Coal Made Gains on Gas Last Winter, Data Show

Coming out of one of the most severe winters ever recorded, indicators are showing that coal is making somewhat of a comeback at the expense of natural gas in the electric generation sector, according to a report released Thursday by Bentek Energy, “Back in the Black: Coal Makes Comeback.”

Asserting that coal will remain “viable” in the power sector, Bentek analyst Michael Bennett cited coal accounting for 44% of the nation’s electric power this past winter, compared to 41% the two previous winters, while gas held its ground at 24%, the same proportion as the previous winter. However, gas declined 2% from the winter of 2011-2012.

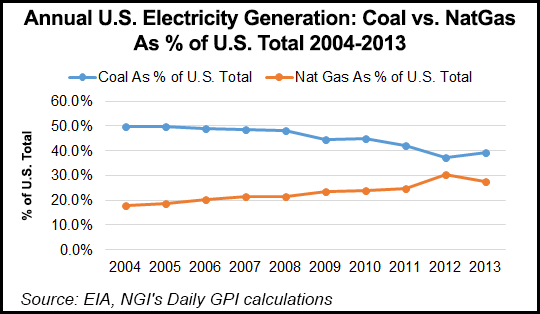

“Based on our analysis, coal is expected to remain a viable fuel source in the U.S. power sector, despite increased environmental regulation and competition from cheap and plentiful shale gas,” Bennett said. “This contrasts sharply with the past decade, during which coal’s market share dropped by 12%.”

Bennett said a major driver for the reversal were natural gas prices this past winter, hitting $7/MMBtu for several days, and averaging $4.60/MMBtu at Henry Hub this past winter. This average compared to $3.46/MMBtu the previous winter, and $2.75/MMBtu in 2011-2012.

Separately on Thursday, the governor in the nation’s biggest coal producing state, Wyoming, hailed state legislative approval for a $15 million Integrated Test Center to develop commercial uses for carbon. A day earlier Gov. Matt Mead harangued federal environmental regulators for going too far in targeting the coal industry, and he has been pushing hard for the state’s carbon research center.

“Power companies and coal producers are excited about this proposal,” Mead said. “Wyoming has an abundance of coal, and we know we must find productive ways to put coal and its byproducts to use.” He said Wyoming is “showing leadership” in pursuing this kind of advanced research.

The test center is to be located adjacent to a coal-fired generation plant in the state, and Mead has asked for industry help in determining the location. The center will supply gas to researchers who hope to develop different uses for carbon dioxide (CO2), the governor said.

Bentek said an offshoot of this winter’s uptick in coal-fired generation is that stockpiles at coal-fired generation plants around the nation have dipped below normal for this time of year. They are the lowest they have been since 2006, Bennett said.

Stockpiles peaked in mid-June 2012, he said, but plunged to 113 million short tons in March this year, compared to a five-year average of 177.9 million short tons. Reserves since, however, have rebounded, hitting 141.5 million short tons recently.

With coal consumption increasing 21% this past winter, Bennett stressed that the comeback is “significant” in the power market, and coal is likely to continue to be an important part of the generation mix, despite “declines in power market share due to an onslaught of emissions regulations and the impact of the shale gas revolution.”

For 2014 overall, Bennett sees a “significant recovery” of the overall coal market as gas prices stay relatively high, and utilities and power companies buy more coal to produce electricity and replace their diminished stockpiles.

Gas-fired power generation displaced coal generation every year between 2004-2012 but fell back somewhat in 2013, according to Energy Information Administration data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |