Marcellus | E&P | NGI All News Access

1 Bcf/d Market-Pull Project Proposed for Marcellus Gas

A quartet of gas utility/marketing companies is planning to tap Marcellus Shale gas with a new 100-mile pipeline that would serve markets in Pennsylvania and New Jersey.

PennEast Pipeline Co. LLC is a joint project of AGL Resources; NJR Pipeline Co., a subsidiary of New Jersey Resources; South Jersey Industries; and UGI Energy Services (UGIES), a subsidiary of UGI Corp. The pipeline would carry up to 1 Bcf/d to serve demand equivalent to that of 4.7 million homes. The project backers are promising customers lower energy and transportation costs.

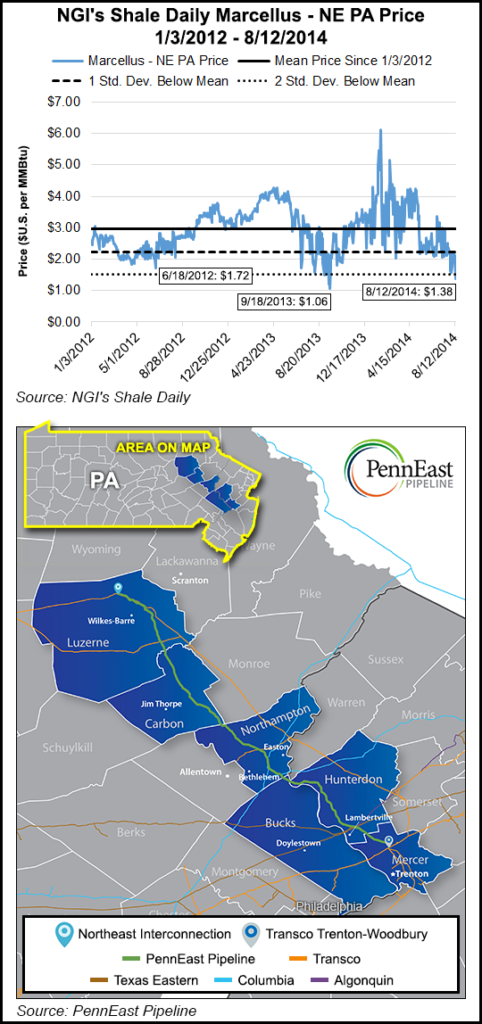

The pipeline would begin in Luzerne County in northeastern Pennsylvania and end at Transco’s Trenton-Woodbury interconnection in New Jersey. PennEast would invest nearly $1 billion to build the pipeline with the costs split among the four entities. UGIES is to be project manager and the pipeline’s operator.

“In response to the abundant supplies and low price of natural gas, customer demand has increased significantly,” said UGI Corp. CEO John Walsh. “This project serves to meet that growing demand in the mid-Atlantic marketplace, while providing greater system resiliency and reliability for local utilities.”

Thanks to the Marcellus, Pennsylvania is the fastest-growing gas-producing state in the country, according to the U.S. Energy Information Administration, and the PennEast sponsor companies said they recognized the opportunity to use locally produced gas to serve growing markets in the mid-Atlantic.

The PennEast project announcement came a day after the ongoing capacity constraints rocked next-day Marcellus gas pricing. While most eastern index prices for Tuesday delivery jumped anywhere from a dime to 50 cents higher on Monday, prices plummeted in the Marcellus region as constraints made gas movement difficult, according to NGI’s Daily Gas Price Index (see Daily GPI, Aug. 11). Tennessee Gas Pipeline (TGP) reported no operational capacity available between stations 201 and 204 in southern Ohio and western West Virginia. TGP reported on its website 1,050,000 Dth of operational capacity, but total (over) scheduled capacity of 1,244,233 Dth, or no available capacity.

Prices in the Marcellus reacted quickly. Deliveries to Transco Leidy for Tuesday plummeted 29 cents to average $1.75/MMBtu, but at Tennessee Zone 4 Marcellus next-day gas traded as low as 15 cents/MMBtu before ending the day at 60 cents/MMBtu, or down a whopping $1.37.

“Capacity-induced price compression has become a recurrent, late-summer theme over the past few years in the Marcellus Shale, whether due to pipe maintenance, or just too much gas,” said NGI Markets Analyst Nathan Harrison. “During 2012, NGI’s Shale Daily Marcellus-NE PA index reached a low of $1.72 in mid-June, while in 2013 the glut of gas brought the index all the way down to $1.06 on September 18th. We’re seeing it again this year. In Monday’s trading we saw prices in the area going as low as 15 cents as folks just couldn’t get their gas into the lines. Additional takeaway capacity will be welcomed by producers in the Marcellus who can’t be happy with current prices.”

Last winter, gas prices in New Jersey traded as high as $100/Dth. Gas in the area that PennEast will access traded in the range of $3-4/Dth. The proposed pipeline will help reduce this price volatility to the benefit of New Jersey’s nearly three million gas consumers, the companies said.

Additionally, the new pipeline is expected to benefit the region’s economy and create jobs. During the seven-month construction phase, the PennEast project is expected to create more than 2,000 jobs.

PennEast will begin preliminary engineering studies in the coming months, along with a formal application before the Federal Energy Regulatory Commission. With timely approvals, project construction could begin in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |