Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | Permian Basin

New Completion Design Lifts Value of SM Energy’s Eagle Ford Inventory

Denver-based SM Energy Co. executives on Wednesday released early positive results from new Eagle Ford Shale well completion techniques and detailed an acquisition of Bakken/Three Forks acreage that is adjacent to land where the company has experienced faster drill times and better completions.

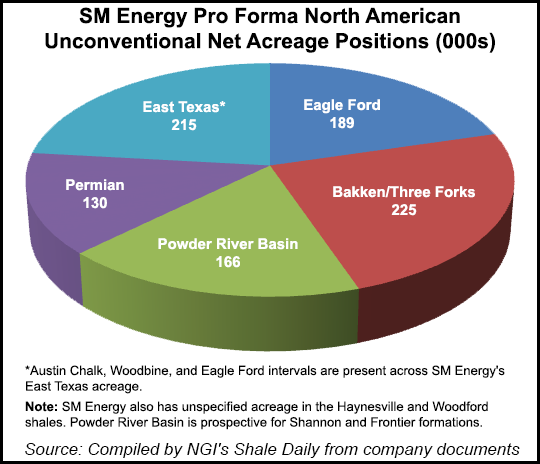

“We had another very strong quarter,” said CEO Tony Best. “We reported record quarterly production of 147,000 boe/d, led by our Eagle Ford assets, which had significant growth in the quarter…We recently signed an agreement to acquire a significant block of acreage in Divide and Williams counties [ND], adjacent to our Gooseneck acreage, where we have been operating a very successful Three Forks program.

“This pending acquisition is the largest in the company’s history on a dollar basis and is expected to add a significant amount of oily inventory to our Williston Basin program, adding 61,000 net acres to our existing position.”

Third, Best highlighted testing of new completion designs and longer laterals in the Eagle Ford and the Bakken/Three Forks. “During the second quarter, we started to receive a sufficient amount of data from these alternative completion tests to make some initial conclusions on the improved frack [fracture] designs. We can now comfortably say we are seeing improved results that are significantly increasing the value of these core development programs…”

Operated net production in the Eagle Ford Shale averaged 83,200 boe/d in the second quarter, a 9% sequential increase from the prior quarter and a 26% increase over the second quarter of 2013. In the latest period, SM Energy made 23 flowing completions in its operated Eagle Ford program.

The company has been shifting the Eagle Ford program toward longer lateral wells and completions with higher sand loading. Although longer lateral testing is ongoing, sufficient data on increased sand loading tests has demonstrated that some wells completed with higher sand loadings are more productive, have improved initial condensate yields, and have significantly improved economics.

“Although it does cost us some incremental money to pump more sand, we have largely offset those costs through our improved efficiency in drilling and completions operations over the last several years,” COO Jay Ottoson said during a conference call. “The combination of higher sand loadings and our success in cost control means that our newer wells in Area 2 are generating 40% higher returns, and our NPVs [net present values] have been improved by approximately $2 million per well.

“Obviously this is great news for area 2, which is about a 22,000-acre block, but we expect to see this type of improvement in other key areas of the operated acreage as well. We also expect good results from our change to longer lateral drilling and we’ll have results on some longer-lateral, high-sand loading wells for you later this year, some of which will be in oilier areas of the field.

“I think your takeaway from all this should be that our Eagle Ford drilling inventory is becoming a lot more valuable.”

In the nonoperated Eagle Ford, net production for the second quarter averaged 23,800 boe/d, a 2% sequential increase over the first quarter of 2014 production of 23,400 boe/d and a 37% increase over the second quarter of 2013. The operator made about 95 flowing completions. The drilling and completion carry provided under the company’s agreement with a unit of Mitsui & Co. Ltd. was completed in the second quarter.

In the Bakken/Three Forksm average daily production was 16,500 boe/d. Average daily production for the quarter increased by 3% over the prior quarter and 21% from the second quarter of 2013. SM Energy made 12 gross flowing completions in its operated Bakken/Three Forks program.

SM Energy also has struck an agreement to acquire 61,000 net acres in Divide and Williams counties, ND, adjacent to its Gooseneck area for $330 million. Assets being acquired have associated net production of 3,200 boe/d (91% oil, 1,500 BTU rich gas). The properties are 90% operated and about 70% held by production. SM Energy gains interests in 126 drilling spacing units, 81 of which will be operated by the company. Working interest (WI) for the operated spacing units is expected to range between 37.5% and 50%.

“Directly adjacent to the acquisition area, SM Energy has seen improvements in its Three Forks program recently due to faster drilling times and improved completions, where results to date indicate that recent wells have higher sustained production rates than older wells,” the company said.

The company is reviewing its capital budget for this year in light of the Bakken/Three Forks acquisition and expects to provide updated capital, production, and performance guidance in mid-August.

SM Energy completed one well in its Powder River Basin acreage during the second quarter. The Rush State 4277-36-1FH (100% WI) with a 3,788-foot effective lateral length had a peak 30-day initial production (IP) rate of 737 boe/d. This year the company has acquired or entered into transactions to acquire 33,000 net acres, resulting in a total of 166,000 net acres in the basin. SM Energy added a third rig to its program during the second quarter and has contracted a fourth rig for delivery in the third quarter.

In the Permian Basin during the second quarter, SM Energy made four flowing completions in its Sweetie Peck property and completed two of its most productive wells to date in this program on a peak IP per lateral foot basis. The Dorcus 4236H (100% WI) had a peak 30-day IP rate of 1,093 boe/d, and the Dorcus 3036H (100% WI) — the company’s first long lateral well in Sweetie Peck with an approximately 7,650-foot effective lateral — had a peak 30-day IP rate of 1,559 boe/d. In its Buffalo prospect in the northern Midland Basin, SM Energy spud its first Wolfcamp D test at the end of the second quarter.

Second quarter net income was $59.8 million (88 cents/share) compared to $76.5 million ($1.13/share) for the year-ago quarter. Adjusted net income was $106.5 million ($1.56/share) compared to $51.8 million (76 cents/share) for the same period of 2013.

Earnings before interest, taxes, depreciation, depletion, amortization, accretion, and exploration expense set a new quarterly record of $423.4 million, an increase of 24% from $342.5 million for the same period of 2013. Total operating revenues were $675.0 million compared to $559.4 million for the same period of 2013, a 21% increase year/year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |