Eagle Ford Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Anadarko Boosts Full-Year Production Guidance; Wattenberg Leads the Way

Anadarko Petroleum Corp.’s U.S. onshore sales volumes averaged 667,000 boe/d during the second quarter, an increase of more than 117,000 boe/d from a year ago, primarily driven by the Wattenberg Field in Colorado, the Eagle Ford Shale and the Permian Basin’s Delaware formation.

The operator overall delivered record volumes of 848,000 boe/d, including a 50,000 b/d increase in oil sales volumes from the U.S. onshore.

Sales volumes of crude oil, natural gas and natural gas liquids (NGL) represented an increase of almost 100,000 boe/d over the second quarter of 2013. The quarterly volumes exceeded the high end of the quarterly guidance, with liquids volumes were 408,000 boe/d, about 71% weighted to oil.

On the big gains, full-year guidance has been raised by 5 million boe to 299-302 million boe from an original forecast of 293-298 million boe.

CEO Al Walker was joined by COO Chuck Meloy and other executives on Wednesday to discuss the latest results.

“Anadarko delivered exceptional operating performance during the second quarter…led by our U.S. onshore assets and the El Merk development in Algeria,” Walker said. The increase in projected volumes “reflects our confidence in the portfolio’s capability to continue delivering strong results.

“To further enhance performance, we will continue to be an active portfolio manager and pursue additional opportunities to accelerate value as appropriate.”

Led by the Wattenberg, the Rockies portfolio by itself delivered sales volumes averaging 365,000 boe/d between April and June, a 24% jump from a year ago, adjusted for divestitures.

On average, 19 rigs were in operation, with 171 wells drilled — mostly in the liquids-rich Wattenberg, which has been Anadarko’s leading producer for several quarters (see Shale Daily, May 6; March 4; Feb. 4).

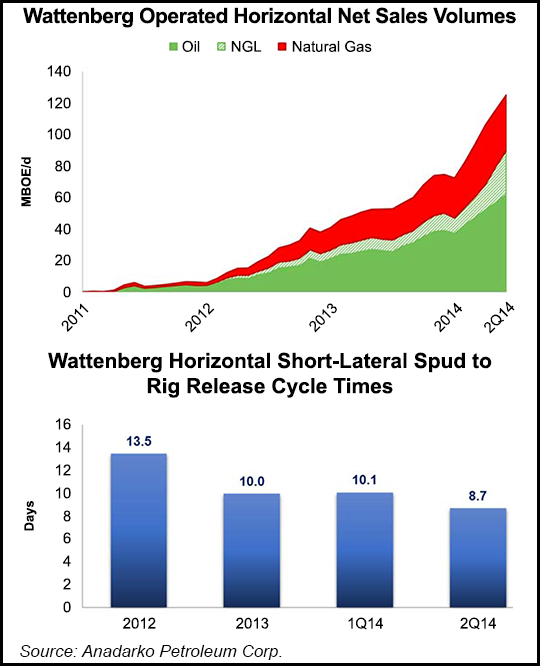

Sales volumes from the field at the end of June were 169,000 boe/d net, up 39,000 boe/d (30%) sequentially. An average 14 horizontal rigs were in operation, with 102 wells drilled, equivalent to 143 short-laterals.

Three “buckets” are driving growth from the Colorado field, noted Meloy.

“A lot of pent-up capacity was built through the last few quarters waiting on compression,” he noted. The second was the start-up of the 300 MMcf/d Lancaster cryogenic plant, which sits in the middle of the Wattenberg.

“Once Lancaster came on, we were able to move volumes in our system. It’s a high capacity plant with fantastic recoveries and it’s running really well. It did something for us that we couldn’t really quantify.

“When you look at Wattenberg, the way the infrastructure was laid out, the old plant was south of the field. Lancaster is right in the middle, which has changed the flow dynamics,” said Meloy.

About one-third of the growth “is associated with just improved flow dynamics, which materially reduced line pressures,” the second third of the growth. Given the capacity to flow, Anadarko is achieving one-third of the uplift from “better recoveries.”

Lancaster now is processing 290 MMcf/d and recovering 42,000 b/d of NGLs. The 150,000 b/d Front Range NGL pipeline also is being commissioned. Front Range provides access to the Mont Belvieu market to the Texas Gulf Coast.

With so much of its growth tied to Colorado, Walker acknowledged concerns about two ballot initiatives that could be before state voters this fall to allow municipalities to prevent oil and natural gas production (see Shale Daily, July 17). Ballot initiative 88 would establish a 2,000-foot setback requirement, while No. 89 would grant local governments the ability to oversee drilling activity. If the setback initiative were to pass, activity in the Wattenberg could come to a standstill.

“I think for those who live in Colorado, politics there is hard to always appreciate,” said the CEO. He compared Colorado politics to that of Russia during the Cold War.

“I was reminded the other day of a [Winston] Churchill quote that I have always loved. When asked what he thought of Russia, Churchill said it was a ‘riddle wrapped in a mystery inside an enigma.’ I don’t know what the ballot initiatives are going to look like…More importantly, I don’t know what the [state regulator] rulemaking would be if it were unsuccessful” regarding setbacks or local oversight.

“I just can’t speculate…We are committed as an industry, as a company, to educate voters. We still have a lot of work to do…as far as education.” Through advertising and trade groups, “we are trying very hard to make sure voters know what they’re voting on.”

Colorado “really is a purple state,” with Democrats, Republicans and Independents each capturing around one-third of the voters. However, “the business community is lined up against it,” he said.

“Without sounding politically charged, it doesn’t seem like any party has seen what the industry sees of what [the initiatives] would do to the state…”

The oil and gas industry, he noted, has been at the forefront of lifting Colorado’s recovery since the recession in 2008. “We are coming nicely out of recovery, and we are encouraged right now of things on the ground. People are listening.”

Drilling success in the United States extends well beyond Wattenberg. Anadarko, based in The Woodlands near Houston, also is achieving across-the-board reductions in drilling cycle time. Short lateral wells averaged 8.7 days from spud-to-release in the latest period, representing a six-day, or 40%, reduction in cycle times since 1Q2012.

The Greater Natural Buttes field, also in the Rockies, delivered 560 MMcf/d net for the quarter, up 6% year/year, with three rigs in operation with 40 wells drilled.

An emerging play in Laramie County, WY, also is proving its worth. Anadarko holds more than 100,000 mineral interests in the play and year-to-date has participated in testing more than 30 wells in the Niobrara and Codell formations.

“Early results have been strong,” Meloy said, with 40 more wells planned through 2014.

In the period, the Southern and Appalachian division, extending to the Midcontinent and across Texas, also delivered record sales volumes of 302,000 boe/d, 18% higher from a year ago. Daily oil volumes rose 8% sequentially and were up 41% from 2Q2013.

In the Permian’s Delaware subbasin, step-out delineation resulted in six wells averaging 1,100 boe/d on 30-day rates.

And in the Gulf of Mexico, Anadarko completed all major construction and installation projects at its Lucius development. The 80,000 b/d Lucius spar is expected to achieve first oil on schedule around the beginning of the fourth quarter. In addition, construction on the hull of the Heidelberg spar is nearly complete, and it remains on schedule to achieve first oil in 2016.

The super independent’s profits fell 76% from a year ago on $442 million in derivatives losses, impairments and asset sales. Net earnings were $227 million (45 cents/share), compared with $929 million ($1.84) in 2Q2013. One-time costs included a $151 million loss on derivatives, $75 million in impairment costs and $19 million in interest expenses related to its $5.15 billion settlement regarding Tronox Inc. (see Daily GPI, April 3).

Anadarko had a “gang buster quarter,” said analysts with Tudor, Pickering, Holt & Co. “We expected a production beat but the company blew the lid off numbers, driven primarily by Wattenberg growth. Full-year guidance increased 2%, led by U.S. liquids, with 3Q2014 guidance midpoint 3%-plus versus the Street.”

Wells Fargo Securities also pointed to the solid quarter, underpinned by onshore growth.

“Despite the myriad of noise and issues surrounding the company over the last few years, they continue to deliver and over-deliver,” said the Wells Fargo team, and “there remains a significant amount of upside potential (e.g. portfolio optimization, shareholder returns, acceleration, etc.)…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |