Lawler Brothers Separately to Helm Two Huge U.S. Natural Gas-Heavy Independents

In less than one month, two brothers from one family will be in charge of two of the biggest onshore natural gas producers in the United States. Doug Lawler as CEO already is running the second largest gas producer, Chesapeake Energy Corp., while younger brother David Lawler was tapped Wednesday to lead BP plc’s new Lower 48 business.

David Lawler, 46, COO of onshore operator SandRidge Energy Inc., is to begin working at BP on Sept. 15 as CEO of BP’s continental U.S. operations. BP in March formally established the onshore unit to better focus on its opportunities (see Daily GPI, March 4).

“With an impressive track record at integrated oil and gas companies as well as independents, Dave is uniquely qualified to lead our onshore business during this exciting transition,” said BP Upstream Americas CEO Lamar McKay. “His experience and skills match up perfectly with our goals for the business. I’m confident he will create a competitive and sustainable operation that will be a key component of BP’s portfolio for many years.”

Lawler, a long-time Oklahoma City resident, began working at SandRidge in 2011. For four years previously, he was president and CEO at PostRock Energy Corp., also based in Oklahoma. Lawler spent close to a decade also at Shell Exploration and Production Corp. He began his career as a production engineer at predecessor Conoco Inc. and worked at the former Burlington Resources Corp.

“I’m looking forward to leveraging BP’s talent and resources while running the business as if it were an independent,” Lawler said. Like his brother Doug, David graduated from the Colorado School of Mines. Doug earned a masters degree at Rice University, while David earned his at Tulane University.

The combined talents of the Lawler brothers over two of the biggest domestic onshore natural gas producers could prove a potent mix in the U.S. exploration sector.

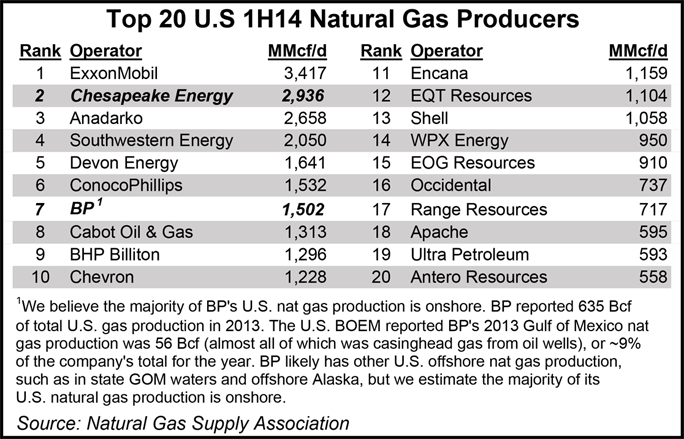

Chesapeake and BP produced respective totals of 2.9 Bcf/d and 1.5 Bcf/d in the United States during the first half of 2014, which combined is 1.0 Bcf/d higher than the 3.4 Bcf/d produced by market leader ExxonMobil Corp., according to Pat Rau, director of Strategy and Research for Natural Gas Intelligence.

“While BP has a sizable presence in the Gulf of Mexico, we believe the majority of the company’s U.S. natural gas production is onshore, meaning the Lawler family will oversee the largest block of onshore gas production in the country,” Rau said.

Once separate, BP has said it would continue to own the exploration and production unit, but under a different name. Lawler and his management team would develop and implement the strategy to expand the oil and gas portfolio. The new business also is to have separate governance, processes and systems to address the onshore operating environment. Separate financials for the business would be disclosed beginning in 2015.

In addition to its top position in the deepwater Gulf of Mexico (GOM), BP’s U.S. onshore portfolio stretches from the Gulf Coast onshore north through the Rocky Mountains. The portfolio includes an unconventional resource base of 7.6 billion boe across 5.5 million acres. BP also has an interest in close to 20,000 wells in the domestic onshore.

Rising Anadarko Petroleum Corp. executive Robert “Doug” Lawler was hired to take over Chesapeake in May 2013, following in the footsteps of co-founder Aubrey McClendon (see Daily GPI, May 21, 2013). Lawler, only the second CEO to lead the company, since has placed his own stamp and strategy on the venerable independent.

Chesapeake and BP have been onshore partners for years, beginning with some outright sales and joint ventures as the unconventional revolution got underway in 2008. That summer, BP America Inc. paid $1.75 billion to acquire all of Chesapeake’s interests in 90,000 net acres in the Arkoma Basin of the Woodford Shale (see Daily GPI, July 18, 2008). In another venture, Chesapeake and BP America formed a joint venture giving BP a 25% interest in Chesapeake’s Fayetteville Shale assets in Arkansas for $1.9 billion (see Daily GPI, Sept. 8, 2008).

The loss of Lawler continues a shakeup in the executive suite for SandRidge, which has refocused is strategy on the U.S. onshore following a brief foray into the GOM (see Shale Daily, Jan. 7). Founder Tom Ward was ousted in 2013 following a shareholder squabble (see Shale Daily, March 22, 2013). The board continues to face litigation related to transactions set up during Ward’s tenure (see Shale Daily, July 8, 2013).

With Lawler’s departure, SandRidge has promoted Craig A. Johnson to executive vice president of operations and initiated a search for a new COO. Johnson, 47, currently is senior vice president of development for Oklahoma. CEO James Bennett noted that Lawler had done a “remarkable job” in leading the operations team.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |