Marcellus | E&P | NGI All News Access | Utica Shale

As Volumes Rise, Antero Focusing on Moving Gas From Appalachia

Pure-play Antero Resources Corp. continues to churn out record natural gas production, surpassing 1 Bcfe/d in July, but its focus has increasingly shifted to building a processing and midstream portfolio to handle those volumes and generate more value.

Antero has had 20 rigs running in Ohio and West Virginia since the beginning of the year, with year/year production in 2Q2014 increasing by 94% to 891 MMcfe/d. The company said last month that it had passed the 1 Bcfe/d milestone, joining a handful of other operators (see Shale Daily, July 18).

Production in the latest period included a 387% boost in liquids, which were 20,237 b/d in 2Q2013. The company has been targeting production growth of 75-85%, with plans to exit the year at 925-975 MMcfe (see Shale Daily, Jan. 30).

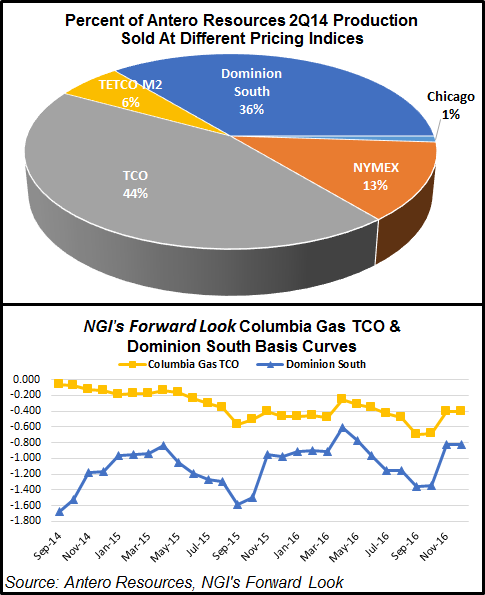

But rising volumes didn’t exempt Antero from the widening basis differentials that daunted other Northeast operators last quarter as supplies in the region continued to go up and cooler-than-normal temperatures subdued demand heading into the summer (see Shale Daily, Aug. 7; Aug. 6; July 29; July 25; July 24).

Excluding hedges, Antero’s average realized natural gas price for the quarter was $4.49/Mcf, up 3% from the year-ago period when it earned $4.37/Mcf, but still an 18-cent negative differential from the average New York Mercantile Exchange price. While it got a boost from liquids and a diverse midstream portfolio, commodity prices still varied from what investors had anticipated, according to Wells Fargo Securities analysts, who wrote that earnings took a hit as a result.

Antero sold 58% of its gas at more favorable pricing indices, such as Columbia Gas Transmission, through the first six months of the year. Although the remainder was sold at Dominion South Point and Texas Eastern Transmission M2, and new access to the Rockies Express Pipeline eventually is expected to increase exposure to 65% in better markets.

Since going public in October, management has been focused on highlighting its midstream efforts, especially as subsidiary Antero Resources Midstream LLC prepares for an initial public offering (see Shale Daily, Feb. 7; Oct. 11, 2013).

This year, several agreements to bolster midstream capacity have been announced (see Shale Daily, July 18; March 26). It also continues to authorize processing expansions in West Virginia (see Shale Daily, May 7) and has added to a firm transportation portfolio that would provide 3.4 Bcf/d of capacity by 2016.

“We now have sufficient firm transportation capacity to accommodate our accelerated development program for the foreseeable future, which will enable us to achieve our targeted production growth rate, while also securing access to the most favorable pricing regions,” said CEO Paul Rady.

Antero also reached an agreement to anchor Sunoco Logistic Partners LP’s Mariner East II project to move liquids from eastern Pennsylvania beginning in late 2016 (see Shale Daily, Dec. 5, 2013). Additionally, the company is to be one of the primary shippers on Energy Transfer Partners LP’s ET Rover pipeline, with an option to purchase a nonoperating equity interest (see Shale Daily,June 26).

“As we build our midstream business and forecast how our [master limited partnership] looks going forward, it makes a lot of sense to be an anchor shipper on some of these projects,” CFO Glen C. Warren Jr. told analysts. “This is one of those things about being one of the bigger players and the most active drillers, these kinds of opportunities can come to you.”

The Marcellus Shale continues to drive production gains. By the end of the second quarter 70 wells since the start of the year had been completed and tied to sales, with most utilizing shorter stage lengths that improved well results by 20-30% from the year-ago period. In the Utica Shale, the company completed and tied to sales 23 wells. However, it currently has 100 MMcfe/d of production curtailed as it awaits an expansion at MarkWest Energy Partners LP’s Sherwood processing facility in West Virginia.

Antero reported a net loss of $44 million (minus 17 cents/share) in 2Q2014, mainly on non-cash losses from unsettled hedges, non-cash stock compensation and debt. That’s compared with net income of $131 million (50 cents/share) in the year-ago period. The company plans to update its capital expenditures and full-year guidance at the end of the third quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |