NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Shell Prepares Launch of U.S. Midstream Partnership

Royal Dutch Shell plc said Wednesday its Houston-based midstream subsidiary plans to launch an initial public offering (IPO) on the New York Stock Exchange in the second half of the year.

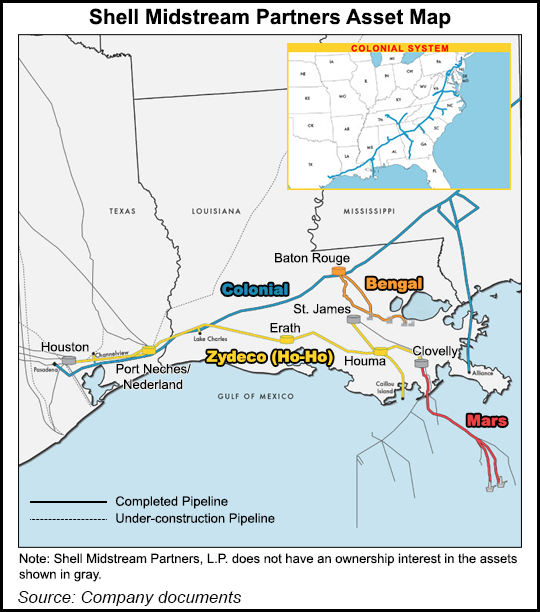

Shell Midstream Partners LP (SPLC), a fee-based master limited partnership, was created in March. It would offer its common units in the IPO under “SHLX.” Initially, Shell Midstream would own interests in two crude pipeline systems, Zydeco Pipeline Co. LLC and Mars Oil Pipeline Co., one of the biggest oil pipeline operators in the deepwater Gulf of Mexico. Zydeco and Mars “are strategically located along the Texas and Louisiana Gulf Coast and offshore Louisiana, linking major onshore and offshore production areas with key refining markets,” the Securities and Exchange Commission Form S-1 indicated.

Zydeco would include the Houston-to-Houma, LA (Ho-Ho) oil pipeline system, which is regulated by the Federal Energy Regulatory Commission. Mars is a major corridor crude oil pipeline that originates about 130 miles offshore in the deepwater Mississippi Canyon area, including the Olympus platform, and the Medusa and Ursa pipelines, and from the Green Canyon and Walker Ridge areas via the Amberjack pipeline connection. SPLC would own a 42.9% interest in Mars and an affiliate of BP plc would own the remaining 28.5% stake.

SPLC also would own stakes in two refined products systems, Bengal Pipeline Co. LLC (49%), which connects four refineries in Louisiana’s St. Charles, Norco, Garyville and Convent areas, and in Colonial Pipeline Co., the largest refined products pipeline in the United States. Colonial transports more than 100 million gallons/d of refined products, or 50% of refined petroleum products consumed in the East Coast of the United States, through its 5,500 mile system. Colonial operates its pipeline system. SPLC would own a 14.508% interest in Colonial and third parties would own the remaining interests.

Most of the midstream venture’s revenue would be generated under long-term agreements by charging transportation fees. The business would not market or trade commodities. Shell’s downstream portfolio includes refineries throughout the United States with a combined refining capacity of more than 1.8 million b/d.

“We believe Shell is motivated to promote and support the successful execution of our business strategies, including using our partnership as a growth vehicle for its midstream assets,” the filing noted. Shell has an expansive portfolio of midstream infrastructure, including additional interests in our assets, which could contribute to our future growth if acquired by us. We may also pursue acquisitions jointly with Shell or its affiliates.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |