Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Cash, Futures Decline After Second Triple-Digit Storage Build

Physical gas for Friday delivery retreated broadly in Thursday’s trading. Only a handful of points made gains, and most locations were off a nickel to a dime although some in the Northeast and a few other spots fell by double digits.

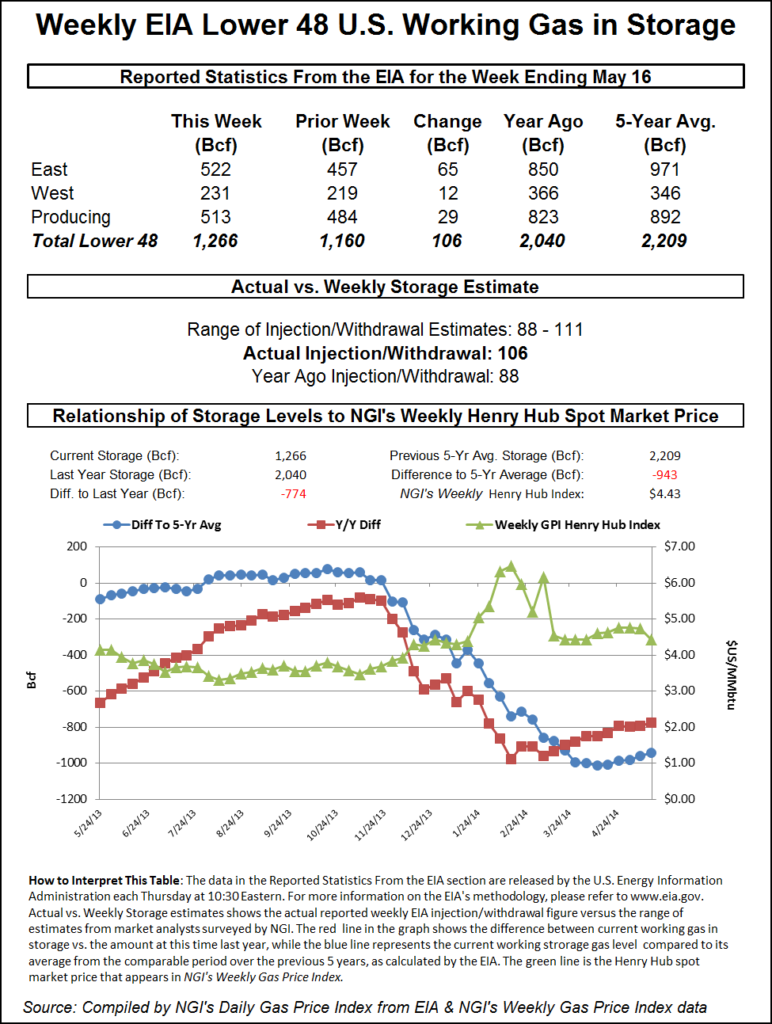

Overall, the market shed 7 cents, and although traders typically take great pains to make sure their deals are completed before the 10:30 a.m. EDT release of weekly inventory data, losses in the futures markets paralleled those in the cash market. The Energy Information Administration reported an increase of 106 Bcf in gas storage, just a few Bcf more than what the market was expecting, and futures nose-dived. At the close, June had fallen 11.4 cents to $4.359 and July was down 12.1 cents to $4.357. July crude oil lost 33 cents to $103.74/bbl.

Prices at Midwest locations retreated as forecast temperatures were expected to hover around seasonal averages. Forecaster AccuWeather.com predicted that the high in Minneapolis Thursday of 72 degrees would rise to 77 Friday and 80 on Saturday. The normal high in Minneapolis at this time of year is 71. In Chicago, Thursday’s high of 60 was seen making it to 68 on Friday and easing to 66 Saturday. The seasonal high in Chicago is 72. Indianapolis’ 77 maximum on Thursday was anticipated to slide to 73 Friday but rebound to 78 on Saturday. The normal late-May high in Indianapolis is 74.

The National Weather Service (NWS) in Chicago said, “Outside of temperatures near the lake…current forecast high temperatures of lower 70s is still on track. Persistent onshore flow keeping areas near the lake rather cool…with upper 50s currently being reported. Did adjust temperature trends into the afternoon…and feel that most locations near the lake will struggle to rise much from the upper 50s/around 60 [Thursday] afternoon.” It said it expected a quiet end to the week. “While there are small chances of thunderstorms forecast from Sunday through the middle of next week…the regime forecast is one that keeps the probability low of any high-impact weather through the holiday.”

Quotes at Joliet fell 6 cents to $4.50, and on Alliance next-day gas was quoted at $4.50, down 7 cents. At the Chicago Citygates, Friday packages came in at $4.50, down 7 cents, and on Northern Natural Ventura gas for Friday delivery changed hands at $4.43 off by 7 cents. At Demarcation Friday gas was seen at $4.43, down 9 cents.

Northeast and East points took a double-digit drubbing as weather was forecast to remain cool and wet. The NWS in southeast Massachusetts forecast that “low pressure will bring occasional showery weather and cool temperatures into Saturday. Turning milder Sunday then warm and dry conditions expected for Memorial Day. A weak front may bring scattered showers Tuesday into early Wednesday along with cooler temperatures.”

At the Algonquin Citygates, Friday packages fell 6 cents to $3.56; gas at Iroquois Waddington dropped 18 cents to $4.27, and gas on Tennessee Zone 6 200 L retreated 3 cents to $3.72.

Gas headed for Philadelphia and New York also fell. Gas on Tetco M-3 Delivery fell 11 cents to $3.17, and gas headed for New York City on Transco Zone 6 skidded 9 cents to $3.18.

On the West Coast, declines in next-day gas were aided by a soft power pricing environment. IntercontinentalExchange reported that next-day peak power at Mid C fell $15.09 to $18.75/MWh and next-day power at COB dropped $9.57 to $29.79/MWh.

Gas at Malin fell 4 cents to $4.37, and deliveries to the PG&E Citygates shed 4 cents to $4.93. At the SoCal Citygates, Friday gas was quoted at $4.79, down 7 cents, and at SoCal Border points gas was seen at $4.52, 12 cents lower. On El Paso S Mainline packages for Friday came in at $4.63, off 11 cents.

Technical analysts hit the nail on the head when they viewed Tuesday’s gains and Wednesday’s like-minded pullback as showing that recent strength, which took June up to $4.57, wasn’t going to last. To fully vindicate the bearish argument, however, the market needed to trade down another 12 cents or so from Wednesday’s close. “From the perspective of a spot continuation chart, fresh lows look unlikely. However, when we look to the individual contracts and the medium-term technicals, the case for a significant low being in place at $4.289 quickly loses any appeal,” said Brian LaRose, an analyst at United ICAP. “As such, we continue to view this advance as corrective. To indicate this advance has already run its course $4.350 will need to be broken,” he said in closing comments Wednesday to clients.

Before the release of inventory data, most analysts were expecting a build in inventories of just over 100 Bcf, well above last year’s and the five-year average injection of 90 Bcf. Bentek Energy was forecasting a 101 Bcf increase utilizing its flow model, but it admitted that there were some wrinkles in the data. “Fundamentals pointed toward a stronger build week-over-week, with demand falling slightly combined with the highest weekly production levels on record at 67.8 Bcf/d. Despite the bearish fundamentals, storage injections fell, with Bentek’s total sample dropping 3 Bcf week-over-week, with the largest fall concentrated in the West Region while injection activity increased in the East,” the firm said.

Bentek was right in line with a Reuters poll of 28 industry cognoscenti at 102 Bcf and Citi Futures Perspective also at 102 Bcf. A Reuters poll, however, had a wide range of 88 Bcf to 109 Bcf. United ICAP came in at a 111 Bcf estimate.

“The number came in a little higher than the [expected] range at 103 Bcf to 104 Bcf, and that just gave an excuse for people to come in and pound this thing,” said a broker with INTL FC Stone in Miami.

“I think the market has established resistance at higher levels, and we are looking at near term support at $4.30. Below that look for support at $4.246, and $4.192,” he said.

Tudor, Pickering, Holt & Co. analysts Dave Pursell and Brandon Blossman said Thursday morning that they still believe storage will reach 3.6 Tcf by the end of the refill season in mid-November.

“We need to see an incremental 600 Bcf in total, 20 Bcf per week, or 2.7 Bcf/d go into storage over this injection season,” they wrote in a morning note. “At the beginning of April (the start of injection season), natural gas storage stood at 825 Bcf, or 800 Bcf below the 1.6 Tcf 10-year norms. A normal injection season puts an incremental 2.1 Tcf into the ground, getting to an average annual max of 3.8 Tcf. We continue to expect injection season to end with 3.6 Tcf — that means versus the historic norms we need an incremental 600 Bcf to be injected over 32 weeks of the injection season.”

Pursell and Blossman said a combo of normal weather and gas-to-coal switching is needed to get to 3.6 Tcf. “The main show will be gas power gen market share as summer weather heats up. What if we see above normal temperatures? Then storage likely trends closer to 3.4 Tcf and have to acknowledge a more bullish 2015 price outcome (say $4.5/Mcf-plus). With normal weather, 3.6 Tcf is achievable and 2015 priced at $4/Mcf is more likely.”

The TPH analysts said supply is currently setting up to surprise to the upside, with all the year-over-year growth coming from the Northeast currently, with the more recent sequential growth occurring in nearly all regions.

“Current data indicates we are running at 3-plus Bcf/d of incremental year-over-year gas supply. Supply is up 4-plus Bcf/d from the Northeast, but netting back to 3 Bcf/d largely on Gulf Coast onshore declines. The recent trend is for sequential growth from most regions with the last couple of months showing 500 MMcf/d of incremental production driven by smallish contributions across all non-eastern basins. Much of this looks to be seasonal recovery but, if the trend continues, Producing and West storage levels will be incrementally easier to refill, driving summer 2014 Henry Hub prices lower.”

Weather bulls may have a tough go of it in the next three weeks if the WeatherBELL Analytics 20-day forecast holds true to form. Extended heat doesn’t seem to be in the cards. “First of all, it’s going to be tough to get it very hot this summer in any given area. I am worried about the last two weeks of June, with more heat trying to hit and hold,” said meteorologist Joe Bastardi on Thursday. “As of this writing, the JMA [Japan Meteorological Agency weather model] is trending cooler [by establishing a trough Week 2 into Week 4].

“The [heavy] rains forecasted cut into the threat of major heat waves (i.e., 7 days of 90 degrees in Chicago or New York City, or three to five days of 95 degrees in DC). The actual ensemble temperatures on the ECMWF [European model] show the height of the warmth is indeed warm, but it still pours cold water on a true major heat wave, like we saw to end May last year, for instance.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |