Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Broader Strength Trumps Northeast, Marcellus Weakness; Futures Slide Post EIA Report

Spot natural gas for Friday delivery overall moved little, and large setbacks at Northeast and Marcellus points were more than offset by broad gains in the Gulf Coast, Rockies and California. East Texas was also strong.

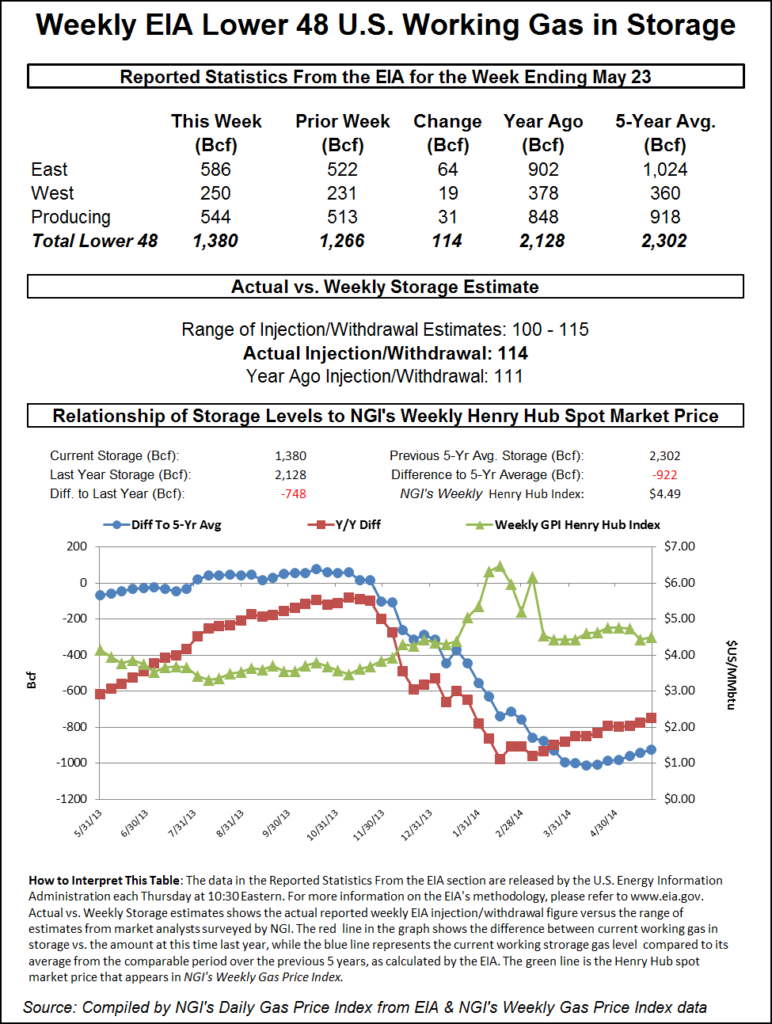

Most traders got their deals done before the release of volatility-inducing storage data from the Energy Information Administration (EIA). At mid-morning the EIA reported a build of 114 Bcf, about 4 Bcf more than market expectations, and futures finished down on the day. At the close, July had dropped 5.6 cents to $4.559 and August was off 5.2 cents to $4.540. July crude oil gained 86 cents to $103.58/bbl.

Northeast and Marcellus points took the day’s biggest hits with weather forecasts calling for a return to more seasonal temperatures. AccuWeather.com predicted that the Thursday high in Boston of 61 degrees would rise to 69 Friday but ease to 62 by Saturday. The seasonal high in Boston is 71. New York City’s high Thursday of 65 was forecast to rise to 72 Friday and Saturday, just shy of a normal late-May high of 75.

“In the wake of 40- and 50-degree Fahrenheit temperatures from the midweek, a warmup is in store for the Boston area this weekend,” said AccuWeather.com meteorologist Alex Sosnowski. “The early stages of the warmup will have a few bumps along the way [with] low clouds and fog…[starting] the day Friday in some areas. A disturbance dropping southeastward from Canada may bring spotty thundershowers Friday afternoon into Saturday.

“Temperatures will remain below seasonable levels on Saturday but will rebound on Sunday with an ample amount of sunshine forecast. Temperatures at the end of May and early June typically range from a low in the middle 50s to a high near 70.”

Gas for delivery Friday to the Algonquin Citygates dived 60 cents to $3.61, and gas on Tennessee Zone 6 200 L tumbled $1.15 to $3.69. Quotes for gas on Iroquois Waddington shed 31 cents to $4.28.

In the Marcellus, parcels on Transco Leidy for Friday delivery fell 5 cents to $2.31, and on Tennessee Zone 4 Marcellus gas changed hands at $2.34, down 15 cents.

Traders seeking to put their bidweek trading to rest said the market is a tough call. “I was talking to a producer who used to work with people that would take a position, and he said that there should be a stronger market going into June than we have had because we haven’t had any heat at all in the Northeast. It’s strictly a power demand deal right now. Are the power plants going to run? And if the nukes are down, I think you will see pretty hefty demand and price spikes during the day,” said a pipeline industry veteran.

“There’s also a problem with maintenance. Transco, Spectra and Tennessee are all going to have maintenance, and that’s going to throw some people into a frenzy. People with the right transport won’t be affected, though.”

Appalachia and the Mid-Atlantic were mixed. Next-day deliveries on Transco Zone 6 New York fell 3 cents to $3.37, and deliveries to Tetco M-3 eased a penny to $3.39. Gas on Columbia TCO added 4 cents to $4.57, and on Dominion South next-day parcels came in at $3.33, up 2 cents.

Texas Gulf and East Texas points firmed. Gas on Transco Zone 1 slipped a penny to $4.38, but gas at the Houston Ship Channel jumped 11 cents to $4.54. At Katy Friday parcels were seen at $4.55, up 10 cents, and at Carthage Friday gas rose 3 cents to $4.45.

July futures put in the low of the day once the EIA announced a 114 Bcf build but recovered slightly as the day’s trading wore on. Prior to the release of the data, analysts were looking for a build a hair above 110 Bcf. A Reuters survey of 24 traders and analysts revealed an increase of 110 Bcf with a range of 100 Bcf to 115 Bcf. United ICAP forecast a build of 113 Bcf, and Bentek Energy’s flow model anticipated an injection of 111 Bcf. July futures fell to a low of $4.529 shortly after the number was released but by 10:45 EDT July was at $4.587, down 2.8 cents from Wednesday’s settlement.

A New York floor trader remarked that with the reaction to the storage report “nothing has really changed. We are still in the range of $4.25 to $4.75. It’s not an ‘a-ha’ moment. It was not a significant development.”

Tim Evans of Citi Futures Perspective saw the figure “implying a further modest weakening of the background supply/demand balance that could carry over into future periods. The build was also a clear step up from the 93 Bcf five-year average for the period, with a further 21 Bcf decline in the year-on-five-year average deficit.”

Going forward, weather forecasts aren’t giving much indication that the series of triple-digit storage builds is likely to be interrupted any time soon. In its morning outlook, WSI Corp. said the “six-10 day period forecast is now colder across the Plains and Great Lakes region whereas warmer over the mid-Atlantic States in through portions of the Northeast. Forecast confidence is considered near average at best as models show fair agreement but with increased uncertainty.

“Risk is to the colder side over the Northern Plains in through the upper-Midwest if a progressive cold trough is stronger than anticipated. There are colder risks over PJM in through the mid-Atlantic States late in the period as well if the latest model guidance solutions are too slow with progressing the overall large-scale pattern.”

“Colder” is relative. WSI predicts that over the next 11 days the high in Baltimore will be a maximum of 84, while the norm is 79. Lows are seen dropping to 53, while the norm is 58. Pittsburgh is forecast to see an 11-day high of 82, while the norm is 76. The low for that period is 53, while a normal low is 55.

Market technicians are watching intently as at current levels the market could be poised to resume a downward trek or if certain parameters are breached continue advancing. “With natgas reaching $4.635-4.679 (a=c from $4.289) we are watching intently for signs of peaking action,” said United ICAP’s Brian LaRose in closing comments Wednesday to clients. “Turn lower from this vicinity and we will have a case for a completed ABC bear market correction and a resumption of the down trend. Fail to reverse and the A=C objectives from $4.221 will be our next upside targets. “a”=”c” targets $4.920-5.089. 1.618 “a”=”c” is up at $5.310-5.357.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |