Bakken Shale | NGI All News Access | NGI The Weekly Gas Market Report

Triangle Triples Production, Prepares to Close on Williston Acquisition

Triangle Petroleum Corp. said Monday it tripled quarterly production in the latest quarter and grew its oilfield and midstream businesses, all while it prepares to complete two agreements this month to acquire more than 46,000 net acres in the Williston Basin.

Denver-based Triangle reported quarterly production volumes of 724,000 boe (8,129 boe/d), during the fiscal first quarter of 2015, which ended on April 30. By comparison, the company had 242,000 boe (2,714 boe/d) of production in fiscal 1Q2014.

Total estimated net proved reserves increased to about 42.1 million boe at the end of 1Q2015, a 162% increase from the 16.1 million boe reported at the end of 1Q2014. Total estimated net proved reserves would be about 46.6 million boe pro forma for the pending acquisitions in the Williston.

“If you’ve been excited about the growth in the past, there’s more to be excited about in the future and it’s something that we are very proud of,” CEO Jonathan Samuels told analysts during a conference call on Tuesday to discuss the 1Q2015 results. “[We] have a long ways to get to where we need to be, but it is a pretty big milestone for us and something that is good and we have a great runway of weather and this is the time of year.”

In May, exploration and production (E&P) subsidiary Triangle USA Petroleum Corp. signed two separate agreements to acquire close to 46,100 net acres (46% operated) in a deal valued at $120 million. The acquired acreage is a contiguous area of Williams County, ND, and Sheridan County, MT, with current production of 1,175 boe/d.

“We’ll close on this thing June 30,” Samuels said. “It’s a lot of acres. There are a bunch of producing wells, and we have a pretty full plate. We are human capital-constrained without that acquisition. You can pile that on top and it’s just not going to change this year’s drilling schedule. It’s too early for us to comment on what we are going to do next year, but the acquisitions will certainly factor into those plans.”

Triangle completed nine gross (6.1 net) operated wells and 10 gross (0.5 net) nonoperated wells during the quarter. The company increased its drilling program from three to four operated rigs and plans to maintain four rigs through its 2015 fiscal year. Triangle also said it had reduced its average spud-to-total depth drill times from 23 days in 4Q2014 to about 20 days in 1Q2015, a 13% improvement.

RockPile Energy Services, its oilfield services subsidiary, generated standalone revenue of about $61.4 million, up 129% from the $26.9 million generated in 1Q2014. The subsidiary also completed nine Triangle-operated wells and 17 third-party wells during the quarter, a 160% increase from the five operated and five third-party wells completed in 1Q2014.

RockPile had a backlog of about 31 wells, including 18 for third-party operators, awaiting completion at the end of 1Q2015. The subsidiary served 10 third-party customers during the quarter.

Samuels said RockPile currently had three hydraulic fracturing crews (spreads), named Alpha, Bravo and Charlie, with Alpha working 100% on Triangle wells.

“Unless we change our rig count, which wouldn’t happen until next year, if it happens at all, Alpha is going to be 100% working for Triangle, and Bravo and Charlie will be working for third parties,” Samuels said.

Caliber Midstream Partners LP, Triangle’s joint venture with First Reserve Corp.’s Energy Infrastructure Fund, generated $1.2 million in standalone revenue attributable to Triangle’s 30% stake (see Shale Daily, Oct. 2, 2012). According to Triangle, Caliber signed midstream services agreements with four third-party oil and gas producers during the quarter.

“Caliber continues to build its business and showcase its strategic value over the course of [the quarter] through gathering and stabilization,” Samuels said. “Gas gathering and produced water volumes steadily increased as more of the Caliber trunk line system was placed into service.

“Fifty-three Triangle wells are connected to gas sales as we work to reduce flaring and flow gas to our plant [located south of Rawson, ND]. Our plant has had no major interruptions since commercial operations began about a month ago.”

Caliber has appointed Poe Reed as president and CEO. In a note Wednesday, Wunderlich Securities analyst Jason Wangler raised his price target for Triangle to $14.00/share from $12.00. Triangle shares closed at $10.72/share on Wednesday on the New York Stock Exchange.

“We continue to believe there is ample value within Triangle that many miss given the consolidated nature of its financials, which hide the strong value in both Rock Pile — especially as the oilfield services market seemingly is improving — and Caliber as the midstream/infrastructure of the Williston remains in demand and being provided in part by Triangle as it grows production, too,” Wangler said.

“Triangle has $330 million in liquidity and with its cash flows from all three business lines increasing we feel the company is in a good position to fund activity going forward. As it builds out the services and infrastructure businesses we look for Triangle to spin-off or sell these in order to recognize full value; this could add further liquidity for the E&P business and show [Triangle’s] true value.”

Triangle’s E&P unit generated $60.8 million during 1Q2015, with adjusted earnings before interest, taxes, depreciation and amortization of $42.4 million, a 34% increase over the previous first quarter.

Triangle holds about 135,000 net acres in the Williston Basin, targeting the Bakken Shale and the Three Forks Formation. The company holds about 92,000 net acres in North Dakota, in the Rough Rider area of McKenzie and Williams counties. Another 43,000 net acres held by Triangle lies in Montana’s Roosevelt and Sheridan counties, a mostly contiguous position adjacent to the Elm Coulee field.

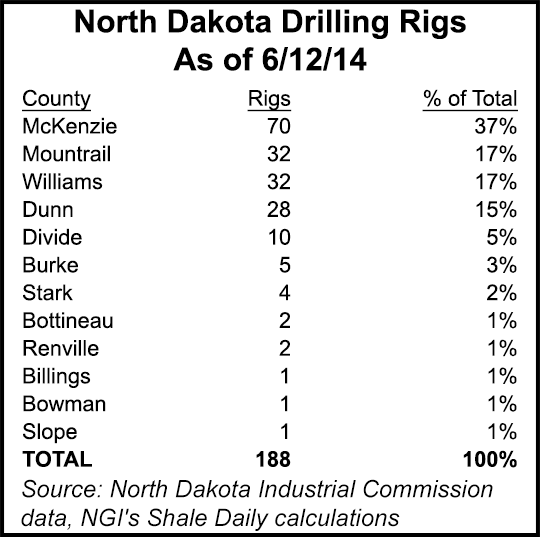

According to North Dakota Industrial Commission (NDIC) data, all four of the rigs Triangle is operating in the Williston Basin are in McKenzie County, which also boasts the highest concentration of drilling activity in the state, with 70 active rigs industry-wide. The NDIC data also show that the four rigs that Triangle currently operates all come from different contractors: one each from Helmerich & Payne, Patterson-UTI, Pioneer Drilling, and Sidewinder Drilling.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |