UK Accepting Bids for Onshore Licenses, Tightens Drilling in Sensitive Areas

The United Kingdom (UK) advanced plans to develop its shale basins on Monday after launching a new round of bidding for onshore oil and natural gas exploration licenses, as it tightened rules for drilling in sensitive areas, including around its World Heritage Sites and national parks.

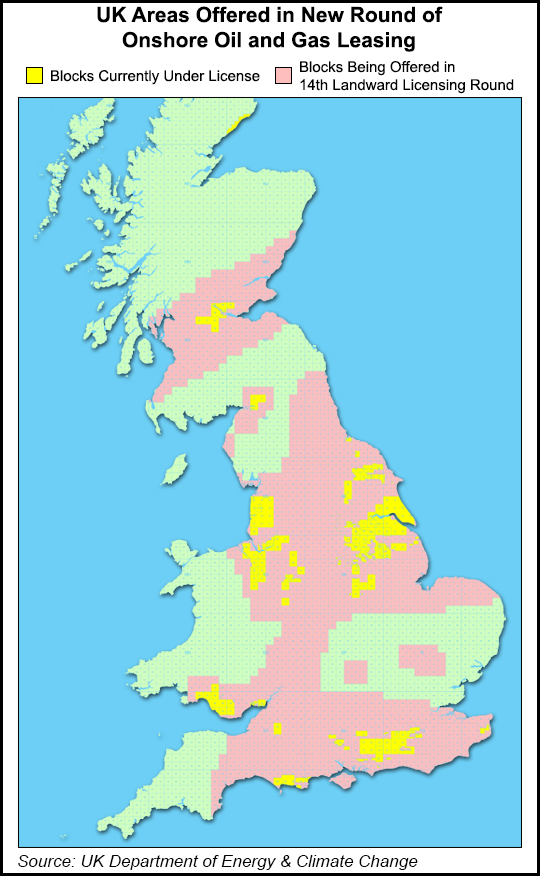

UK Energy Minister Matthew Hancock invited oil and gas companies to apply for licenses for an area that covers the bulk of England, plus a wide swath across the middle of Scotland and parts of Wales. The government would accept applications for the round — officially, the 14th Landward Licensing Round — until Oct. 28.

The UK’s Department of Energy & Climate Change (DECC) is responsible for issuing licenses for oil and gas exploration both in the onshore and on the UK Continental Shelf. Companies need a license to drill in the UK, but they must also secure planning permission and permits from the Environment Agency and a signoff from the Health and Security Executive before they can begin drilling.

“Unlocking shale gas in Britain has the potential to provide us with greater energy security, jobs and growth,” Hancock said. “We must act carefully, minimizing risks, to explore how much of our large resource can be recovered to give the UK a new homegrown source of energy. As one of the cleanest fossil fuels, shale gas can be a key part of the UK’s answer to climate change and a bridge to a much greener future.”

The UK government also announced additional planning guidance for unconventional drilling in its national parks and the Broads, a network of mostly navigable rivers and lakes in England’s Norfolk and Suffolk counties. The new rules also cover places designated as Areas of Outstanding Natural Beauty by the UK government, and World Heritage Sites listed by the United Nations Educational, Scientific and Cultural Organization.

Specifically, paragraph 116 of the UK’s National Planning Policy Framework stipulates that planning permission for drilling in the aforementioned areas “should be refused…except in exceptional circumstances and where it can be demonstrated they are in the public interest.” Oil and gas companies that file applications to drill there need to include an assessment that shows:

The need for the development, including in terms of any national considerations, and the impact of permitting it, or refusing it, upon the local economy;

The cost of, and scope for, developing elsewhere outside the designated area, or meeting the need for it in some other way; and

Any detrimental effect on the environment, the landscape and recreational opportunities, and the extent to which that could be moderated.

“The new guidance published today will protect Britain’s great national parks and outstanding landscapes… building on the existing rules that ensure operational best practices are implemented and robustly enforced,” Hancock said. “Ultimately, done right, speeding up shale will mean more jobs and opportunities for people and help ensure long-term economic and energy security for our country.”

UK Communities Minister Lord Ahmad of Wimbledon concurred.

“Effective exploration and testing of the UK’s unconventional gas resources is key to understanding the potential for this industry — so the government is creating the right framework to accelerate unconventional oil and gas development in a responsible and sustainable way,” Ahmad said. “We recognize there are areas of outstanding landscape and scenic beauty where the environmental and heritage qualities need to be carefully balanced against the benefits of oil and gas from unconventional hydrocarbons.

“Proposals for such development must recognize the importance of these sites.”

Eric Pickles, who heads the UK Department for Communities and Local Government (DCLG), said he would personally consider any appeal for a company’s rejected application to drill in a sensitive area within 12 months of the refusal, and would decide whether the guidance had been properly applied. The DCLG would review any appeals that advance beyond Pickles’ muster.

Last May, the DECC launched a consultation on proposals for improving oil and gas companies’ access to the UK’s shale formations in exchange for the companies making voluntary payments to localities affected by their drilling (see Shale Daily, May 28). The consultation period ends Aug. 15.

Also that month, DECC published a report by the British Geological Survey (BGS) that concluded the Weald Basin in southern England is unlikely to be a potential source for gas but could hold an average of 4.4 billion bbl of oil. The BGS estimates the UK’s Bowland-Hodder Shale could contain 822-2,281 Tcf of gas, with a mid-range estimate of 1,329 Tcf (see Shale Daily, June 28, 2013).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |