Marcellus | E&P | NGI All News Access

Ultra to Escalate NatGas Operations in Rockies, Ignore Marcellus

With natural gas pricing differentials continuing to accentuate the negative in the Appalachian Basin, Ultra Petroleum Corp. plans to continue to escalate operations in the Rockies while continuing to decrease operations in the Marcellus Shale, CEO Mike Watford said last week.

“Our production mix is changing, with increasing higher-returning oil being added while natural gas production overall grows modestly, with a clear goal of increasing Western basin production and decreasing Eastern basin production,” he told analysts during a conference call to discuss 2Q2014 results.

“Price discounts on our oil is decreasing, as is the basis differential on Western basin gas. Eastern basin gas differentials are expanding significantly. So on a relative basis, our margins should be improving as we enter the second half of the year…We continue to be constructive on natural gas demand going forward, particularly 2016 and beyond.”

The Houston-based independent reported net income of $106,049 million (69 cents/share) in 2Q2014, versus $116,377 million (76 cents) in 2Q2013. Operating cash flow rose year/year to $145,086 million from $135,064 million. Total operating revenue of $296.1 million in the latest period easily beat year-ago numbers of $261.4 million, mostly on higher oil prices.

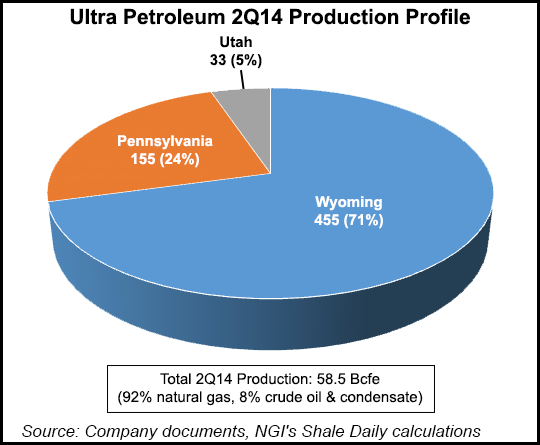

Once a gas-only operator, Ultra’s total oil and gas production in the period increased marginally to 58.5 Bcfe from 58.4 Bcfe. Gas volumes, which account for around 92.2% of Ultra’s output, fell 4.6% to 54 Bcf. However, oil production increased 153.7% year/year to 758,844 bbl.

“Our oil and natural gas production is growing again,” said Watford. “But more importantly, we are generating healthy returns.” The company’s crude oil investments are returning 400-500% internal rates of return, “with an impressive payout period of months, not years.

“In our Wyoming long-life natural gas asset, we were achieving returns of 45-80%, depending upon well size and cash flows exceeding capital expenditures.”

The first three months of this year were “the inflection point in our natural gas production. For the second quarter of 2014, our natural gas production is up sequentially, while down marginally over year-ago numbers. Meanwhile, our oil production is up over 150% year/year and 23% sequentially.”

CFO Garland Shaw said Ultra’s gas production in the Rockies “shifted back to growth mode following our disciplined capital investment program and the under investing from the previous two years. We have shifted our investment focus away from Pennsylvania and onto Wyoming and then Utah.

“There’s no surprise we’ve experienced declining natural gas volumes. This decline is clearly behind us now with the first quarter having served as the inflection point as volumes increase in the second quarter and will continue growing for the remainder of 2014. This natural gas growth is being fueled by our Wyoming asset.”

Between April and June, Ultra sold its natural gas in Wyoming at a 6% discount to Henry Hub, whereas in Pennsylvania, it was sold at a 39% discount to Henry, said Watford.

“The continued basis widening that all Marcellus producers are currently enduring further validates our capital allocation decisions for 2014 where we’re spending virtually nothing in the region.” Across the Rockies, which accounts for nearly three-quarters of Ultra’s current gas volumes, differentials averaged a negative 26 cents/MMBtu in 2Q2014, higher than forecast.

Also, “severe pipeline bottlenecks and extended seasonal pipeline maintenance” in the Northeast resulted in the company’s average discount to New York Mercantile Exchange (Nymex) for the remaining natural gas volumes in the Marcellus region, registering a negative $1.80/MMBtu.

On a combined basis, Ultra’s average natural gas corporate-wide differential to Nymex was a negative 66 cents/MMBtu for the quarter. For oil pricing in the Uinta Basin, the company realized an average discount to Nymex of a negative $18.87/bbl.

The producer’s average realized price on gas, excluding hedging, increased around 2% to $4.23/Mcf. The average oil price was $88.94/bbl, marginally higher than in 2Q2013, when it was $88.90.

Total lease operating costs increased 17.3% from a year ago to $66.1 million. All-in costs averaged $3.06/Mcfe, 6.3% higher from 2Q2013.. Total operating expenses came in at $150.9 million, reflecting a 5.5% increase from $143 million in the year-ago period.

In Wyoming, Ultra and its partners drilled 28 net (45 gross) wells in the Lance formation of the Pinedale Anticline and placed on production 26 net wells. The company’s net output in the play averaged 455 MMcfe/d in the latest period. Pinedale achieved wellhead gas prices of $4.00-5.00/Mcf and estimated ultimate recoveries of $4.0-6.0 Bcfe.

The pace of Marcellus activity during the quarter slowed significantly as a direct result of strategically reducing capital at the beginning of the year, Watford noted. Ultra participated in one net well and no wells were brought online. The company averaged 155 MMcfe/d of Marcellus output in the latest period.

In Utah’s Uinta Basin, Ultra drilled 23 net wells (100% working interest) and placed on production 19. Net output averaged 5,555 boe/d, 23% higher sequentially.

“Our strong well performance in the Uinta allows us to achieve payout within months,” Watford reiterated. “Currently, one-third of the wells brought online in the first quarter have paid out. With regard to the second quarter wells, we expect over half to achieve payout by the end of this year.

“Our growth in Uinta production is ongoing as evidenced by the 28% sequential growth we’re forecasting for the third quarter.”

Two “key factors” should affect Ultra’s overall production positively in the second half of the year, said Shaw. “First, we see our mix of oil production growing relative to natural gas due to our investment in our high-returning Utah asset base. Our increased oil production is expected to result in a third quarter production mix of roughly 9% of volumes and 27% of revenues.

“Second, we see growth in our Wyoming natural gas volumes far outpacing the natural decline in our Pennsylvania volumes due to our reallocation of capital to our higher returning Wyoming asset base. As a result, we see Wyoming production volumes increasing from 73% of our natural gas volumes in the second quarter to roughly 75% of our natural gas volumes in the third quarter. We see the percentage of Wyoming contribution continuing to grow as we move through 2015.”

Tudor, Pickering, Holt & Co. analysts weighed in on the results, noting that Ultra’s stock fell 24% in July, which brought it in line with their net asset valuation of about $23.00/share. Analysts cut their full-year production estimates toward the low-end of guidance, 243-250 Bcfe to account for pipeline constraints and a risk to Marcellus shut-ins during September and October.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |