Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Gulfport Energy Jolts Analysts; Downshifts in the Utica

Gulfport Energy Corp. on Thursday announced a drastic shift in its strategy to develop the Utica Shale, defying expectations and scaling-back its drilling and completion plans in favor of a slower approach aimed at long-term growth that found analysts on edge and sent the company’s stock plummeting.

On Wednesday, the company’s stock, traded on the Nasdaq, had closed at $73.04/share, but by midday Thursday it had dropped by more than 18% and went on to finish at $59.38. Millions of shares had moved shortly after an earnings call in which financial analysts peppered Gulfport’s management with questions regarding its new plans for the Utica.

Much of the skepticism stemmed from Gulfport’s announcement that it would backpedal on its drilling and completions schedule and instead build an inventory of wells to maintain consistency and cut future costs for crews working to tie them into sales. As a result, management said its production and tie-ins would likely stay flat for the remainder of the year and it elected to slash 2014 guidance by 30% from 50,000-60,000 boe/d to 37,000-42,000 boe/d.

Gulfport said it was also having difficulties with retrograde condensate and pressure differentials between its well bores on multi-well pads, which would need to be worked out going forward.

“As in any shale play, offset communication has been observed in a few wells and we continue to monitor these effects,” said COO J. Ross Kirtley. “Communication between wellbores is not always detrimental, however, there does exist a negative production impact associated with any communication. For example, water production will often increase for some period of time and resulting production in the other offset producer is negatively affected.”

Vice President of Ohio Operations Mark Malone said the company will for now hold back the pressure on its wells, which will reduce flow rates.

“We’ve had the opportunity to flow some of our wet gas wells at fairly aggressive rates above what our type curve indicates,” he said. “When that happens, we’ve seen some signs of liquid loading and various things that we think are detrimental. It’s really [about] flowing them at a lesser rate. We’re trying to increase the estimated ultimate recoveries.”

To be sure, Gulfport is not the only independent in the Utica Shale grappling with such issues. Pressure management remains a top concern for operators in the Appalachian Basin and elsewhere across the country as they drill more wells on single pads and target multiple reservoirs in stacked pays (see Shale Daily, April 28). And although the market prefers high initial production rates, analysts had more to be concerned about.

Gulfport also said it was confronting midstream issues in Ohio that were largely beyond its control. The company is working closely with MarkWest Energy Partners LP to gather its dry gas and process its wet gas. A delay in its dry gas gathering will push off sales for some of those wells to an unspecified date, and the company is still awaiting a 200 MMcf/d expansion at MarkWest’s Cadiz facility in Harrison County.

“With regards to our dry gas gathering system, we spent much of the first quarter working with MarkWest to optimize the system design to ensure consistent operating conditions as well as an ability to access firm transportation previously secured,” said Managing Director of Midstream Operations Ty Peck. “MarkWest is working to clear right-of-ways currently, and as a result, tie-ins for dry gas wells will likely come later than originally forecasted.”

Peck added that the expansion at the Cadiz facility will likely be completed in the next three or four months and he said despite access to MarkWest’s Seneca complex in Noble County, OH, without the expansion, wet gas production will be curtailed and in the meantime cut the company off from more lucrative Midwestern markets

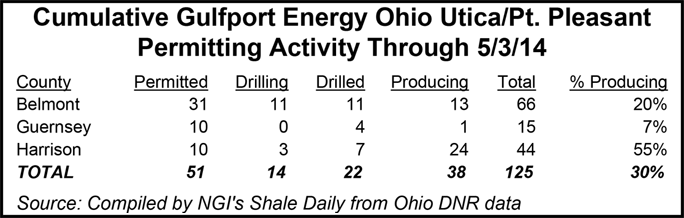

Gulfport drilled its first Utica shale well a little more than two years ago. Since then, the company has spent time building a considerable 179,000 net acreage position (see Shale Daily, Feb. 11). Despite a sizeable position in the Canadian oilsands and a patchwork of assets in the Permian Basin, Niobrara Shale and along the Louisiana coast, the bulk of the company’s program now consists of the Utica, which CEO Mike Moore on Thursday called “the very best shale play in the U.S.”

In the first quarter, Gulfport produced 27,087 boe/d (2.4 million boe), compared to 6,395 boe/d (1.5 million boe) during the same time in 2013. The majority of last quarter’s production, 1.8 million boe, came from the Utica Shale.

The downshift in the Utica can be traced to a number of factors, including Moore, who was appointed CEO last month after James Palm retired in February (see Shale Daily, April 24). The company also hired a number of managers to strengthen its Ohio program, including Kirtley, Malone and Peck, late last year (see Shale Daily, Dec. 13, 2013).

In recent weeks, Moore said the company had undertaken a close review of its operations and he said the earlier assumptions used to determine the pace of development in Ohio were too careless.

“We also believe that it’s in our best interest to manage this asset for long-term sustainable growth,” Moore said of the Utica. “We have learned, from a number of techniques that we have narrowed and applied, to zero-in on a methodical, systematic approach that we think will maximize long-term value.”

Last October, Gulfport lowered its 2013 guidance from 37,000-40,000 boe/d to 27,000-32,000 boe/d (see Shale Daily, Oct. 16, 2013). It exited the year at the low end, reporting 27,780 boe/d. In January, though, when it announced year-end production results, the company said there would be no change to this year’s previously issued guidance of 50,000-60,000 boe/d (see Shale Daily, Jan. 7). At the time, financial analysts remained optimistic about Gulfport’s potential, saying in notes to clients that they expected the company to ramp-up development to meet that target.

Thursday’s results sent those expectations out the window and gave investors a jolt. The company said it spud only 7.5 Utica wells last quarter and offered no new Utica well results in either its first quarter earnings release or on the conference call that followed. Its plan to build an inventory of drilled wells will also likely cut its number of completions per quarter this year from 20 to 14, analysts said.

“While we believe the company’s Utica asset has significant potential, execution is needed in our view to unlock this value,” said Wells Fargo Securities analyst Gordon Douthat.

Still, Gulfport said it had acquired 13,000 net acres in the Utica since March in some unique deals that left analysts something to look forward to. Vice President of Land Lester Zitkus said the company had entered into an agreement with Murray Energy Corp., eastern Ohio’s largest coal producer, to lease 8,000 acres of its oil and gas rights in Belmont and Monroe counties.

Zitkus said Gulfport has also been busy acquiring leasehold in the West Virginia panhandle, building a fairway to target the Utica there, which other operators have announced in recent months as well (see Shale Daily, March 26).

The company reported first quarter net income of $82.6 million (96 cents/share), compared to $44.6 million (61 cents/share) in the prior-year quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |