NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

North America’s Energy Resources to Create ‘Titan of Unprecedented Proportions’ by 2020

North America’s unconventional oil boom, which quickly has risen to prominence to rule with its twin natural gas, will make the continent a global energy trading partner nonpareil within five years, the International Energy Agency (IEA) said Tuesday.

The continent will be a “titan of unprecedented proportions,” with U.S. oil refineries alone expected to export 3.5 million b/d, the energy watchdog said in its Medium-Term Oil Market Report to 2019. Last week IEA said the United States was “beyond the golden age” for natural gas (see Daily GPI, June 10).

“Less than 10 years ago, the United States was the world’s largest importer of refined products,” said IEA Executive Director Maria van der Hoeven. “Today it has become the world’s largest liquids producer, ahead of Saudi Arabia and Russia, as well as its largest product exporter.”

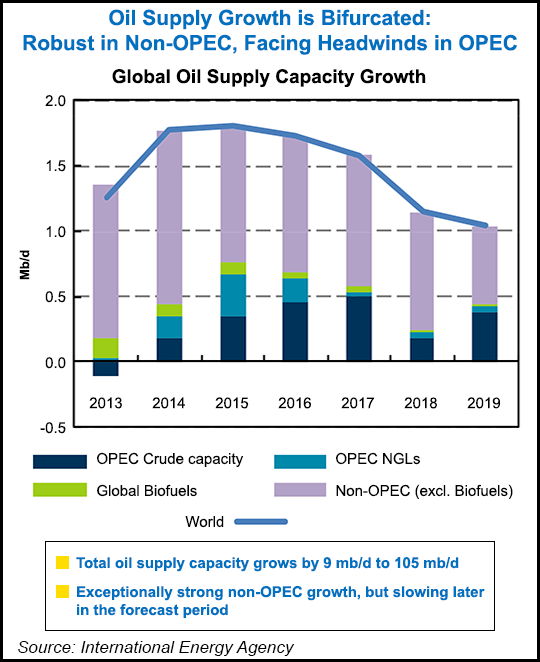

IEA continues to see “unprecedented production growth from North America, and the United States in particular,” said van der Hoeven in Paris. “By the end of the decade, North America will have the capacity to become a net exporter of oil liquids. At the same time, while OPEC remains a vital supplier to the market, it faces significant headwinds in expanding capacity.”

She said “not everything is rosy about crude supply in the next five years” as developed countries rely more on alternatives, including natural gas, and strive for more fuel efficiency. Conventional supplies already are facing headwinds, and “this is especially true for OPEC.”

Downward pressure on oil demand growth, combined with a continued surge in unconventional crude supply, appear in theory to provide a “comfortable” supply-demand balance, but the new prevailing reality of heightened supply risks suggests otherwise. Despite booming production outside of OPEC, crude markets tightened in 2013.

OPEC’s capacity growth forecast on paper “looks…in line with historical trends,” with output expected to rise by 2.08 million b/d from 2013 to 2019 to average 37.06 million b/d. However, OPEC factors in Iraq as the supplier for as much as 60% of the new oil, and sectarian strife there was escalating as the IEA report went to press. “Given Iraq’s precarious political and security situation, the forecast is laden with downside risk.”

OPEC’s recent output performance and medium-term production outlook “have little to do with U.S. output growth or competition from nonconventional supply,” IEA said. “Aging fields are an issue for almost all OPEC producers, but above-ground woes have escalated,” with international oil companies shying away from risky investments in Middle Eastern regimes to more stable political regions, led by North America.

“Surging North American production has had a profoundly disruptive effect on international crude trade flows and will continue to do so for the rest of the decade,” said van der Hoeven. “Growing domestic supply in the United States and Canada has displaced U.S. and Canadian imports and diverted them to other markets. U.S. imports of Nigerian crudes, a set of mostly light, sweet grades with which U.S. tight oil competes, are a case in point: from a high of 1.4 million b/d in November 2007, by early 2014 they had plunged to a trickle of 40,000 b/d.”

Asian crude imports, meanwhile, have grown in absolute levels and as a percentage of the global market. In April, Chinese imports reached a record of 6.8 million b/d, versus U.S. imports of 7.3 million b/d, or 4.6 million b/d if imports from neighboring Canada are stripped out of the total. China is expected to overtake the United States in gross crude imports as early as this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |