Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Northeast, East Lead Extensive Decline; Futures Free-Fall

Friday deliveries of natural gas headed sharply lower in Thursday’s trading at virtually all market points as traders made sure they got their deals done prior to the release of government storage data.

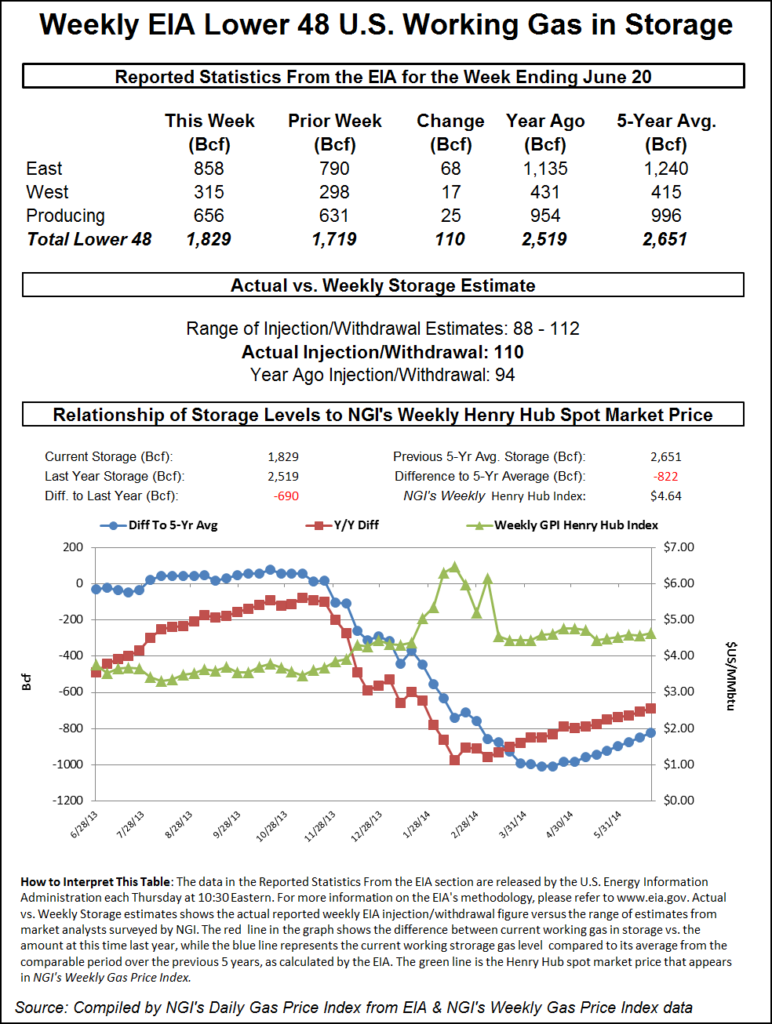

Losses ranged from a few pennies to as much as a half dollar, with Mid-Atlantic and New England locations taking the biggest hits. A few thinly traded points did manage to climb into the “plus” column, but overall the market dropped about 9 cents. The Energy Information Administration reported injections into storage of 110 Bcf, about 3 Bcf above traders’ expectations, and futures tanked. The July contract, which expired Thursday, went off of the board at $4.400, down 15.3 cents, and August plummeted 12.8 cents to $4.441. July crude oil was off 66 cents to $105.84/bbl.

Next-day gas prices in the Great Lakes and Midwest eased as weather forecasts called for near-normal temperatures and gave buyers little incentive to purchase incremental volumes. AccuWeather.com predicted Minneapolis’ high of 79 degrees Thursday would rise to 84 Friday and hold through Saturday. The normal high, however, in Minneapolis this time of year is 82. Milwaukee’s 68 high on Thursday was seen rising to 75 Friday and 80 on Saturday. The normal high in Milwaukee during late June is 79. Chicago’s 67 high Thursday was expected to jump to 81 Friday and reach 83 Saturday, right at the seasonal norm.

Tom Skilling of the Chicago Weather Center (CWC) predicted a warm Friday. “Clouds increase in the afternoon, warmer and more humid in the afternoon. Some widely-scattered thunderstorms later in the day and overnight with about 30% coverage. Highest temperatures in the mid to upper 80s except cooler along the lakefront. Southeast winds,” he said on the CWC website.

A Michigan marketer reported that his company wasn’t quite as able to take advantage of lower prices as it might have been otherwise. “Prices have come down, and we paid $4.90 on Consumers earlier in the week. We didn’t have much gas to buy for this month anyway,” he said.

Friday deliveries to the Joliet Hub eased 5 cents to $4.61, and gas on Alliance shed 8 cents to $4.59. Packages at the Chicago Citygates fell 2 cents to $4.64, and gas on Consumers shed three pennies to $4.76. Deliveries to Michcon were seen 4 cents lower at $4.75.

The day’s declines were greatest at New England points, and the weaker prices were aided by falling quotes for electric power. IntercontinentalExchange reported that Friday peak power into the New England ISO’s Massachusetts Hub fell $9.30 to $43.10/MWh. Next-day power at the PJM West terminal was seen 36 cents higher at $53.86/MWh.

The National Weather Service in southeast Massachusetts reported that “dry weather arrives tonight [Thursday] with seasonable temperatures and lower humidity levels. This continues through the weekend. Warmer temperatures and increasing humidity returns next week.”

Packages at the Algonquin Citygates for Friday tumbled 47 cents to $3.76, and gas at Iroquois Waddington slid 15 cents to $4.65. Gas on Tennessee Zone 6 200 L dropped 35 cents to $3.84.

Mid-Atlantic points softened as well. Gas bound for New York City on Transco Zone 6 plunged 37 cents to $3.71, and deliveries to Tetco M-3 fell 18 cents to $3.69.

The day’s sharp decline in futures trading has some thinking of a realignment of supply and demand. “It would appear that some structural shifts are beginning to develop on both sides of the supply-usage balances that could ease supply concerns considerably, at least until a sustainable hot spell shows up within the forecasts,” a Midwest trader said.

Once again, futures reacted with gusto to a storage report that was moderately higher than what the market was looking for. Last week a stout 113 Bcf was reported for the previous week, about 3 Bcf more than trader expectations, and three days later July futures were wallowing more than 21 cents lower. Such outsize reactions seem to be the norm these days, and the 10:30 a.m. EDT release by the Energy Information Administration was closely watched for variations from market expectations that could lead to similar market gains or losses.

Losses ruled the day. Thursday’s injection of 110 Bcf was about 3 Bcf higher than market surveys and independent analyst projections. The expiring July futures dropped to a low of $4.417 shortly after the number was released, but by 10:45 a.m. July was at $4.4555, down 9.8 cents from Wednesday’s settlement.

For the week ended June 20, the market was looking at builds in the neighborhood of just under 110 Bcf, not much different than the previous week. Bentek Energy’s flow model predicts an increase of 108 Bcf, substantially higher than last year’s 94 Bcf and a five-year average of 81 Bcf. Bentek’s calculations show demand for power generation increased, but that was outdone by even greater injections.

“Demand rose slightly from the previous week, with power burn demand coming in 1.4 Bcf/d stronger week-over-week; however, Bentek’s sample of injections rose slightly by a total of 2 Bcf from the previous week’s tally, due largely to higher injections in the West Region,” the firm said.

“Injections started the storage week extremely strong but were cut significantly within the Producing Region as total power burn demand climbed above the 28 Bcf/d mark during the week. Despite the strong power burn, injections within Bentek’s sample of salt dome facilities rose by a total of 1.3 Bcf from the previous week and drove the majority of the sample increases within the region week-over-week. Bentek’s sample of East Region facilities continued to post strong injections as well, with a total sample build of 45 Bcf on the week as Dominion, ANR, NNG and NGPL have continued at a strong pace for June. Last week’s injection could be the last above 110 Bcf until fall, barring a break in temperatures during the peak power demand months of July and August.”

Other estimates of the EIA report included Houston-based IAF Advisors at a 109 Bcf build and United ICAP at 107 Bcf. A Reuters poll of 22 traders and analysts revealed a sample average of 102 Bcf with a range of 88-112 Bcf.

Inventories now stand at 1,829 Bcf and are 690 Bcf less than last year and 822 Bcf below the 5-year average. In the East Region 68 Bcf were injected and the West Region saw inventories up by 17 Bcf. Inventories in the Producing Region rose by 25 Bcf.

Power burn is likely to remain strong if near-term weather forecasts are correct. WSI Corp. in its morning outlook predicts heat and humidity across the expansive MISO (Midwest Independent System Operator) power grid. “Seasonably warm temperatures and increasing humidity levels are expected [Thursday]. Highs may generally range in the mid 70s and 80s. A southerly flow will support warm and humid conditions during the end of the week into the weekend. Highs may climb into the upper 70s, 80s to low 90s. A cold front and stormy weather may promote a cooling trend across the northern Plains and Upper Midwest by the start of next week. However, warm and humid conditions should persist across the lower Midwest.”

It added that renewable power generation in the form of modest wind output “is expected [Thursday] with output in the 2-4 GW range. An increasing south-southwest wind should cause generation to trend upward and become more favorable during the remainder of the forecast period. Output may peak near 4-6 GW.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |