Markets | NGI All News Access | NGI Data

Bulls Back In the Saddle Following Lean Storage Report

Natural gas futures surged following the release of government storage figures that were on the low side of what the market was expecting.

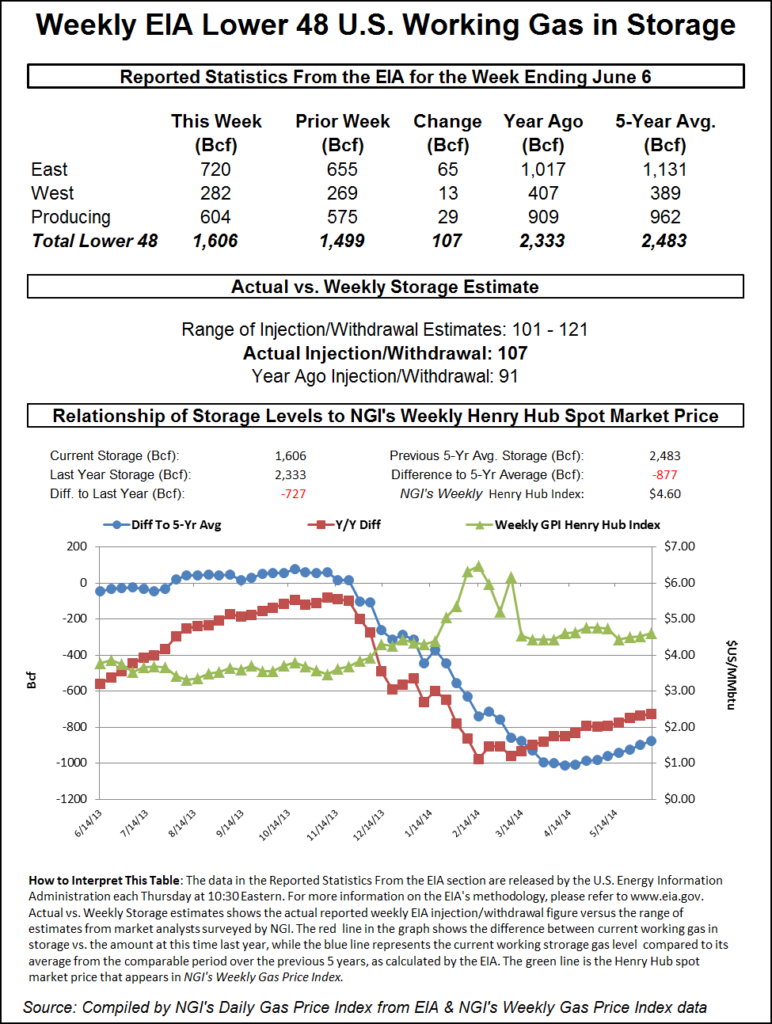

While the report tipped the triple-digit mark again, the injection of 107 Bcf was about 3 Bcf lower than market surveys and independent analyst projections. For the week ended June 6, the Energy Information Administration (EIA) reported an increase of 107 Bcf in its 10:30 a.m. EDT release. July futures jumped to a high of $4.687 shortly after the number was released, but by 10:45 a.m. July was at $4.677, up 16.9 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a build of about 110 Bcf. A Reuters survey of 22 traders and analysts revealed an increase of 110 Bcf with a range of 101 Bcf to 117 Bcf. United ICAP forecast a build of 121 Bcf, and Bentek Energy’s flow model anticipated an injection of 113 Bcf.

In spite of what might seem a supportive figure, analysts see longer-term bearish implications.

“The 107 Bcf figure was less than the consensus expectation, suggesting a slightly tighter supply-demand balance for the week ended June 6,” said Tim Evans of Citi Futures Perspective. “The build was still well above the 88 Bcf five-year average, however, taking another 19 Bcf off the year-on-five-year average storage deficit. Although a bullish surprise, the larger pattern remains bearish, with the declining deficit confirming easier supplies on a seasonally adjusted basis.”

Inventories now stand at 1,606 Bcf and are 727 Bcf less than this time last year and 877 Bcf below the five-year average. In the East Region, 65 Bcf was injected and the West Region saw inventories up by 13 Bcf. Inventories in the Producing Region rose by 29 Bcf.

The Producing region salt cavern storage figure increase by 9 Bcf from the previous week to 172 Bcf, while the non-salt cavern figure rose by 21 Bcf to 433 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |