NGI Archives | NGI All News Access

North American Drillers Shopping Again, Says NOV CEO

More North American land drillers have resumed buying equipment for drilling and fracturing (fracking), in part to secure the state-of-the-art technology and in part because unconventional prospects are chewing up drillbits and pressure pumpers, National Oilwell Varco Inc. (NOV) CEO Clay Williams said Monday.

The Houston-based provider designs and manufactures most of the technology now used worldwide, offshore and onshore. However, while net profits rose 9% from a year ago, they dipped 10% sequentially. Revenues also increased year/year but were down 6% from 4Q2013. The sequential decline was attributed to fewer offshore contracts, not a lack of onshore demand, Williams told analysts during a conference call.

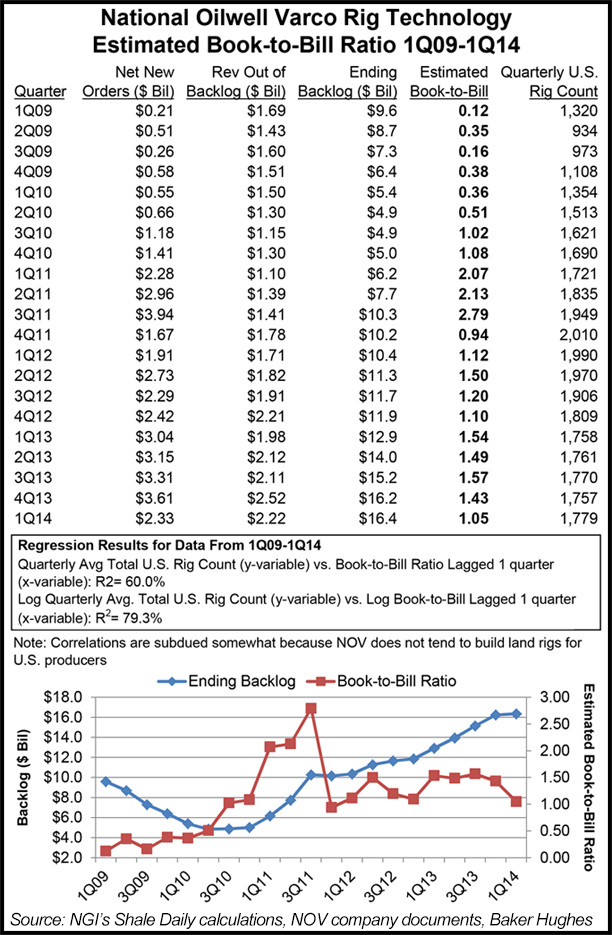

However, the backlog for capital equipment orders within the rig technology segment hit an all-time record of $16.35 billion, up 1% from the fourth quarter, and up 27% from a year ago.

Meanwhile, North America’s onshore equipment market has reawakened and wants to grow, the CEO said.

“Specifically, we are now seeing more North American drillers resume buying equipment, while we continue to sell land rigs into the Middle East, Russia and Latin America,” Williams said. “Drillers the world over continue to retool the land rig fleet to newer, more modern levels of capability. While orders for AC [alternative current] powered, quick move, electronic control land rigs have slowed a bit, the direction is clear.

“These are the workhorses that make our industry steadily safer and more efficient, and enable profitable unconventional resource production. Land drilling contractors appear to be increasingly convinced of their superior economic returns.”

Management has been “encouraged by recent orders for stimulation and pressure pumping equipment in North America. Frack spreads continue to be pushed harder, pumping larger fracks into more stages and higher pressures, and many are now being run at 24 hours a day, consuming these fleets at a faster pace.

“Our book-to-bill for pressure pumping, oil tubing and wireline products all handily exceeded 1:1 in the first quarter.”

Across the company’s offerings, the second quarter “will be in the range of 1:1 book-to-bill,” Williams told analysts. “And at the third and fourth quarters, we’ll gradually drift down, leading us with an ending backlog probably in the low teens,” which he later defined as under $15 billion.

Overall, the book-to-bill declined because total new orders fell from $3.61 billion in 4Q2013 to $2.33 billion in 1Q2014.

The book-to-bill ratio represents the amount of additions to the backlog, divided by the amount of revenue that was booked from backlog in that same period. The ratio doesn’t explain 100% of the backlog changes from period to period, because it doesn’t incorporate, among other things, turns business (orders taken and filled in the same period), cancellations and order push-outs. Book-to-bill ratios above 1.00 generally indicate that backlog grew during the measurement period.

More than half (52%) of NOV’s business is centered on offshore technology and services, while the balance is devoted to equipment for land rigs, workover rigs, pressure pumping equipment and floating production storage offloading (FPSO) equipment.

“This ‘other half’ of our order stream is carrying good momentum into 2014, and we expect to partly offset offshore newbuild declines later in the year,” Williams said.

“Demand for floating production products…dipped this quarter, but we believe this is simply a function of timing and that FPSO demand will increase as we move through the year, given our strong bidding activity.”

Net profits climbed 17% year/year to $589 million ($1.37/share) from $502 million ($1.18), but fell from 4Q2013’s $658 million ($1.54). Operating profits, 15.2% of sales, rose year/year to $880 million from $816 million, but were down from 4Q2013’s $973 million. Revenues declined 6% from 4Q2013 to $5.78 billion, but were up 9% from 1Q2013.

Rig technology revenues totaled $3.01 billion, down 9% year/year but 14% higher than in the year-ago period. Operating profit was $635 million, or 21.1% of sales. Year/year operating profit flow-through, the change in operating profit divided by the change in revenue, was 20%. Revenue out of backlog for the segment was at $2.22 billion.

Petroleum services and supplies also saw a decline in revenues for the quarter, off 7% from 4Q2013 but 5% higher than in 1Q2013. Operating profit was $326 million, or 18.2% of revenue. Operating profit flow-through was 17%. The distribution and transmission segment, which is being spun off as a separate business, generated revenues of $1.28 billion in the first quarter, up 2% sequentially and 4% year/year. Operating profits, 5.3% of shales, totaled $68 million, with operating profit flow-through of 6%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |