E&P | NGI All News Access | NGI The Weekly Gas Market Report

WPX Putting Muscle into San Juan’s Gallup Prospect

WPX Energy Inc. is swapping the rest of its neglected coalbed methane (CBM) property in the Powder River Basin (PRB) for a bigger slice of oily property in the San Juan Basin.

The Tulsa-based producer, which has been reducing its natural gas exposure to improve its margins, said on Monday the San Juan purchase would bolster its oil acreage in the basin by more than half.

“We’re moving quickly to build scale and create additional shareholder value,” newly arrived CEO Rick Muncrief said. “These transactions largely offset and demonstrate our commitment to deploy capital where we can generate the highest returns.”

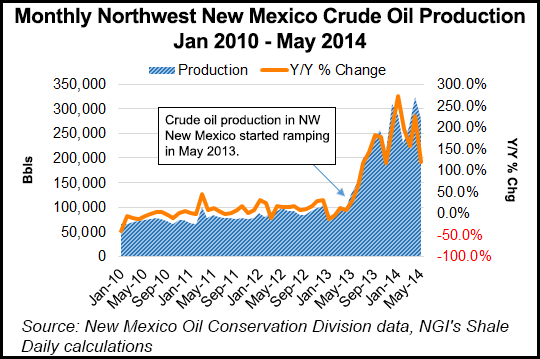

WPX Energy’s oil production has ramped up from only 4,383 bbl in 2012 to 353,618 in 2013, and to 226,809 as of July 3, according to data from the New Mexico Oil Conservation Division. The company ranks No. 29 in total 2014 year-to-date oil production in the state, well below the top five producers: COG Operating LLC, Devon Energy Corp., Apache Corp., Bopco LP and Mewbourne Oil Co.

Muncrief took the helm in mid May following a corporate reshuffle, and the departure of Ralph Hill, in late 2013 (see Shale Daily, Dec. 19, 2013). The onshore exploration company was spun off by Williams in late 2011 (see Daily GPI, Dec. 29, 2011).

Muncrief, 55, previously was senior vice president of operations and resource development for Bakken Shale heavyweight Continental Resources Inc., where he oversaw corporate engineering, reservoir development, drilling, production operations and supply chain management.

Through “multiple transactions,” WPX now controls 74,000 net acres in San Juan Basin’s Gallup oil window, he said. The latest transactions give it another 26,000 acres in the Gallup acreage alone, including 800 boe/d. Most is held by production.

With the acquisition, WPX has an estimated 425 gross drillable locations for oil in the area, assuming 160-acre spacing. A third rig is being added this year, with possibly a fourth in 2015, Muncrief said.

WPX added the San Juan Basin to its target list in mid 2013 (see Shale Daily, Aug. 7, 2013).

Production in the Gallup play in 2Q2014 jumped 500% from a year ago. Sequentially, oil volumes in the play rose 76%. Well costs at the end of June were around $5.2 million/well.

The legacy PRB assets are being sold for $155 million to an undisclosed buyer. The agreement also releases WPX from firm transportation with $30 million in future demand obligations.

WPX’s mid-year reserves in the PRB were 222 Bcfe, with 2Q2014 production of 154 MMcf/d in around 5,000 wells. WPX has not actively drilled in the basin since 2011.

Last year, the PRB portfolio represented about 15% of WPX’s total output, but it generated only 5% of adjusted earnings, minus the unused transportation.

“The transaction should improve WPX’s consolidated operating cost structure for lease operating, gathering and transport expenses,” management said.

The dual transactions are a positive for WPX, according to Tudor, Pickering, Holt & Co. The CBM assets “finally exit the portfolio, netting $155 million plus relief of a $30 million firm transport contract.”

The price WPX fetched for the PRB portfolio for was “nothing to brag about,” which analysts estimated was for around $1,200/Mcfe per day, but WPX “should be rewarded” given its gassy operating expenses, which they estimated at about $2.00/Mcf.

The decision to add one and possibly two rigs to the San Juan Basin was “faster than we anticipated,” said analysts. Assuming the acreage is being purchased using the CBM proceeds, the scale/escalation could generate $1.00/share or so in proved, possible and probable net asset value.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |