Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Soft Cash Quotes Outgunned by Firm Futures

Most physical traders elect to get their deals done before the release of storage data, and spot prices overall moved little in Thursday for Friday trading. The big movers on the day were New England points, falling more than $1, but Mid-Atlantic locations were also soft.

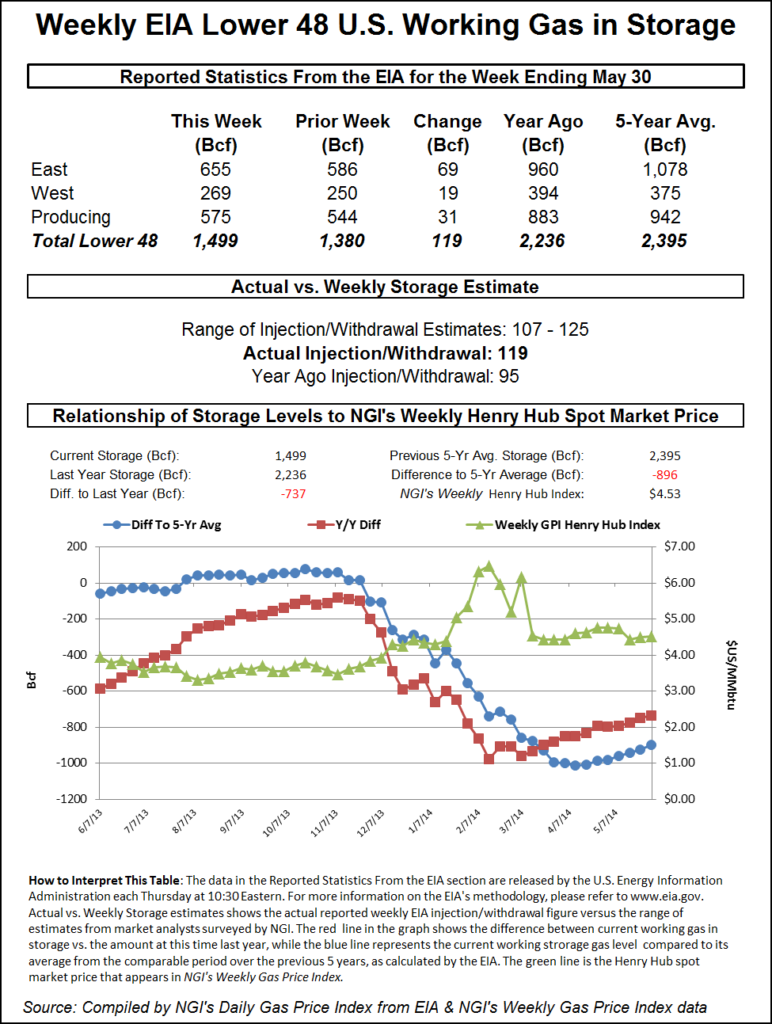

The market as a whole was off a little over a penny. The Energy Information Administration (EIA) reported a storage injection of 119 Bcf Thursday, which was higher than market expectations. After an initial dive, the market recovered and moved higher on the day. At the close, July had risen 6.1 cents to $4.701 and August had gained 5.9 cents to $4.686. July crude oil eased 16 cents to $102.48/bbl.

Gas for delivery Friday in the soggy Northeast plummeted as the region was expected to see a drying trend set it. “Sunshine and warmth are forecast for the Boston area this weekend,” said AccuWeather.com meteorologist Alex Sosnowski. “In the wake of the drenching rain Thursday, only spotty showers are likely Friday and Saturday through Sunday will be free of rain. High temperatures will range from the lower 70s on Friday to the 80s Saturday and Sunday.”

The forecaster predicted that Thursday’s high in Boston of 62 would rise to 73 Friday and 85 by Saturday. The seasonal high in Boston this time of year is 73. New York City’s Thursday high of 75 would rise to 78 on Friday before climbing further to 82 Saturday, well ahead of the seasonal norm of 76. Philadelphia’s Thursday high of 76 was anticipated to reach 79 Friday before jumping to 85 Saturday. The normal high in Philadelphia in early June is 80.

One day after jumping $1.32 higher on continued capacity constraints on the system, quotes at the Algonquin Citygates for Friday delivery dropped a gut-wrenching $1.19 to average $4.07. Deliveries to Tennessee Zone 6 200 L shed $1.21 to $3.71 and gas on Iroquois Waddington was flat at $4.87.

The National Weather Service in New York City forecast active conditions for the next few days. “[L]ow pressure will track along the New England coast and into the Canadian maritime tonight [Thursday] while high pressure builds from the west into the weekend. Multiple low pressure systems impact the Northeast next week.”

Gas on Tetco M-3 for Friday delivery shed 7 cents to $3.35, and gas bound for New York City on Transco Zone 6 fell 9 cents to $3.35.

Marketers in the Great Lakes reported having to step up to the plate to purchase volumes for their customers. “We had bought some gas earlier but ended up buying 1,500 MMBtu for tomorrow on Consumers,” said a Michigan marketer. “We aren’t worried about buying forward for July or August, but we are concerned about the basis for the winter months. That has gone up, and up, and up. We have been looking at Consumers basis of upper 30 cents, and just at the beginning of bid week it was in the upper 20 cents. After what we experienced this past winter, you don’t want to repeat,” he said.

Prices did inch higher in the region. Deliveries on Alliance were seen at $4.74, up a penny. At the Chicago Citygates, next-day parcels changed hands at $4.74, up 2 cents, and on Consumers gas rose a nickel to $4.91. On Michcon, Friday gas also rose a nickel to $4.91.

Industry consultant Genscape reported that gas demand at Southeast power plants has grown despite higher prices. “Transco Zone 4 prices have continued to trade higher since 2012. Transco Zone 4 averaged higher at $4.55/MMBtu for May-to-date compared to an average of $3.97/MMBtu in May and June 2013,” the company said in a report. “The increase in price does not appear to drive some gas-fired plants off of the generation stack. This suggests a portion of coal-to-gas switching we saw in 2012 is structural and likely to remain. Southeast demand from power plants has increased by an average of +0.8 Bcf/d year-on-year for April, about a +14% increase.”

In the financial arena, all eyes were on the storage statistics. May is typically the month for the largest storage injections and the EIA report for the week ending May 30 did not disappoint. Estimates came in just a hair above last week’s stout 114 Bcf build and well ahead of last year’s 108 Bcf injection and a five-year pace of 93 Bcf.

Some question whether these hefty increases are really necessary to bring storage to a satisfactory level by the end of October. “[G]iven that we started the season so far behind the curve, ‘blowing out’ the 2013 numbers and the five-year norms may not be good enough,” said John Sodergreen, editor of Energy Metro Desk. In the past four weeks we injected 399 Bcf of gas, compared to 357 Bcf last year and 337 Bcf for the five-year average. The trend needs to continue; if we only manage average levels for the balance of the season, we’ll begin the heating season with roughly 3 Tcf in the till. That ain’t huge. But nor is it anything to freak out about. We had hoped to speak to EIA leadership about this little matter about perception in the coming weeks.”

Utilities aren’t concerned about adequate storage? “Last time we checked, most utilities aren’t even a little bit concerned about starting the heating season with such low inventory levels. For that matter, producers aren’t so worried either. How can this be? Simple, production is expected to surprise, yet again. That being the case, maybe we should rethink appropriate storage levels,” Sodergreen said.

“Given the robust production picture, is a 3.0 or 3.5 Tcf end-of-season tally good enough? Are we using the wrong yardstick? We’re thinking that yes, we are. We think this should be the basis for some new market analysis, and quick. Anybody willing to pick up the task and run with it? From what we can see, futures prices may be based on some fairly flawed fundamentals, like, ‘needed end of season fill levels.'”

Most estimates of the report centered around a 115+ Bcf storage injection. United ICAP calculated a 118 Bcf increase and a Reuters poll of 24 traders and analysts revealed an average 116 Bcf with a range of 107 Bcf to 125 Bcf. Bentek Energy’s flow model was looking for a build of 115 Bcf.

Traders were looking for a 115 Bcf build, and “we made new lows once the number came out,” said a New York floor trader. “In the overall scheme of things this was not much of a reaction at all. Market resistance is $4.75 and we are creeping up towards that.”

Tim Evans of Citi Futures Perspective said, “The gain wasn’t quite as much as our model’s 122 Bcf estimate, suggesting that the underlying supply/demand balance may not have been quite as weak as in the prior week. However, the trend toward bearish surprises relative to consensus expectations continues.”

Inventories now stand at 1,499 Bcf and are 737 Bcf less than last year and 896 Bcf below the five-year average. In the East Region 69 Bcf was injected and the West Region saw inventories up by 19 Bcf. Inventories in the Producing Region rose by 31 Bcf.

The National Weather Service (NWS) in its 2 p.m. Thursday report noted no further development of a stationary system of showers and thunderstorms in the southern Bay of Campeche. “Despite strong upper-level winds, some further development of this system is possible over the next day or two if the low remains offshore of eastern Mexico,” NWS said. It kept the probability of storm formation to 30% over both the next 48 hours and next five days, unchanged from the morning report.

Meteorologists see most of the action taking place next week. “It appears more of the system is getting into the extreme southern Gulf where water temperatures are warm enough to support development,” said meteorologist Joe Bastardi in a Thursday morning report. “I got kind of excited yesterday when the ECMWF [European model] actually showed this developing and coming northward in the kind of fashion that I think we would see at this time of year, but it has backed off again. Even the GFS [Global Forecast System] has backed off. My take is we will have this to deal with next week, after it sits and stews in the southern Gulf through the weekend, but until I can see an actual low level center taking shape, this is speculative. I think any storm is liable to be heavily east-side weighted, and it is at least five and probably more like seven days away from any impact in the northern Gulf.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |