Infrastructure | NGI All News Access

Mexico a Major Cog in Sempra’s Long-Term Growth Plans, CEO Says

Sempra Energy plans to continue to seek a variety of energy development projects in Mexico, given the federal government reforms now unfolding there (see Daily GPI, Aug. 7). The San Diego, CA-based holding company has a well-established foothold south of the border, CEO Debra Reed told financial analysts Thursday.

A little more than a year after a successful initial public offering (IPO) for IEnova, Sempra’s 81%-owned Mexican operating company is on schedule to finish by the end of the year the first phases of its two $1 billion natural gas transmission pipelines in Mexico (see Daily GPI, Nov. 2, 2012), said Reed. She said during a conference call to discuss 2Q2014 results that IEnova in the past 20 months has become “the best performing IPO in the Americas and second best performing IPO worldwide [see Daily GPI, May 6, 2013].”

IEova has about $500 million invested in each of the Sonora and Las Remoras pipelines, but it’s only the start of Sempra’s latest plans for Mexico, assuming it can win more infrastructure bids. Subsequent projects announced for bidding so far have included two more gas pipelines: a 155-mile line to connect to a new U.S.-based pipeline and a 260-mile line in northern Mexico.

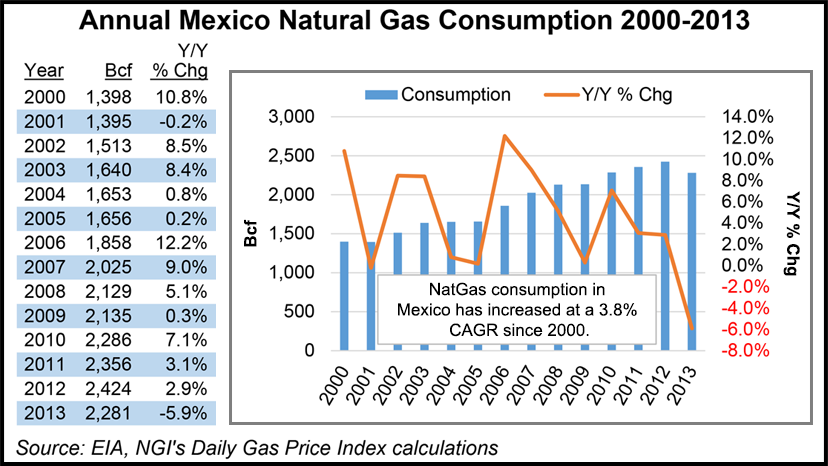

“IEnova is prepared to participate in both bids,” Reed said. “The two projects together would likely represent an investment of more than $1 billion.” This year, she expects requests for bids to be released for three U.S. pipelines and five more lines in Mexico — all part of the Mexican government’s effort to increase imports of U.S. gas supplies.

Reed ticked off a list of upcoming projects that the Mexican reforms are expected to bring: liquids transportation; gathering and processing; and electric transmission lines.

Sempra President Mark Snell said studies have begun on the company’s Energia Costa Azul (ECA) liquefied natural gas (LNG) receiving terminal in Baja California on the Pacific Coast in Mexico to determine supplies that would be available for export through that facility and the cost of getting gas to the somewhat pipeline-constrained location.

“Once we determine that by the end of the year we will lay out some plans for the size of the facility and begin marketing to customers,” Snell said. “We have a lot of customer interest, and we don’t think acquiring customers will be a big issue. The economics are roughly the same [as the Cameron receiving terminal conversion], but ECA will be a smaller facility.”

“A positive development is that ongoing reforms in Mexico now include the potential for private-sector LNG exports,” said Reed, noting that issues still to be resolved involve questions of gas supply, customer interest, existing contracts (for importing LNG) and regulatory requirements as “critical path” items.

With major global financing now in place and construction of its Cameron LNG export facility in Louisiana about to begin (see Daily GPI,Aug. 7), Sempra already is thinking about expansion there and beginning the regulatory process at the Federal Energy Regulatory Commission.

“For our Cameron facility we will begin working with our partners [GDF Suez SA, Mitsui & Co. Ltd. and Mitsubishi Corp.] to complete the development plans and initiate the FERC process for building two additional trains [No. 4 and No. 5],” Reed said.

“We believe a Cameron expansion will be one of the lower-cost [U.S. LNG] alternatives, especially compared to greenfield development.”

Reed said Sempra has competitive advantages for the upcoming pipeline project bids in Mexico because of the assets and employees it already has on the ground in the country. “We’ve done projects there,” she said, adding that competition for the Mexican pipe projects in the United States would most likely be higher than what was experienced in the past. “We’ve shown we can deliver on these projects; there will be a lot of projects coming out, and we’ll have to decide on which projects we can be the most competitive.”

Snell said two of the upcoming projects are for new connecting U.S. pipelines.

The company reported 2Q2014 net income of $269 million ($1.08/share), compared with $245 million (98 cents) for the same period in 2013.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |