Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Bearish Build Sees Futures Retreat, But the Road to 3.5 Tcf Remains Long

Physical natural gas prices put in another mixed day Thursday as northeastern pricing points logged a third straight decline-day with temperatures expected to warm up a bit, while California and Rocky Mountain indexes firmed. June natural gas futures sank below $4.800 on bearish storage data to finish out Thursday’s regular session at $4.719, down 9.6 cents from Wednesday’s close.

Much like Wednesday, most cash points moved a couple of pennies in either direction, with less than a handful recording a move of more than a dime. Similar to how the Northeast’s weakness carried over into Thursday, strength in the Rockies and California appeared to be a holdover from the previous day’s trade. PG&E Citygate added 3 cents to average $5.30, while Socal Citygate tacked on 4 cents to $5.12. In the mountains, CIG gas for Friday delivery lost 8 cents to average $4.56, and Opal lost a penny to $4.66.

Williams’ Opal, WY, facility was back in the headlines Thursday as two of the five cryogenic processing trains — with a combined processing capacity of 395 MMcf/d — were brought back online eight days after an explosion and subsequent fire shuttered the facility (see related story). Opal had been processing up to 1.1 Bcf/d and supplying up to 1 Bcf/d to interstate pipelines before the incident (see Daily GPI, April 25; April 24).

Northeastern values continued to sink as memories, and more importantly temperatures, associated with the arctic winter were replaced with more spring-like temperatures for much of the region. Tetco M3 Delivery came off 13 cents to average $4.11, and Dominion South shaved 7 cents to average $4.08. Algonquin Citygate for Friday delivery declined 12 cents to $4.40.

Storage prognosticators got their first real signal Thursday morning as to how the 2014 refill season might play out as the Energy Information Administration (EIA) reported that a top-of-the-estimates 82 Bcf was deposited into working gas inventories for the week ending April 25. Natural gas futures bears took the number and ran in morning trading, with the June contract dropping below $4.800.

Prior to the 10:30 a.m. EDT eastern report, June natural gas futures were hovering around $4.804, but in the minutes that immediately followed, the prompt month sank as low as $4.718. Later in the session it reached $4.707 before finishing at $4.710.

Citi Futures Perspective analyst Tim Evans called the report “bearish,” noting that it was significantly larger than both last year’s date-adjusted 41 Bcf injection and the five-year average build for the week of 58 Bcf.

“The 82 Bcf in net injections was somewhat more than expected and bearish compared with the 58 Bcf five-year average refill,” Evans said. “This was a second consecutive bearish surprise in the data, helping to confirm an underlying weakening in the supply-demand balance.”

Heading into the report, most market watchers are gunning for an injection in the mid- to high-70s Bcf. Evans was looking for a 78 Bcf build, while a Reuters survey of 22 market analysts and traders produced a 62-82 Bcf injection range with consensus pegged at a 75 Bcf build.

After more than 3 Tcf was removed during the brutally cold 2013-2014 winter heating season, the race — and the bets — are on as to whether domestic production can muster the push necessary to refill inventories prior to next winter. While Thursday’s report was a step in the right direction towards completing the goal, the road to 3.5 Tcf is still a long one.

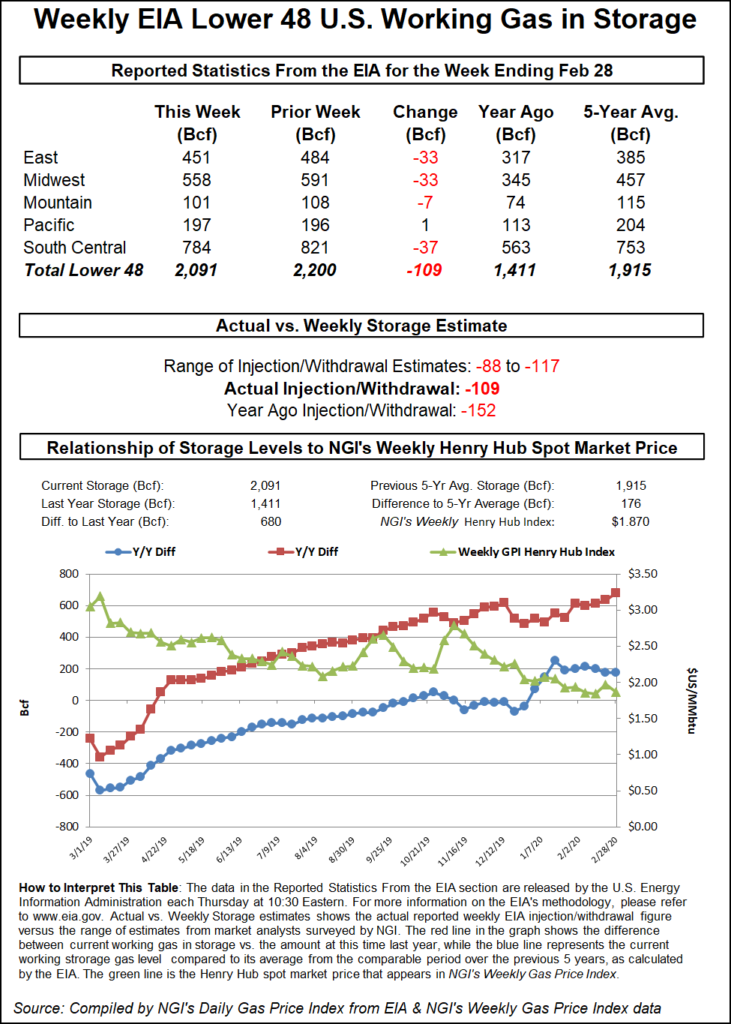

As of April 25, working gas in storage stood at 981 Bcf, according to EIA estimates, which is still 790 Bcf less than last year at this time and 984 Bcf below the five-year average of 1,965 Bcf. For the week, the Producing Region injected 35 Bcf and the East Region contributed 34 Bcf, while the West Region chipped in 13 Bcf.

Teri Viswanath, BNP Paribas director of commodity strategy, natural gas, said that while Thursday’s report marked “the second consecutive higher-than-anticipated stock build,” she expects the surprises could be coming to an end soon.

“Because the month of May has historically been the heaviest injection month of the season, the market has pinned significant hope on paring the y/y storage deficit this month ahead of the peak summer heat,” she said in a Thursday afternoon note. “With the daily interstate storage receipts beginning to lose ground this week, we see a real possibility that the forthcoming storage reports might soon disappoint.”

It is far too early to tell how the refill season will play out due to variables embedded in the long list of fundamentals — not the least of which is summer temperatures, according to Credit Suisse analysts Marcus Garvey, Tom Kendall, Bhaveer Shah, Andrew Shaw, Jan Stuart and Johannes Van Der Tuin.

“In a nutshell, the story of 2014 U.S. natural gas is that the market’s fundamentals are stronger than they have been in at least five years,” the analysts said in a note Thursday. “Indeed, reaching inventories anything like normal levels ahead of next winter will require the largest-ever storage injection over a six-month period; this will probably tax the U.S. natural gas supply system as well as the ability of electricity generators to burn more coal. At a price, this should be achievable if the weather is close to normal.”

The analysts said that if anything should go wrong on the supply side this summer, and/or the weather turns out too warm, “then prices should have a great deal of upside above our target of $4.85/MMBtu.”

On the other side of the coin, even if lower than normal temperatures tamp down gas demand, and/or more gas production than expected comes online, Credit Suisse argues that the gates to the downside might not be wide open for prices, “given the extremely wide year-on-year storage deficit.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |