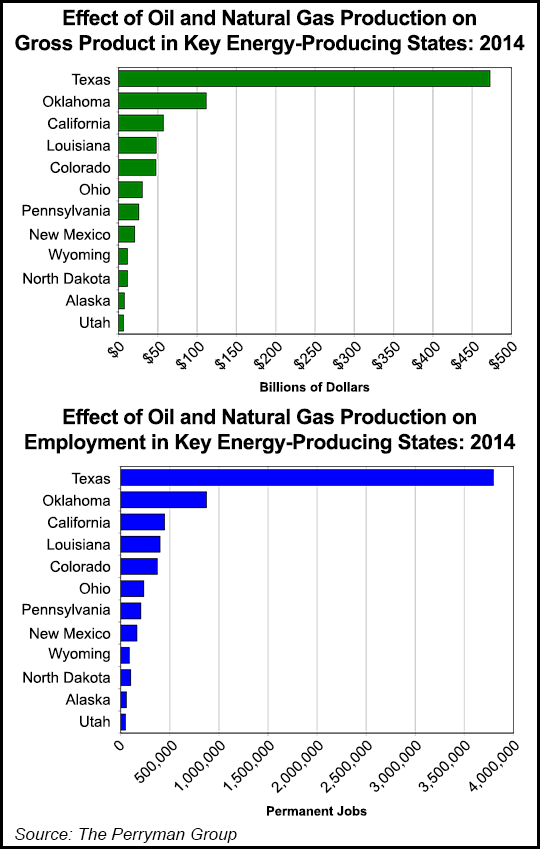

The assessment said what many already know: Texas realizes the largest economic benefits from the substantial oil and gas reserves, as well as the supporting sectors.

TPG estimated that permanent jobs related to the Texas oil and gas industry are close to 3.8 million, with GP of $472.54 billion in 2014 dollars.

Oklahoma, at No. 2, has estimated permanent jobs of 874,456, with GP of $111.57 billion. California’s oil and gas industry, in third place, generates around 446,800 jobs with GP of $57 billion.

Twelve states were included in the study. At No. 4 is Louisiana, followed by Colorado, Ohio, Pennsylvania, New Mexico, Wyoming, North Dakota, Alaska and Utah.

“In states where oil production has only recently begun to escalate, such as North Dakota, support industries are still developing and ripple effects through the state economy are smaller,” TPG said. “It should be noted, however, that North Dakota sees benefits of more than 100,000 jobs in an economy with total employment of only about 500,000. In the newly emerging areas, overall economic effects can be expected to rise over time.”

According to TPG, any economic stimulus, such as direct spending, investments, or corporate activity, generates multiplier effects throughout the economy.

“Three primary factors determine future oil and gas production: prices, geology and the technology available for exploration and recovery,” said economists. “Technology has already played a major role in increased production, with the development of hydraulic fracturing and other innovative recovery methods unlocking oil and natural gas from shale plays.

“While changing market conditions will lead to cycles in the industry, the oil and gas industry will be a driver of substantial economic activity for many years to come.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |