Markets | NGI All News Access | NGI Data

Bulls Seize Control Following EIA Storage Stats, But Will It Last?

Natural gas futures rose following the release of government storage figures Thursday morning that were less than what the market was expecting. In spite of falling about 5 Bcf short of traders’ expectations, the build was nearly double the five-year average for the week.

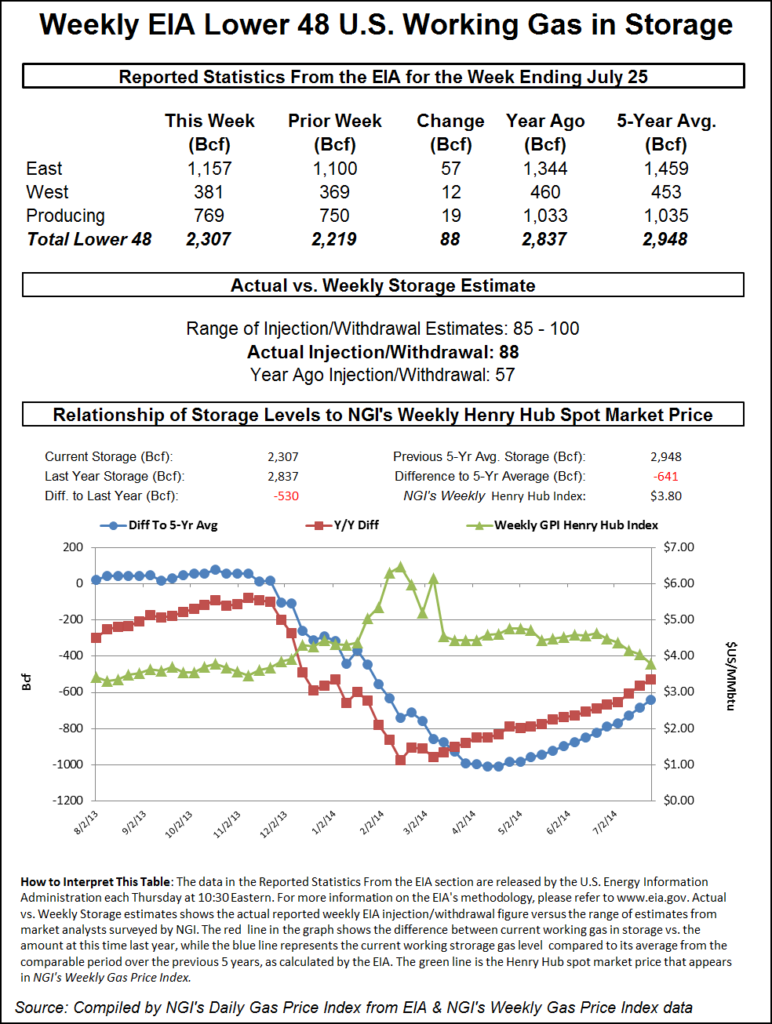

The injection of 88 Bcf for the week ending July 25 was about 5 Bcf less than market surveys and independent analyst projections. Shortly after the Energy Information Administration’s (EIA) 10:30 a.m. EDT storage report release, the September natural gas futures contract rose to a high of $3.869, and by 10:45 a.m. the contract had slipped only slightly to $3.864, up 7.8 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a build of approximately 93 Bcf. A Reuters survey of 26 traders and analysts revealed an average increase of 93 Bcf with a range of 85 Bcf to 100 Bcf. Citi Futures Perspective was looking for a build of 89 Bcf, and Bentek Energy anticipated an injection of 93 Bcf. Last year 57 Bcf was injected and the five-year pace is for a 46 Bcf increase.

“88 Bcf is still a big number,” said a New York floor trader. “It’s quite a bit larger than last year and the five-year average, so I’m not sure why this thing would want to rally. I think this is temporary. There is no reason for the market to rally.”

Inventories now stand at 2,307 Bcf and are 530 Bcf less than last year and 641 Bcf below the five-year average. In the East Region 57 Bcf was injected, and the West Region saw inventories up by 12 Bcf. Inventories in the Producing Region rose by 19 Bcf.

The Producing region salt cavern storage figure increased by 3 Bcf from the previous week to 210 Bcf, while the non-salt cavern figure rose by 16 Bcf to 559 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |