Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Chesapeake’s Pennsylvania NatGas Output Blows Past Competition

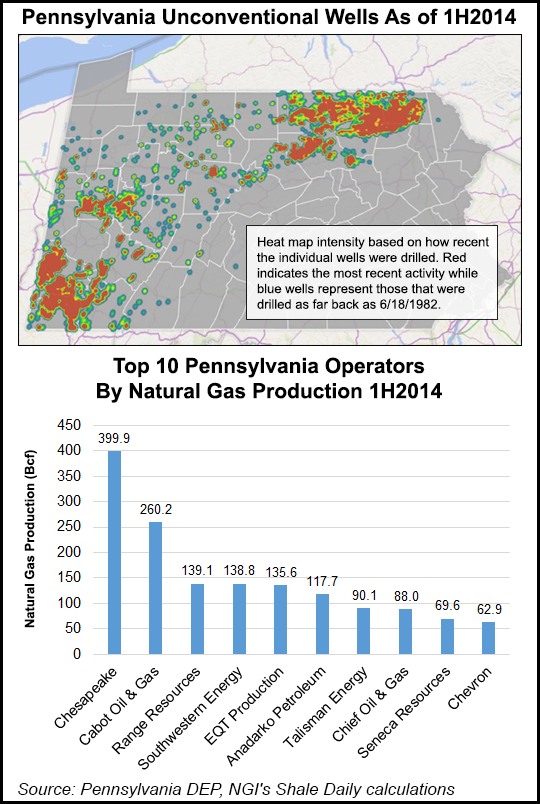

Chesapeake Energy Corp. is far and away the leading natural gas operator in Pennsylvania after production in the first half of this year closed in on 400 Bcf, easily surpassing any other top-10 producer in the state.

The top five gas producers in the state accounted for almost half of the state’s gas supply in the first half of 2014 (1H2014) and were, in order, Chesapeake, Cabot Oil & Gas Corp., Range Resources Corp., Southwestern Energy Co. and EQT Corp.

Gas production in the state broke another record in 1H2014, with total output of 1.94 Tcf, about 520 MMcf higher than in the year-ago period, the Department of Environmental Protection (DEP) reported on Monday (see Shale Daily,Aug. 18). Pennsylvania operators in 1H2014 also produced 1.8 million bbl of condensate and slightly more than 200,000 bbl of oil.

The six-month figures “typically are updated as operators update their production reports due to reporting errors that may include missing wells, incorrect data and in some cases there are operators who have not submitted their data prior to DEP releasing the data,” said Pennsylvania State University’s Matt Henderson, shale gas asset manager for the Marcellus Center for Outreach and Research.

Oklahoma City-based Chesapeake delivered 1H2014 gas output of 399.9 Bcf, with Cabot contributing 260.2 Bcf. Range, the initial developer of the Appalachia unconventional bonanza, recorded 139.1 Bcf, followed by Southwestern’s 138.8 Bcf and EQT at 135.6 Bcf.

According to data, which was provided by the producers, Anadarko Petroleum Corp. was the sixth-largest gas producer in 1H2014 with 117.7 Bcf, followed by Talisman Energy Inc., 90.1 Bcf and Chief Oil & Gas LLC, 88.0 Bcf. Seneca Resources Corp., the exploration arm of National Fuel Gas Co., reported total gas output of 69.6 Bcf, while Chevron Corp. rounded out the top-10 at 62.9 Bcf.

“When looking at production on a per-well basis during the period, Cabot has the top five, and seven of the top-10,” Henderson said. “Chief has the other top three wells.” On a daily average basis, “Cabot has nine of the top-10, and 11 of the top-20 in the Commonwealth. Chief…has seven, and Range and Seneca Resources each had one.

“The top eight wells all averaged over 20 MMcf/d.”

Cabot’s big wells all were in Susquehanna County, except for one in Lycoming County. Cabot’s top Susquehanna producer (Molnar M1) had 26,680 MMcf/d during the period, followed by Molnar M3 at 26,382 MMcf/d, according to Henderson.

Chesapeake has of late been turning to more oil/liquids targets, but its gassy showing in Pennsylvania might offer a different tale. Although it has been dropping gas rigs to move to oilier targets, northern Marcellus output in Pennsylvania rose 12% in 2Q2014 from a year ago to average 878 MMcfe/d net; it was down 3% sequentially (see Shale Daily, Aug. 6).

Chesapeake, like its peers, could have produced even more gas in the first six months of this year had there been enough infrastructure, according to management. At the end of June, Chesapeake had 120 wells that were awaiting pipeline connection or were in various stages of completion across the region. It was the same story for Cabot, Range and others.

Cabot’s Marcellus production was 41% higher year/year in the second quarter at 1.26 Bcf/d (see Shale Daily, July 25). Range during 2Q2014 reported 848 MMcfe/d of output in the southern division, where 36 wells were turned to sales, while in the northern division, it produced 200 MMcfe/d and turned five wells to sales (see Shale Daily, July 29).

According to DEP, 510 wells were ramped up in 1H2014.

Washington County, in the Greater Pittsburgh area, edged out all others in the state for condensate production with 1.76 million bbl reported. During 1H2014, most of the liquids were produced by Range, with Chesapeake contributing all of the reported oil supplies at 204,316 bbl. Washington County also was the fourth largest dry gas producer in 1H2014 at close to 198 Bcf.

Forest County, in second place for condensate, reported 14,500 bbl. Mercer County reported 4,695 bbl of output, all by Halcon Resources Corp. Eight total counties reported condensate production for 1H2014, including Mercer, Crawford, Lawrence, Venango, McKean, Forest and Butler.

“Some of this production is due to increased activity within other shale formations than the Marcellus,” Henderson said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |