Markets | NGI All News Access | NGI Data

Futures Falter Following Plump Storage Build

Natural gas futures continued the recent trend of outsize market moves off of modest storage forecast misses by industry forecasters.

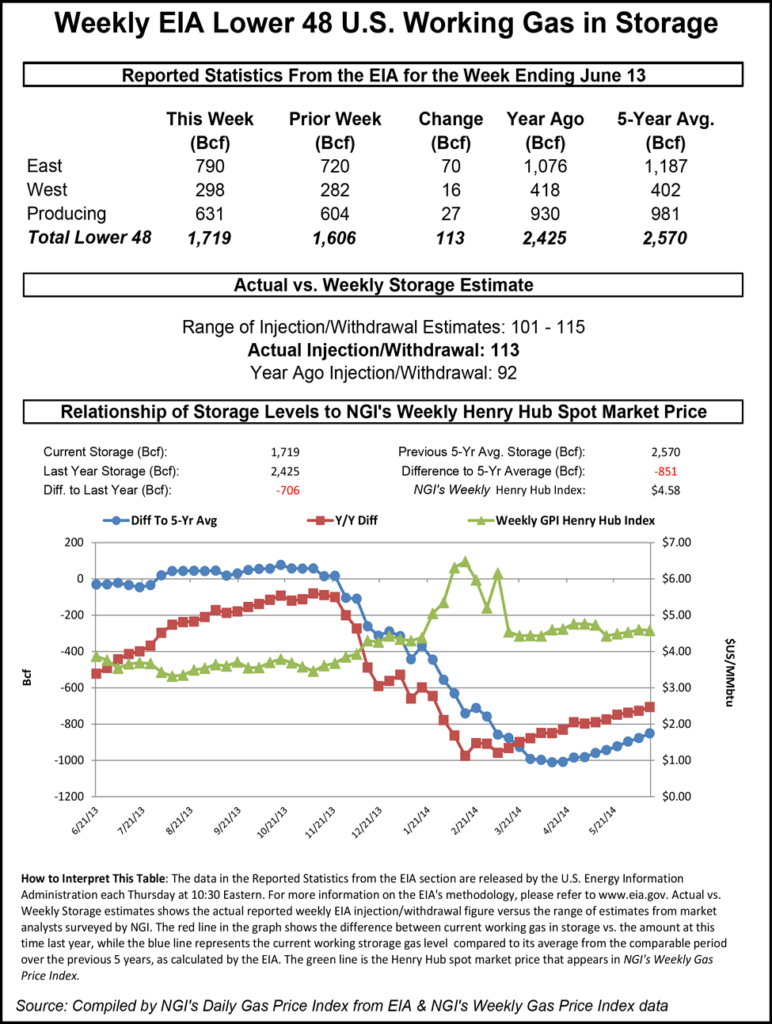

Following the release of government storage figures that were on the high side of what the market was expecting, the market dropped sharply. The injection of 113 Bcf was about 3 Bcf higher than market surveys and independent analyst projections, and for the week ended June 13 the Energy Information Administration (EIA) reported an increase of 113 Bcf in its 10:30 a.m. EDT release. July futures dropped to a low of $4.579 shortly after the number was released, but by 10:45 a.m. July was at $4.625, down 3.4 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a build of about 110 Bcf. A Reuters survey of 22 traders and analysts revealed an increase of 110 Bcf with a range of 101 Bcf to 115 Bcf. Credit Suisse was looking for a build of 109 Bcf, and Bentek Energy’s flow model anticipated an injection of 110 Bcf.

Traders noted a quick recovery. “Within five minutes after the market came off, it bounced back to unchanged before easing further,” said a New York floor trader. “The high print in overnight trading was $4.69, but prices seem to have leveled off.”

Analysts see a pattern of continuing strong injections. “This largely sustains the existing background supply-demand balance, with more intense heat needed to offset the year-on-year growth in supply,” said Tim Evans of Citi Futures Perspective. “Otherwise, above-average injections will remain the norm, as has been the case for nine consecutive weeks.”

“Despite a bearish storage number, the market is actually up slightly in mid-day trading after dropping initially after the report came out,” analysts with EMEX LLC said in a note Thursday afternoon. “This suggests that the bulls retain significant influence in the market. “We will still need record injection numbers (85 Bcf/week) to refill storage to the levels expected by the Energy Information Administration and to get to the high of 2012, we would need to average 109 BCF/week.”

Looking further down the road, EMEX said bulls might find room to roam. “With the need to continue to refill storage at a breakneck pace, EMEX maintains a bullish position on the natural gas market for the balance of the year, pending a clearer winter weather forecast.”

Inventories now stand at 1,719 Bcf and are 706 Bcf less than last year and 851 Bcf below the five-year average. In the East Region 70 Bcf was injected, and the West Region saw inventories up by 16 Bcf. Inventories in the Producing Region rose by 27 Bcf.

The Producing region salt cavern storage figure increased by 5 Bcf from the previous week to 177 Bcf, while the non-salt cavern figure rose by 22 Bcf to 455 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |