NGI Data | NGI All News Access

Weekly NatGas Cash Losses Pile Up As No Point Left Unscathed

Red ink spilled far and wide in weekly physical natural gas trading as the low-demand characteristics tied to the shoulder season were more than evident. All actively traded points followed by NGI showed losses ranging from just over a dime to as much as 90 cents. For the week ended May 16 the NGI Weekly Spot Gas Average nationally fell 28 cents to $4.27.

The smallest individual market point decline was 12 cents at Emerson in the Midwest to average $4.45. Marcellus points took the heaviest hits with the Leidy Hub giving up 92 cents to $2.43 and Tennessee Zone 4 Marcellus retreating 78 cents to $2.12.

Regionally the Northeast cemented its position as the low cost producer dropping 57 cents to average $3.56, while South Louisiana shed 29 cents to $4.37. South Texas and East Texas were right behind with 28-cent declines to $4.31 and $4.34, respectively.

The Midwest was down 24 cents to $4.54 and the Rocky Mountains fell 22 cents to average $4.29.

The Midcontinent declined 17 cents to $4.33, and regionally California came in with the smallest losses dropping 16 cents to average $4.75.

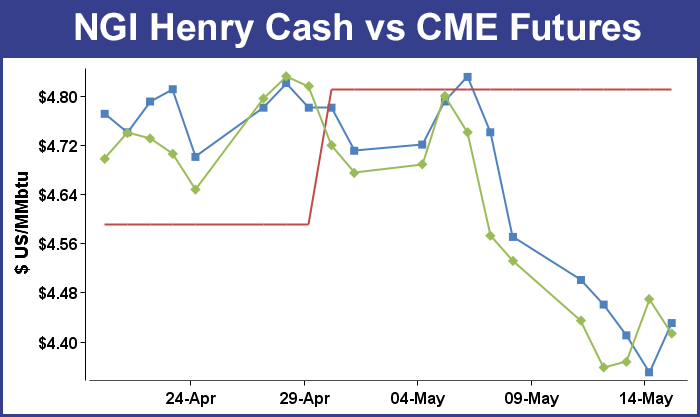

June futures fell 11.8 cents during the week to $4.413, but traders had a bit of a roller coaster ride Thursday as fresh storage data proved confusing.

The EIA reported a build of 105 Bcf for the week ending May 9, which at first glance looked bearish, but that number also included 8 Bcf of reclassified gas leading traders to conclude actual gas going in the ground was closer to 97 Bcf, bullish. As a result, natural gas futures plunged, then rallied on Thursday.

“There was a reclassification to 105 Bcf, so initially off the bigger number, we made new lows, but once traders figured that the reclassification put it at 97 Bcf, we rallied and made new highs. We almost saw support and resistance at the same time, $4.25 on the downside and $4.50 on the upside,’ said a New York floor trader.

Other analysts elected to focus on the 105 Bcf figure. “The market may be staging an upward technical correction after having fallen hard over the past week, but the weekly storage data was bearish, not bullish, a larger-than-expected 105 Bcf build that was well above the 83-Bcf five-year average for the period. The build also implies a further weakening of the background supply/demand balance, which will give the market a better chance of reaching an adequate storage level ahead of next winter,” said Tim Evans of Citi Futures Perspective.

The Energy Metro Desk weekly survey came up with a 101 Bcf build, and others were also looking for three digits. Bentek Energy’s flow model calculated a 108 Bcf increase, and Raymond James figured on 101 Bcf. IAF Advisors forecast a 99 Bcf build, and a Reuters survey of 24 traders and analysts showed a sample mean of 99 Bcf as well. The range on the Reuters survey was 91 Bcf to 108 Bcf. Last year, 99 Bcf was injected for the week, and the five-year pace was a 82 Bcf build.

Short-term traders were looking for an injection “somewhere north of 95 Bcf. I think that range is baked into the market already, but I do look for a test of $4.25. That’s how the market feels,” said a New York floor trader following Wednesday’s close.

There was also abundant conflicting data with storage refills pointing one direction and power burn data indicating a thinner build. Industry consultant Bentek Energy said its flow model showed an estimated injection of 108 Bcf, but its supply-demand model predicted a 95 Bcf increase. Bentek said its storage activity models showed “several fields recorded at or near their all-time high for a single week of injections for Bentek’s history, including NGPL, Blue Lake, Southern Pines, SOCAL and PG&E. The strong storage activity gives the high-side risk to this week’s forecast while the fundamentals, particularly Bentek’s power burn estimates during the week, provide[d] the low-side risk.”

The firm estimated that “power burn demand increased by 1.1 Bcf/d from the previous week, most of which was centered in the Southeast. However, Bentek’s sample of storage fields in the Southeast contradicts the increased power estimates as total sample injections within the region rose 6 Bcf week-over-week, with the largest increase coming from Bentek’s sample of saltdome facilities.”

Inventories now stand at 1,160 Bcf and are 790 Bcf less than last year and 959 Bcf below the 5-year average. In the East Region 60 Bcf were injected and the West Region saw inventories up by 16 Bcf. Inventories in the Producing Region rose by 29 Bcf.

After all the smoke cleared from Thursday’s volatile trading, analysts saw the market confined to a range. “The bulk of [Thursday’s] trade developed within the 15 minutes subsequent to the release of the weekly EIA storage report. The 105 Bcf injection was initially viewed as bearish, with nearby futures dropping to our expected support of $4.29 with the market subsequently advancing by more than 20 cents,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Thursday to clients.

“The reported reclassification of 8 Bcf to base gas suggested an actual increase of 97 Bcf, a number closer to our projected 95 Bcf upswing. With the injection coming in a couple of Bcf lower than average ideas, shorts ran for cover in the process of accentuating today’s response to the numbers. At the end of the day, we viewed [this Thursday’s] and last Thursday’s response to the figures as overreactions that are forcing most of the weekly price volatility into the Thursday trade. While we still advise a small or core long holding in the deferred summer contracts in this market, we are not ruling out a revisit to our $4.29 support level.

“Although stocks are still 45% below five-year averages, the dynamic of deficit contraction remains in place and will likely be restricting additional price rallies to above the $4.60 level, especially if the short-term temperature outlooks continue to tilt bearish. In sum, we are expecting about a $4.30-4.60 trading range until another storage figure spikes volatility again next week.”

Longer term, analysts at Goldman Sachs see supply growth outstripping demand with season-ending inventories at a lean 3.4 Tcf. “[N]ow that we have finally come through the prolonged, cold winter, which generated the largest seasonal draw on record, the market is turning to the question of what it will take to rebuild inventories to healthy levels for next year and beyond. We now believe that storage levels will likely reach 3.4 Tcf by end October 2014 — a historically tight level, which nevertheless requires a record summer build from now until end-October,” said analysts Daniel Quigley, Jeffrey Currie and Michael Hinds in a report.

“In our view, the new shale environment makes the market better equipped to deal with this task than ever before. Indeed, [Thursday’s] EIA stock data showed another large weekly build of 105 Bcf, relative to a five-year average of 84 Bcf. Fundamentally, we still expect supply growth in 2014 and 2015 to outpace demand as downstream investment has not yet ramped up to exploit the benefits of the shale resources that are currently being produced.”

Market technicians versed in Elliott Wave and retracement analysis see a compelling case that Thursday’s down-move and reversal higher represents a completed market correction from the April high of $4.852 and the market is poised to move higher. Walter Zimmermann, vice president of United ICAP, in a Thursday afternoon webcast outlined how $4.221 (April 2) to $4.852 was the first leg of a larger advance. “The bullish case centers around the correction of the advance ending Thursday with the low at $4.289.

“Either natural gas bottomed today or it is about to bottom within the next day or two with a test of the prior lows. The prospects of natural gas have improved dramatically, but not enough to rule out a retest of Thursday’s lows,” said Zimmermann.

In Friday’s trading gas for weekend and Monday delivery continued the trend of lower prices. Mild weather in the Northeast prompted double-digit declines, but prices in the Midwest and Midcontinent moved less drastically. Futures trading was quiet and limited to a microscopic 4-cent range. At the close, June had fallen 5.6 cents to $4.413 and July had retreated 5.7 cents to $4.421.

At the beginning of physical trading Friday, traders had to deal with pipelines that were requesting shippers to either maintain their nominations or keep withdrawals equal to or above nominations regardless of their imbalance situation. “Mild weather weekend in the Northeast has prompted pipelines to ask their shippers to stick to their nominations,” said Genscape in a Friday morning report. “Due to the ongoing scheduled maintenance and milder weather, Tennessee is experiencing very limited flexibility in Zone 4, [and] Algonquin issued a notice requiring all delivery point operators to keep actual daily takes out of the system equal to or greater than scheduled quantities regardless of their cumulative imbalance position.”

It also said that TETCO “issued a notice requesting all delivery point operators in Market Area Zone M3 to keep actual daily takes out of the system equal to or greater than scheduled quantities regardless of their cumulative imbalance position.”

Prices in the East fell as forecasters called for conditions more characterized by rain and thunderstorms than by temperature movements. The National Weather Service (NWS) in southeast Massachusetts said, “a period of heavy rain is expected later tonight into early Saturday morning…but dry and mild weather should return Saturday afternoon. As for early next week…temperatures will average near or just below normal with just isolated to widely scattered afternoon/evening showers. A period of more widespread showery and cool weather is possible for the middle to late portion of next week…but confidence [in the forecast] is low.”

Forecaster Wunderground.com predicted that Boston’s Friday high of 73 degrees would hold Saturday and drop to 66 by Monday. The normal high in Boston is 66 at this time of year.

Quotes at the Algonquin Citygates fell 65 cents to $3.40, and deliveries into Iroquois Waddington shed 5 cents to $4.46. Gas on Tennessee Zone 6 200 L tumbled 63 cents to $3.40.

Farther south, NWS forecast that for the Washington, DC, area “a cold front will continue to move off the middle-Atlantic coast through this evening [Friday]. An upper trough will persist over the eastern states through Sunday while surface high pressure builds over the region. High pressure remains overhead through Tuesday. Weak low pressure is expected to move southeast through the middle-Atlantic Wednesday night with a trailing cold front.

Wunderground expected the high in Washington, DC, Friday of 71 to ease to 70 Saturday before rising back to 71 Monday. The seasonal high in Washington DC is 75.

Parcels for weekend and Monday delivery to Dominion South tumbled 14 cents to $3.02, and gas bound for New York City on Transco Zone 6 slid 15 cents to $2.98. On Tetco M-3 gas fell 14 cents to $3.02.

In the Midwest, gas was seen anywhere from a nickel higher to a nickel lower. On Alliance gas came in at $4.45, down 3 cents, and at the Joliet Hub gas for the weekend and Monday changed hands at $4.44 down 3 cents. At the Chicago Citygates, deliveries fell 4 cents to $4.47. Buyers on Consumers had to pay 4 cents more to $4.60, and gas on Michcon rose 5 cents to $4.60.

A Great Lakes marketer voiced skepticism about whether it was necessary to do much in the way of spot purchases. “We are not sure if it is necessary. It’s going to be cool, but then it is going to warm up again,” said the buyer, adding that clients such as hospitals had pretty steady demand throughout the shoulder period.

Gas in the Midcontinent was mostly unchanged. Gas on ANR SW was down 2 cents to $4.20, but deliveries to NGPL Mid-Continent Pool were flat at $4.27 and OGT was down a penny at $4.14. Gas on Panhandle Eastern was 7 cents higher at $4.18.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |