M&A | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Oil, NatGas Operators Countering Flat Cash Flow With More Debt, Asset Sales

Large domestic oil and natural gas companies are incurring more debt and selling off assets as cash flow falters, the U.S. Energy Information Administration (EIA) said Tuesday.

Based on data supplied by the Evaluate Energy database, EIA said lower cash flow has come from low volatility in commodity prices, particularly crude oil prices, based on 1Q2014 reports.

Cash from operations in the first quarter for 127 operators reviewed totaled $568 billion, and major uses of cash totaled $677 billion, a difference of nearly $110 billion.

“This shortfall was filled through a $106 billion net increase in debt and $73 billion from sales of assets, which increased the overall cash balance,” according to the report, whose principal contributor was Jeff Barron.

“The gap between cash from operations and major uses of cash has widened in recent years from a low of $18 billion in 2010 to $100-120 billion during the past three years.”

The cash flow statements have become a useful tool in analyzing a company’s biggest sources and uses of cash over a given period, EIA said.

Cash sources mostly are from generated cash from operations and proceeds from sales of property, plants and equipment. Cash outflows include capital expenditures to purchase property, plants and equipment, and from dividends provided to shareholders.

“Average cash from operations from 2012 through first quarter 2014 increased $59 billion, or 12%, compared to its 2010-2011 average,” EIA said. “At the same time, major uses of cash increased by $136 billion, from an average of $548 billion in 2010-2011 to $684 billion in the 2012-2014 period.

“While capital expenditures, typically the largest use of cash, accounted for most of the increase, cash spent on share repurchases increased $39 billion on average. In fact, net share repurchases was a source of cash for the 2010-2011 average, changing to a net use of cash in mid-2011.”

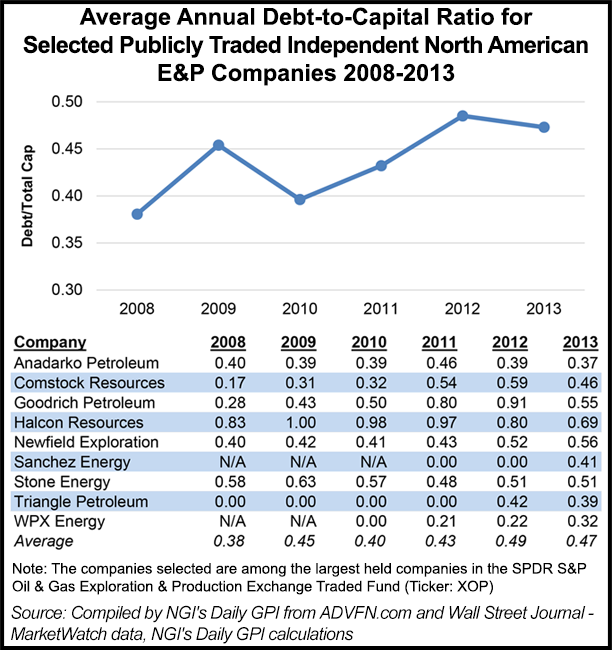

To meet capital expenditures with flat cash flow from operations, companies have increased their borrowing. Comparing the major sources of cash for the first quarter only, the net increase in debt has made up at least 20% of cash since 2012,” the report said.

However, increasing debt isn’t necessarily a negative.

“Low borrowing rates have allowed companies to use outside sources of capital (debt) to meet their spending needs,” said analysts. “Production in North America, where many of the reporting companies have major operations, has increased dramatically in recent years.

“Using debt to fuel growth is a typical strategy, particularly among smaller producers. The increased debt load is anticipated to be met with increased production, generating more revenue to service future debt payments.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |