Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

New England Municipal Electric Utilities Want Ownership of New Regional NatGas Pipeline

Seeking an alternative to a proposal by New England’s governors to promote construction of natural gas pipelines in the region, officials at Massachusetts Municipal Wholesale Electric Co. (MMWEC) say it would be a better deal for customers if the Ludlow, MA-based non-profit owned a new natural gas pipeline.

MMWEC and its 21 member utilities would be able to use the same revenue stream the governors proposed, but they wouldn’t require the profit margin of for-profit companies to build a pipeline to carry Marcellus Shale gas to New England, CEO Ron DeCurzio told the Boston Business Journal. MMWEC would need to own the new pipeline so it could issue bonds for the project, but construction and operation of the pipeline would be outsourced, DeCurzio said.

The MMWEC model would remove pipeline companies from ownership, streamline the business model and create “a lot of practical and economic efficiencies,” DeCurzio said. The project would likely cost $1.5 billion to $2.0 billion.

In January, the governors of six New England states called on the Independent System Operator of New England (ISO New England) to provide technical support and assistance with necessary tariff filings for new electric and natural gas infrastructure (see Daily GPI, Jan. 23). In a letter to ISO New England CEO Gordon van Welie, the New England States Committee on Electricity (NESCOE), on behalf of the governors, asked for assistance as they request proposals for transmission infrastructure to deliver at least 1,200 MW and as much as 3,600 MW of electricity from clean energy sources into the grid, as well as to develop a funding mechanism to support investment in additional pipelines to bring natural gas from the Pennsylvania region into New England.

The additional pipeline capacity should be capable of delivering gas at prices similar to Henry Hub in amounts which, combined with firm commitments by other market participants, would increase the amount of firm pipeline capacity into New England of 1,000 MMcf/d above 2013 levels or 600 MMcf/d beyond what has already been announced for the Algonquin Gas Transmission Incremental Market project (see Daily GPI, July 10, 2013) and Tennessee Gas Pipeline’s Connecticut Project (see Daily GPI, Nov. 25, 2013), according to the letter. Recovery of the net cost for procurement of the pipeline capacity is expected to be shared by the New England states.

NESCOE asked that ISO New England seek Federal Energy Regulatory Commission approval of a tariff for the recovery of the cost of the firm gas pipeline capacity “with the objective of allowing commitments to be made that would permit the new pipeline capacity to be available no later than the winter of 2017-2018.

The MMWEC model would put that tariff money to use by non-profit electric utilities.

The NESCOE model hit a potential roadblock when the Massachusetts legislature failed to adopt a bill, endorsed by Gov. Deval Patrick, that would have required utilities to enter into long-term contracts with Canadian hydropower operators, an initiative which would have helped pay for power lines between Canada and New England.

NESCOE on Friday said it would delay discussion of the tariff with New England Power Pool.

On the same day, Northeast Utilities, National Grid and United Illuminating sent a letter to NESCOE, encouraging NESCOE “to continue to pursue an aggressive schedule to achieve the goal articulated by the New England governors for new gas transportation capacity to be available by the winter of 2017/2018.” The urgency to increase natural gas supply to power generation in the region was highlighted last winter when gas-fired generation produced significantly less than its capacity, the companies said.

“This had over a $3 billion cost impact on New England customers last winter and will continue until new gas pipeline capacity is built,” they said in their letter.

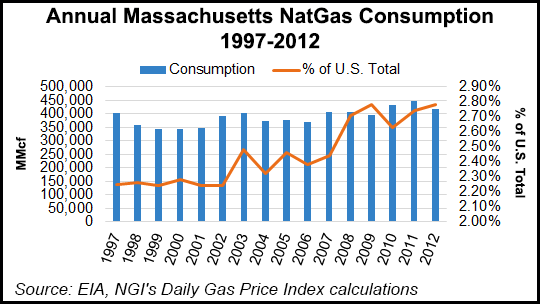

Natural gas consumption in Massachusetts averaged 390 Bcf per year between 1997-2012, good for 2-3% of total U.S. demand in each of those years. Overall, gas consumption in Massachusetts grew at a trend-line rate of 1.1% per year during that time period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |