Infrastructure | NGI All News Access

Energy Future Holdings Bankrupt, Blown Down by Shale Gale

Texas power company Energy Future Holdings Corp. (EFH) — the product of a 2007 leveraged buyout that was the largest ever — filed for bankruptcy after years of struggling against the shale gale, which drove down prices for electricity as well as gas.

Dallas-based EFH — formerly known as TXU Corp. — said Tuesday it struck agreements with key stakeholders to cut about $40 billion in debt, lower interest expenses, access additional capital “and create a sustainable capital structure for the future.”

EFH and its units Texas Competitive Electric Holdings Co. LLC (TCEH) (the holding company for EFH’s competitive businesses, including Luminant and TXU Energy) and Energy Future Intermediate Holding Co. LLC (EFIH) (the holding company for EFH’s regulated Oncor Electric Delivery Co.) filed for Chapter 11 bankruptcy.

“This restructuring is focused on our balance sheet, not our operations. We fully expect to continue normal business operations during the reorganization,” said EFH CEO John Young.

EFH went private in 2007 in a deal involving KKR & Co., TPG Capital, and Goldman Sachs Group Inc. that loaded the company with debt. In the years preceding the deal, high natural gas prices were driving power generators to embrace coal-fired plants (see Daily GPI, Nov. 12, 2007; Nov. 21, 2005).

However, EFH and others would soon feel the first breezes of what would become the shale gale. Adding to EFH’s challenges, the 2008 economic crisis and subsequent recession cut demand for electricity.

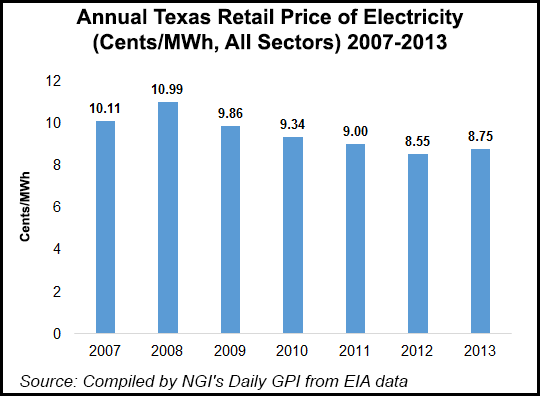

In subsequent years, shale plays kept producing ever increasing volumes of natural gas, driving the price of the commodity down, and with it the price of electricity in Texas and elsewhere. Coal-fired power plants, like those operated by EFH, were increasingly out of the money (see Daily GPI, Feb. 6, 2012; Aug. 22, 2011).

On Tuesday the Public Utility Commission of Texas (PUCT) sought to calm any fears the bankruptcy filing might be causing among electricity consumers. “We have every expectation that the Texas electric market will continue to thrive,” said PUCT Chairman Donna Nelson. “Both the PUCT and Energy Future Holdings are committed to a continuation of all customer protections during this bankruptcy proceeding.”

EFH is the parent of three retail electric providers in Texas: TXU Energy, ET Services Co. and 4Change Energy. TXU Energy has about 1.7 million customers.

Luminant is a power plant operator owned by EFH with a total generation capacity of about 15,400 MW across its generation fleet. About 8,000 MW of the capacity is fueled by coal and another 2,300 MW is nuclear.

Oncor is a transmission and distribution utility that is owned by EFH and regulated by the PUCT. However, Oncor is expressly not a debtor in these bankruptcy cases. Also, in 2008 the PUCT mandated a “ring fence” provision that protects Oncor from any risk incurred by other EFH companies.

Under the reorganization plan, TCEH and its subsidiaries would separate from EFH without triggering any material tax liability, and TCEH’s first lien lenders would receive all of the equity in the reorganized TCEH and cash proceeds from the issuance of new debt at the reorganized TCEH in exchange for eliminating $23 billion of TCEH debt.

At EFIH, about $2.5 billion of debt would be eliminated through, among other things, a capital infusion of up to $1.9 billion from unsecured noteholders. This capital would convert, along with all EFH and EFIH unsecured notes, into equity in the reorganized EFH upon the completion of the reorganization. Certain EFIH unsecured noteholders would receive cash consideration as a part of the reorganization.

At EFH, the proposed transactions would eliminate about $600 million of debt. The reorganized EFH would continue to own EFIH, and EFIH would continue to retain its interest in Oncor.

TCEH and EFIH have secured commitments for new capital totaling up to $4.475 billion and $7.3 billion, respectively, in debtor-in-possession financing.

The reorganization plan requires approvals from the Internal Revenue Service, the PUCT and the U.S. Nuclear Regulatory Commission. EFH said it expects confirmation of its reorganization plan within about nine months and an exit from bankruptcy in about 11 months.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |