NGI Data | NGI All News Access

Short Week No Hindrance To Weekly Price Slides

In just two days of August trading last week, spot gas prices still found a way to lose ground. The NGI Weekly Spot Gas Average dropped 13 cents to $3.59 for the Thursday-Friday time slot. Gains were limited to a few points in the Rockies, Arizona, and California, but otherwise the red ink was widespread.

The week’s greatest gainer was Opal with a modest advance of 4 cents to $3.82 and the week’s biggest loser was Transco-Leidy at 87 cents to $1.46. Regionally the Northeast retreated furthest dropping 42 cents to $2.45 and the Rockies lost the least giving up 3 cents to $3.74.

The Midcontinent and Midwest both posted double-digit losses falling 15 cents and 13 cents, respectively, to $3.61 and $3.83.

South Texas, East Texas, and South Louisiana all fell 7 cents to $3.66, $3.72, and $3.70, respectively.

California shed 6 cents to $4.22.

For the two trading days September futures gained 1.2 cents to $3.798.

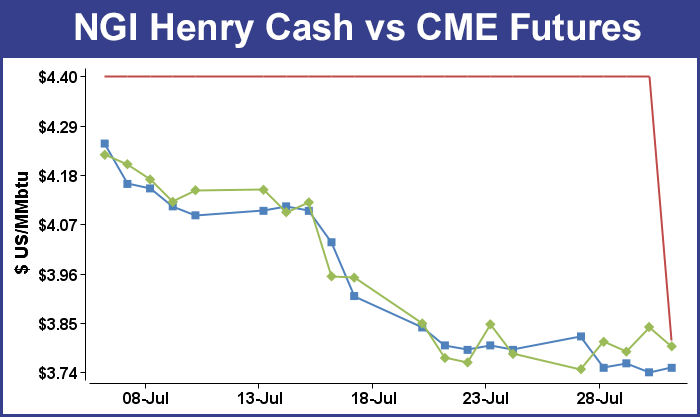

Market bulls got a boost Thursday when the Energy Information Administration (EIA) reported that working gas inventories rose by 88 Bcf for the week ended July 25. That was slightly below expectations, and September futures rose 5.5 cents to $3.841 and October gained 6.2 cents to $3.867.

The Thursday morning release of storage data by the EIA can be a trader’s delight or nightmare. Often only a few Bcf above or below expectations can cause wide price swings. Thursday was no different, but the dominant trend has been for storage builds way above historical averages and, in many cases, above expectations as well.

The reported 88 Bcf injection was just short of industry expectations in the low 90 Bcf range, but last year, 57 Bcf was injected, and the five-year pace stands at 46 Bcf. Tim Evans of Citi Futures Perspective calculated an injection of 89 Bcf, and United ICAP was looking for an increase of 93 Bcf. A Reuters poll of 24 analysts revealed an average 93 Bcf with a range of 85 Bcf to 100 Bcf. Prices scooted higher following the release of the data.

“88 Bcf is still a big number,” said a New York floor trader. “It’s quite a bit larger than last year and the five-year average, so I’m not sure why this thing would want to rally. I think this is temporary. There is no reason for the market to rally.”

Inventories now stand at 2,307 Bcf and are 530 Bcf less than last year and 641 Bcf below the five-year average. In the East Region 57 Bcf was injected, and the West Region saw inventories up by 12 Bcf. Inventories in the Producing Region rose by 19 Bcf.

Bentek Energy’s flow model also chimed in with a 93 Bcf estimate. “Total U.S. population-weighted cooling degree days fell for the fourth straight week, dipping below the 70 degree day mark for the first time since the June 27 storage week,” Bentek said. “The relatively mild weather compared to historic norms helped keep Bentek’s total sample of storage injections flat week-over-week. Combined with the low levels of demand were strong production levels, with Lower 48 dry gas production coming in above 68.5 Bcf/d for the week, which is the highest weekly average on record.”

Futures traders Friday were thinking that the groundwork might be in place for prices to start moving higher. “As of [Thursday], it appeared possible that natural gas prices could possibly register the first weekly gain in eight weeks. With nearly all short-term events aligning to make this feat possible, it is clear that market sentiment remains perennially bearish for US natural gas prices,” said Teri Viswanath, director of commodity strategy for natural gas at BNP Paribas.

“This week’s constructive developments include: ample opportunities for short-covering, with the Aug’14 futures contract expiry earlier in the week; the mid-week change in the weather maps, showing a brief warm-up in the eastern half of the US; and yesterday’s second consecutive below consensus expectation’s stock report. And yet as we round into the weekend, it appears that despite these encouraging developments prices will exit the week flat.” At the close Friday September finished 4.3 cents lower at $3.798 and October shed 4.5 cents to $3.822.

“As we warned yesterday in our weekly storage report, given the season-to-date restocking trend, short-term rallies will likely fail until such time that the weekly injections materially taper. Have just recorded the largest monthly drop since March 2012, we see little in the way of fundamentals that will reverse the current well entrenched trend before weather demand begins to pick up…in October.”

Additional stout storage builds not withstanding, some see a market bottom looming. “The market signals indicate we are likely near a floor for the natural gas market,” said Phillip Golden, director of risk and product management at Energy Market Exchange in Houston. “While the market may come off further, EMEX puts the risk to the upside and would advise clients to give serious thought to taking advantage of the market fall which has occurred over the past month.

“We will still need injection numbers of 80 Bcf/week to refill storage to the levels expected by the Energy Information Administration and to get to the high of 2012, we would need to average 114 Bcf/week. While the record builds are helping us make up the storage deficit, the misses to the low side with mild summer weather is some cause for concern about how strongly the market will continue to build.”

In trading for weekend and Monday deliveries spot gas was mixed in Friday’s trading. Gains at Gulf Coast points contrasted with a weak Northeast and a mixed Great Lakes, Midcontinent, Rockies and California.

The gains posted by the September futures contract Thursday proved to be short-lived as traders saw little in the way of events that could provide any kind of meaningful turnaround. At the close, September had fallen 4.3 cents to $3.798 and October was down 4.5 cents to $3.822.

Forecasters are calling for a return to more summer-like conditions. “While persistent waves of cool weather have some people in the Midwest and East saying that 2014 is the year without a summer, a forecast pattern change during August could have people thinking otherwise,” AccuWeather.com said in a report. “A shift in the jet stream is forecast during the middle of August that will lead to longer-lasting warm weather over much of the eastern two-thirds of the nation and less extreme heat over the Northwest. The jet stream will split apart prior to fully flattening out and will allow some warmth to build from the Tennessee and Ohio valleys to the East during the middle of next week,” meteorologist Paul Pastelok said Friday.

“Only brief, limited cooling is likely for parts of the Central and Eastern states later next week. During the middle of the month, an area of warm air and generally fair weather is forecast to build westward from the Atlantic. This system is known as the Bermuda High. It is possible that during the period from around Aug. 14 to Aug. 24 areas in the Midwest, Texas and the Northeast will have their warmest weather of the summer.

“The pattern shift may be most dramatic for those over the Central states, where the cool conditions thus far this summer have been the most extreme.”

In the near term, temperatures over the weekend and into Monday over a broad stretch of the country were expected to struggle to get above seasonal norms. AccuWeather.com predicted that the 70 degree high in Boston Friday would climb to 73 Saturday and reach 78 Monday. The normal high in Boston is 81. Cleveland’s Friday high of 83 was expected to drop to 77 Saturday but recover to 82 by Monday. The normal early August high in Cleveland is 82. St. Louis’ Friday maximum of 87 was predicted to fall to 85 Saturday before jumping to 90 on Monday.

Weekend and Monday gas at the Algonquin Citygates fell 16 cents to $2.36, and deliveries to Iroquois Waddington shed 28 cents to $3.36. Gas on Millennium was flat at $2.13.

In the Mid-Atlantic and Appalachia, gas was mostly lower. Gas bound for New York City on Transco Zone 6 shed a dime to $2.17, and parcels on Tetco M-3 were down by 7 cents to $2.17.

Gas for the weekend and Monday on Columbia Gas TCO rose 2 cents to $3.74, and packages on Dominion South changed hands at $1.99, down 5 cents.

Midwest quotes were mixed. At the Chicago Citygates, parcels came in at $3.79, up 3 cents, and on Alliance gas added 2 cents to $3.79. Consumers was down a penny to $3.84 and Michcon was flat at $3.85, but gas at NNG Demarcation rose 4 cents to $3.79.

There seems to be no end in sight to the widening negative Marcellus spot market basis to the Henry Hub. NGI Daily Cash Market Prices July 31 show a gaping -$2.42 basis on Transco-Leidy Line and a similar -$2.54 basis on Tennessee Zone 4 Marcellus.

Those negative Northeast basis values are also showing up in the forward market, although the gaps are somewhat narrower. According to NGI’s Forward Look data posted Friday, August basis at Transco Z6 NY was -$1.094 and Algonquin Citygate was -$0.859. However, looking ahead into the winter months, both of those locations turn dramatically positive this winter with basis topping $3 and $9 respectively.

Natgasweather.com said, “the latest weather models are still coming in, but what we have seen is in line with our forecast of warming temperatures the next couple of weeks, especially over the southern U.S., including the high-demand states of Texas, Oklahoma and California. With temperatures warming into the mid 90s and 100s, cooling demand will be quite strong and could support prices regionally. The northern U.S. will still see weather systems tracking through, although they will be quite a bit milder than the recent string of cool blasts.

“What is important is strong bearish headwinds will be easing over the coming weeks, apart from next week’s much larger than normal build that will be factoring in this week’s impressive cool blast.”

The National Hurricane Center in its 5 p.m. EDT Friday report said Tropical Storm Bertha was lumbering to the west-northwest at 24 mph and was holding winds of 50 mph. The storm was 405 miles southeast of San Juan, Puerto Rico and NHC projections showed it hitting the Bahamas and veering to the Northeast.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |