E&P | NGI All News Access | NGI The Weekly Gas Market Report

North America Natural Gas Faces Export Headwinds, Lack of Markets, Says IEA

Hold the applause on assurances that North America’s unconventional gas producers will see big returns through global exports, the executive director of the International Energy Agency (IEA) said Tuesday.

It’s more complicated than that, Maria van der Hoeven said in presenting the IEA’s 2014 Medium-Term Gas Report, which offers a global forecast to 2019. The energy watchdog agency warned that North America’s liquefied natural gas (LNG) export advocates may be getting a little ahead of themselves.

“Recent talk of plentiful LNG being available from the U.S. shale boom is simplistic,” she said during a webcast. “The necessary export facilities are not yet in place, and we must remember that gas is an expensive fuel to transport and is sold into a global market dominated by current high prices in Asia.”

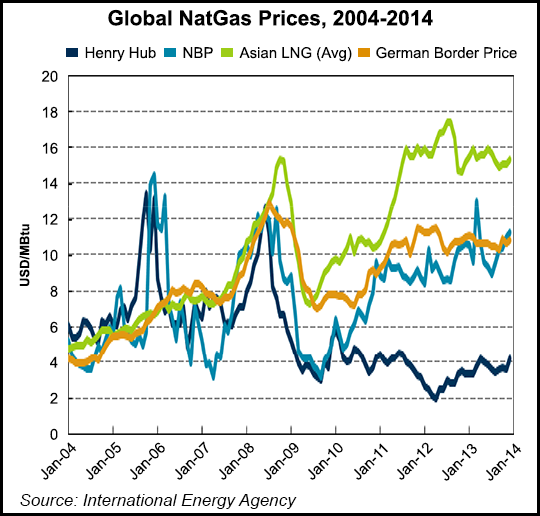

The gap between gas prices in Asia and U.S. spot prices narrowed slightly in 2013, but it was still large. Asia’s LNG importers paid on average US$16.00/Mcf, higher than prices in Europe, where imports collapsed and represented only 14% of global LNG trade.

Over the next five years, North America and Australia by themselves are expected to account for 40% of additional worldwide gas supply — and most of the international trade expansion. Australia will be well ahead of North America, however, with half of the new exports. North America should account for around 8% of global trade by 2019.

U.S. gas exports also will be competing for market share from stronger gas output in Canadian basins, IEA said.

“Given the abundance of gas in the U.S. domestic market, the recovery of gas production in Canada will be conditional on finding new markets for that gas, either in Asia in the form of LNG, or domestically in the transportation sector,” said van der Hoeven. “One of the key drivers for the massive and rapid expansion of the sector within these economies has been the private sector’s ability to raise capital. In dollar terms, more upstream investment is flowing to North America than to the Middle East and Russia combined.”

Pricing, as always, is key.

“High LNG prices are threatening to crimp demand as many countries are increasingly unwilling, or unable, to afford these supplies — and that could open the door to coal,” van der Hoeven said. “Looking ahead, unless we see timely investment in new production and LNG facilities and the reversal of the recent cost inflation of LNG, only a very strong climate policy commitment could redirect Asia’s coal investment wave to gas.”

Global gas production is on its way to cross the 4,000 bcm mark by 2020, according to IEA. The medium-term outlook remains optimistic, with demand set to hit 3,980 bcm by 2019, despite a slight reduction from IEA’s 2013 outlook.

Also, the role of U.S. natural gas liquids in supporting domestic production “will be essential, as prices remain below US$5.00/MMBtu over the forecast period,” IEA said. In contrast, the growth in developed nations in the Asia Pacific region “is almost entirely dedicated to LNG exports from Australia…”

Despite all its well-known qualities, gas will find it difficult to gain market shares, notably in the power generation sector.

Gas “must compete against electricity and oil products; in industry, the main competitors are oil products; and in the power generation section, coal, renewable energies and nuclear are the alternative energies. Presently, the difficulty mostly arises from the competition with either renewable energies or coal in the power sector.”

Gas is making new inroads into other sectors, including transportation, but it’s not easy.

“While a promising new outlet, with demand projected to double in road transport to 93 bcm by 2019, this market could prove to be a long and challenging process, with the main risk being the respective relationship between oil and gas prices,” IEA said. “Using gas for shipping is particularly promising for the post-2020 period.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |