NGI Data | NGI All News Access

Good News Bears and Bad News Bears Reign In Weekly Trading

The good news for gas buyers is that weekly prices worked another 18 cents lower to $3.72 according to the NGI Weekly Spot Gas National Average for the week ended July 25. The bad news is that for unhedged physical market longs the pace of weekly declines is accelerating. For the week ended July 18 the market fell 11 cents to a national average of $3.90.

Only one actively traded point made it into the black. In the Northeast, Texas Eastern M2 30 Delivery added 2 cents to $3.00, and the week’s steepest decline was at St. Clair in the Midwest dropping 31 cents to $3.99. Regionally, the Midwest saw the greatest losses, dropping 25 cents to $3.96, and the Northeast lost the least, posting a setback of 14 cents to $2.87.

South Louisiana fell 23 cents to $3.77, and South Texas and East Texas both were off 22 cents to $3.73 and $3.79, respectively.

The Midcontinent, Rocky Mountains, and California all shed 21 cents to $3.76, $3.77, and $4.28, respectively.

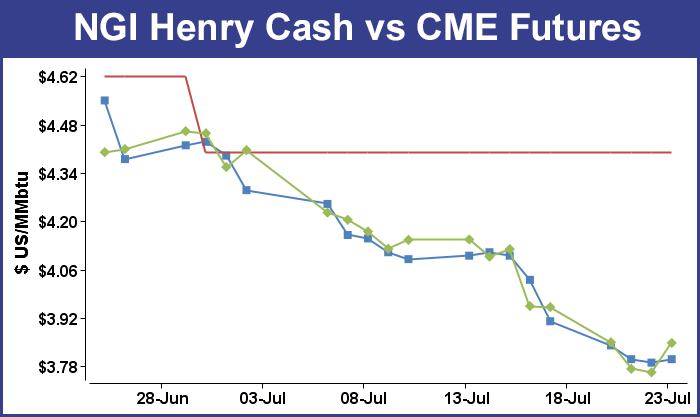

August futures for the week fell 17.0 cents to $3.781.

Storage bears got something of a surprise Thursday when the Energy Information Administration (EIA) reported injection of 90 Bcf, somewhat shy of market expectations.

The week prior, the market was counting on a build of about 100 Bcf, but the actual figure came in at a plump 107 Bcf, and futures had the trajectory of a coyote falling off a cliff in a Saturday morning cartoon. August settled 16.5 cents lower at $3.954.

No such luck for the bears this time around, even though recent cool weather in eastern and Midwest markets had analysts looking for a build just about double the normal patterns for this time of year. Last year, 43 Bcf was injected, and the five-year average stands at 46 Bcf. Analysts at United ICAP expected an increase of 90 Bcf, and Kyle Cooper at IAF Advisors calculated a 93 Bcf build. A Reuters poll of 23 industry cognoscenti revealed an average 96 Bcf with a range of 89-106 Bcf.

Bentek Energy calculated a 91 Bcf increase and said, “Mild temperatures across the middle of the Lower 48 allowed for a continuation of strong storage injections from the previous week, especially in Bentek’s sample of East Region fields, which posted a total sample injection above 38 Bcf on the week. Facilities in the Producing and West regions decreased their injections within Bentek’s sample by a combined 6 Bcf as an uptick in power demand in the West Region by 0.5 Bcf/d cut into storage activity and prompted an increase in net flows from the Producing Region to the West. The increased net flows helped reduce total injections below triple digits on the week.”

The rally that followed EIA’s Thursday storage report had traders thinking the momentum might extend at least into Friday. “I think the market will try to build a base for a little while. If traders can do that and take it into [Friday] with a higher close in the $3.81 to $3.83 area maybe they [traders] will try to work the market a little more and take some profits into the weekend,”said a New York floor trader. August settled 8.5 cents higher at $3.847.

Analysts saw a bullish bias to the figures. “The 90 Bcf build was bullish relative to the 96-Bcf consensus expectation and well below our own model’s 104 Bcf estimate,said Tim Evans of Citi Futures Perspective. “It was clearly a bullish surprise. At the same time, we note we’ve seen some volatility over the past two weeks, with the larger than expected 107 Bcf build in the prior week and the smaller than expected 90 Bcf figure in the latest report, making it hard to be too confident regarding just where the supply/demand balance is. It’s also worth bearing in mind that while it was a bullish surprise, the 90 Bcf build was still well above the 47 Bcf five-year average, and the larger bearish storage trend remains intact.”

Phillip Golden at Energy Market Exchange in Houston noted that “We will still need injection numbers of 80 Bcf/week to refill storage to the levels expected by the Energy Information Administration, and to get to the high of 2012, we would need to average 113 Bcf/week. Today’s number increases the likelihood that we will reach the EIA projected number of just over 3,400 Bcf by the end of injection season. However, with the teeth of summer and the hurricane season still ahead, cautious optimism is the watchword.”

Following Thursday’s rally doubts were voiced that the advance had much substance. According to Teri Viswanath, director of commodity strategy for natural gas at BNP Paribas, “[Thursday’s] market reaction was probably more a temporary lull in selling rather than a fundamental trend change. To be sure, rapid institutional deleveraging has occurred over the past several weeks as the cumulative effect of more than two months’ worth of outsized storage injections weighs on market sentiment. What’s more, the persistent mild weather might further embolden short-sellers as the current restocking trend is extended through August.”

She also recognized the “possibility for further price deterioration, [but also] expects that the threat of economic fuel-switching and the potential for early heating demand will quell some of the selling interest at current price levels.”

Price deterioration didn’t waste any time Friday. August settled 6.6 cents lower at $3.781.

Others were also questioning whether Thursday’s gains could carry forward.

“[W]e are suspect of the ability to maintain [Thursday’s] modest gains without major assistance from some warming in the temperature forecasts,” said Jim Ritterbusch in closing comments Thursday to clients. “As seen on numerous occasions, a significant miss in weekly storage data can be easily overshadowed within 10 or 12 hours by changes to the one- to two-week temperature outlooks. So far, we are not seeing much shift with the six-10 day forecasts that are advising significantly below normal trends across a broad chunk of the Midcontinent with deviations in some regions exceeding 15 degrees.”

With cooler than normal temperatures dominating the trading landscape, the coast seems clear for additional hefty storage builds, possibly landing ending inventories close to last year’s 3,816 Bcf final tally. “The prospect of an additional two and maybe three larger than normal supply injections will tend to restrict additional upside follow through. Although the August contract may be able to fill last Monday’s downside price gap between 3.89 and 3.93, a further extension of gains would appear unlikely. [Friday’s] trade will likely provide some price consolidation largely within today’s parameters with next the significant price swing deferred until Monday when weekend updates to the temperature views will need to be priced in. While [Thursday’s] price advance tightened the front switch in virtually erasing a modest 1.5 cent contango, we expect a carrying charge to be reestablished ahead of Tuesday’s August contract expiration,” Ritterbusch said.

“All in all, we are maintaining a bearish stance as we feel that a 5-6 Bcf miss in the storage data from average street ideas isn’t capable of offsetting an unusually cool summer that is showing no sign of completion. We will also note a potential need to begin subtracting some storm premium as Caribbean wave activity has been quiet thus far during this hurricane season.”

Weekend and Monday deliveries retreated in Friday’s trading as weekend temperature forecasts struggled to make it to seasonal norm. By Monday temperatures were expected to be more than 10 degrees below normal throughout the Midwest and Great Lakes.

The Northeast suffered some double-digit losses, but Appalachia and the Marcellus Shale region also weakened. Losses were widespread, but a few Texas Gulf points managed small gains. The overall market shed almost a dime. Futures trading wasn’t any more enlightened, and Thursday’s August low of $3.744 was the lowest a spot contract has traded since late November. At the close, August was down 6.6 cents to $3.781 and September had lost 6.3 cents to $3.787.

Midwest and Great Lakes points were down a couple of pennies as forecasters expected temperatures by Monday to plunge well below seasonal norms. In the Midwest, load-killing showers and thunderstorms were in the mix. “Strong and potentially severe thunderstorms will mark the start of the weekend for the Chicago area,” said AccuWeather.com’s Kevin Byrne. “A couple of spotty showers will move into the area Friday afternoon, but into the evening hours, strong and perhaps severe thunderstorms are expected to develop. Threats from the storms include flooding downpours and hail. Saturday will have intervals of clouds and sun with a shower or thunderstorm around during the day. The chance for a shower or storm will remain into the evening.

“It will be humid on Sunday with a couple of showers and breeze in the afternoon. The severe weather threat will conclude with the end of the weekend as the start of next week looks to bring cooler and more pleasant conditions.”

Wunderground.com forecast Chicago’s Friday high of 77 would rise to 86 Saturday, but by Monday highs were expected to reach only 71.The seasonal high in Chicago is 84. Milwaukee was forecast to see its Friday high of 74 reach 85 on Saturday before dropping to 71 on Monday. The normal late-July high in Milwaukee is 80. Indianapolis’ Friday high of 78 was predicted to reach 90 by Saturday but slide to 74 on Monday. The normal high in Indianapolis this time of year is 85.

Weekend and Monday deliveries on Alliance fell a penny to $3.85, and gas at the Chicago Citygates dropped 3 cents to $3.84. At NNG Demarcation, packages were seen at $3.85, down 3 cents, and on Consumers weekend and Monday gas fell 2 cents to $3.94. Parcels on Michcon fell a penny to $3.96.

Greater declines were seen at eastern points. Gas at the Algonquin Citygates fell 16 cents to $2.64, and deliveries to Iroquois Waddington shed 13 cents to $3.77. Tennessee Zone 6 200 L was off by 7 cents to $2.84.

On Millennium East Pool, weekend and Monday gas was seen at $2.38, down 15 cents, and on Transco Leidy deliveries came in at $2.20, down 12 cents.

Appalachia locations were also soft. Gas on Columbia TCO shed a penny to $3.73, and on Dominion South, packages skidded a dime to $2.28.

WSI Corp in its Friday morning outlook showed substantially below normal temperatures extending from Colorado to Connecticut. “[Friday’s] six-10 day forecast is not quite as cool as yesterday’s over most of the eastern two-thirds, especially across the northern tier of the nation. No major changes out West where above to well above normal temps continue, especially over the interior Northwest. Confidence in this forecast is average, perhaps near to slightly above average early in the period. Models maintain the amplified pattern dropping the deep trough down into the Southern Plains and Deep South while ridging builds across southern Canada and the northern tier.”

WSI advocates “a slight cooler risk over the Mid South (including Texas) early in the period. Otherwise, the risk begins to shift to the warmer side over the latter half of the period south and east of Chicago.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |