M&A | NGI All News Access | NGI The Weekly Gas Market Report

Wisconsin Energy and Integrys Plan Midwest Gas/Power Utility Combo

Wisconsin Energy Corp. is to acquire Integrys Energy Group Inc. in a cash and stock deal worth $9.1 billion, including debt, to create a Midwest natural gas and power utility giant called WEC Energy Group Inc.

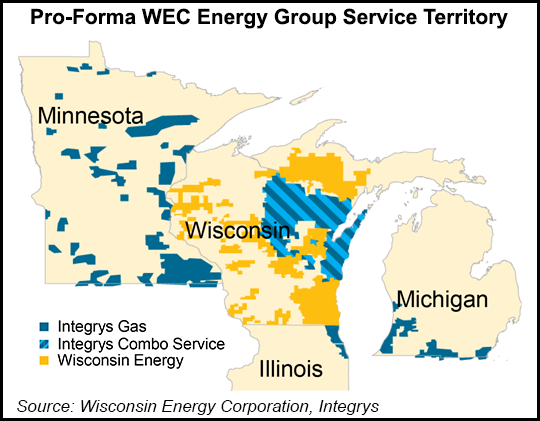

WEC is projected to have a regulated rate base of $16.8 billion in 2015, serve 2.8 million gas customers and 1.5 million electric customers across Wisconsin, Illinois, Michigan and Minnesota, and operate nearly 71,000 miles of electric distribution lines and more than 44,000 miles of gas transmission and distribution lines.

Based on the number of gas customers, the combined company would rank eighth among U.S. utility companies. It would rank 15th among U.S. utilities based on the number of gas and electric customers combined.

The deal combines Wisconsin Energy utility We Energies with Integrys electric/gas utilities Wisconsin Public Service, Peoples Gas, North Shore Gas, Minnesota Energy Resources and Michigan Gas Utilities. In addition to expanding and diversifying Wisconsin Energy’s regulated holdings into other large Midwestern states, the combined company will hold a 60% stake in American Transmission Co. The combined company’s long-term earnings per share growth rate is projected to be about 6%.

Wisconsin Energy shares closed down 3.45% Monday at $45.27, but Integrys shares climbed more than 12% to $68.35 after setting a new 52-week high intraday of $70.61.

“We believe this combination provides a unique opportunity to create the premier regulated utility system in the Midwest, with superior service and competitive pricing for years to come,” said Wisconsin Energy CEO Gale Klappa. “The operational and financial benefits to all of our stakeholders — from the customers and communities we serve, to the people we employ, to the shareholders who count on us to create value — are clear, achievable and compelling.”

Last year the Illinois General Assembly approved legislation that supports Peoples Gas’ $2.5 billion accelerated plan to modernize Chicago’s natural gas infrastructure by providing a cost-recovery mechanism.

“We still have about 1,600-1,700 miles of pipe to be replaced, and in order to ensure that we have reasonable return on and of our investment there, we worked with the legislature in Illinois last year and had a rider passed that allows us to very quickly to start collecting on the investment we’re making in Illinois. That is legislative, so it’s very solid in that respect,” Integrys CEO Charlie Schrock said during a conference call Monday to discuss the deal.

WEC will be headquartered in metropolitan Milwaukee with operating headquarters in Chicago, Green Bay and Milwaukee. Klappa is to be chairman and CEO of the combined company. Schrock will remain in his current roles with Integrys until the closing of the transaction, when he will retire. Other senior leadership roles in the combined company will be filled by current senior officers of Wisconsin Energy.

“Our shareholders will receive an attractive premium for their investment and will also benefit from the opportunity to participate in the upside of the combination, including future value creation and a growing dividend program,” Schrock said. “Wisconsin Energy is committed to the accelerated investment we’re making in our territories — investment that will help build on our strong track record of quality. As a larger combined company committed to growth, we believe the combination will also offer more diverse opportunities for employees.”

The transaction has been approved by the boards of both companies.Integrys shareholders are to receive common stock at a fixed exchange ratio of 1.128 Wisconsin Energy shares plus $18.58 in cash per Integrys share. Total consideration is valued at $71.47 per Integrys share, with a consideration mix of 74% stock and 26% cash, representing a 17.3% premium to Integrys’ closing price on June 20 and a 22.8% premium to the volume-weighted average share price over the past 30 trading days ending June 20. Upon closing, Integrys shareholders will own about 28% of the combined company. Excluding debt, the deal is worth about $5.7 billion in cash and stock.

Integrys is in the late stages of a process to divest Integrys Energy Services, its nonregulated marketing subsidiary. The business provides retail gas and power marketing services across 22 states and had sales of $2 billion last year. In January it also announced an agreement to sell Upper Peninsula Power Co. to Balfour Beatty Infrastructure Partners.

Milwaukee-based Wisconsin Energy serves more than 1.1 million electric customers in Wisconsin and Michigan’s Upper Peninsula and 1.1 million natural gas customers in Wisconsin. The company’s principal utility is We Energies. The company’s other major subsidiary, We Power, designs, builds and owns electric generating plants. It also has a 26% equity ownership interest in American Transmission Co., a federally regulated electric transmission company.

Chicago-based Integrys Energy Group Inc. has regulated natural gas and electric utility operations serving customers in Illinois, Michigan, Minnesota and Wisconsin; an approximate 34% equity ownership interest in American Transmission Co., and nonregulated energy operations.

The deal is subject to approvals from the shareholders of both companies, the Federal Energy Regulatory Commission, Federal Communications Commission, Public Service Commission of Wisconsin, Illinois Commerce Commission, Michigan Public Service Commission and the Minnesota Public Utilities Commission, as well as antitrust clearance and other customary conditions. Closing is expected during summer 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |