E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Permian Horizontals Driving U.S. Land Rig Forecast Higher

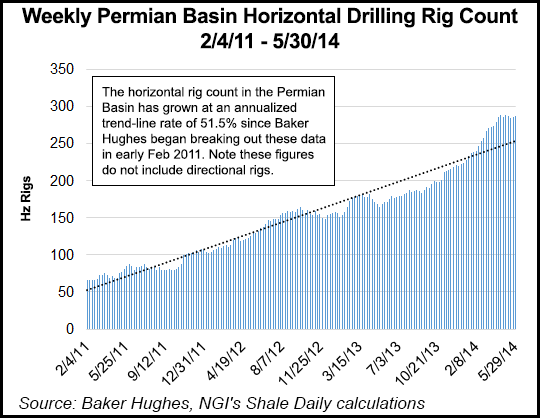

The vertical-to-horizontal rig switch in the Permian Basin is accelerating faster than expected, and the overall domestic rig count also is on pace to be higher than forecast this year, Raymond James & Associates Inc.’s analysts said Monday.

The U.S. rig count now is forecast to be 1,849 in 2014, a 5% increase from 2013, said analysts J. Marshall Adkins, James M. Rollyson and Praveen Narra. Raymond James had expected the rig count to be about 2.5% higher year/year (y/y) and average 1,806 rigs.

“More importantly for oil service companies, we are increasing our 2014 U.S. horizontal y/y rig growth forecast from 11% growth to 14% growth, or up an additional 30 horizontal rigs from our previous estimate,” analysts said (see Shale Daily, Feb. 18). On average, there should be an additional 153 horizontals in operation versus a previous estimate of 123.

It’s all about the Permian and the continued switch to horizontal drilling, said the team.

“Even though our bullish outlook for 2014 U.S. exploration and production (E&P) spending and oilfield activity has been higher than most, the recent surge in U.S. horizontal activity has surpassed even our expectations,” said the trio. In late May Adkins and his colleagues increased their long-term U.S. gas price deck by 25 cents to $4.50/Mcf on concerns that the market is underestimating how difficult it will be to refill storage this year (see Daily GPI, May 27).

“While there are many moving parts driving our rig forecast (e.g. pad drilling, infrastructure bottlenecks, higher completion spending, etc.), the focal points for this upward revision are 1) the Permian, 2) the Permian, and 3) the Permian.”

It’s not that simple, but the message is the same: most of the horizontal expansion, which is driving newbuilds/equipment repositioning, is going to be in the Permian.

The increase in horizontal activity and overall oilfield spending is notable, considering Raymond James’ modestly bearish 2015 oil price forecast and expectations for gas takeaway issues persisting in the Marcellus and Utica shales.

“In keeping with improved efficiencies, land rig newbuilds introduced in 2015 will mostly be replacing lower spec rigs and therefore not drive total rig count drastically higher,” said the Raymond James team.

Next year a slight decline is forecast for rigs that work the oily plays. Also, more older mechanical rigs should be replaced with the higher spec, walkers. There also may be “marginal growth” in the Appalachian region rig count where new takeaway capacity “will not close the gap.”

The most valuable player — MVP — this year goes to the Permian, said the trio. The largest driver of the rig count increase is the increased use of horizontal drilling and no where is that going more strongly than in the Permian.

“Yes, the industry has finally figured out that it is more efficient to extract Permian shale oil by horizontally drilling the multiple productive layers that exist in the Permian Basin. With the application of horizontal pad drilling reducing costs per unit of production, the Permian horizontal well count is slated to continue its upward climb over the next couple of years.”

The analysts previously had forecast that the percentage of rigs drilling horizontally in the Permian would be 40% of the total in 2013 to 50% in 2014.

“We are now expecting the 2014 horizontal percentage to grow from 40% to 55% (exiting the year at 60%),” said Adkins and his colleagues. “Further, with near-term oil prices staying above $100/bbl and improving horizontal drilling well economics, we believe that the Permian will be able to absorb many of the remaining 60 high-end land rig new-builds slated to be delivered by the end of 2014.” Forty newbuilds have been delivered to date.

After making adjustments to 2014, the analysts now believe the total 2014 horizontal rig count will be 25% higher, with 153 new horizontals lifting the total horizontal count of 1,255 from 1,102.

For U.S. land drillers, it’s good news all the way around.

“With our new forecast, we now expect 2014 demand for high-end rigs to surge to over 150 rigs, leaving the market short over 50 rigs this year. That means the U.S. land rig market would tighten considerably in 2014 leading to more reactivation of SCR [silicon controlled rectifier] rigs and higher prices across the board.”

Of the new 153 high-end horizontals, the Permian is expected to take on almost 90% as newbuilds are delivered and rigs are repositioned from other areas to the Texas/New Mexico formations.

Looking to 2015, Raymond James team is forecasting the rig count in the Permian, Bakken and Eagle Ford shales to peak in the second half of the year. However, the Permian horizontal rigs “should hold up well in 2015 as the shift from vertical to horizontal continues to play out. In total, we expect the Permian Basin to exit 2015 at 70% horizontal rigs.”

The Marcellus Shale doesn’t help the rig forecast, noted the analysts.

“With natural gas storage levels left lower due to unusually large winter withdrawals, the market should pull the Marcellus to produce more gas. While the gas is there, we don’t think additional takeaway capacity will be there to the point where drilling activity will surge.” With additional takeaway capacity buildouts already projected to be 100% utilized, “we cannot justify horizontal rig growth in the latter half of 2015.”

Raymond James is modeling a 5% growth, or about five more rigs, for the Marcellus for 2015, with all of the growth in the early months.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |