NGI Data | NGI All News Access

Market Sputters Higher In Weekly Trading; Opal Fallout Assessed

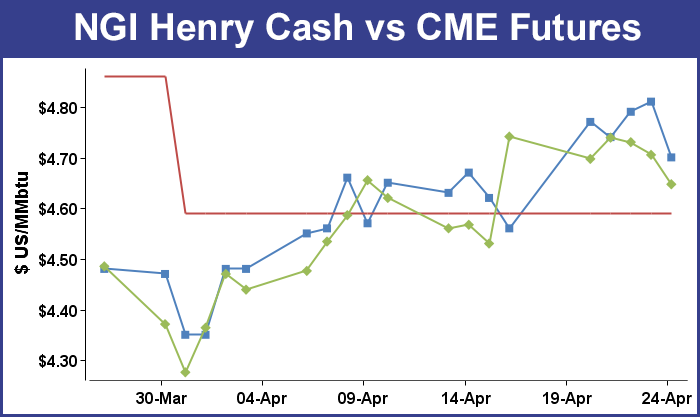

Weekly physical natural gas prices compiled by NGI put in a deceptively modest gain of 6 cents to average $4.66 for the week ended April 25. Although futures slid on the week, the advance of the May contract from an April 2 low of $4.221 managed to make a high for the move on Thursday at $4.805 hinting that the advance from earlier in the month may still have more legs.

Physical price gains were widespread but a few dozen individual points in the Midcontinent, Midwest and Northeast did slip into the loss column. Of the actively traded points the week’s biggest gainer was Columbia Gas adding 19 cents to $4.69, and the largest losses were posted at the Algonquin Citygates, down 90 cents to average $4.56.

Regionally the Northeast and Midwest both lost ground dropping 6 cents and 3 cents respectively to $4.38 and $4.83. The Midcontinent rose 3 cents to average $4.59.

All other regions made robust double-digit gains, with the Rockies and West Coast markets aided by a fire and explosion at the Opal gas processing plant in southwest Wyoming on Wednesday. South Louisiana and the Rocky Mountains were both up by 13 cents to $4.69 and $4.58, respectively, and 14 cent additions were seen at South Texas, East Texas and California to $4.63, $4.69, and $4.91.

For the five trading days May futures fell 9.4 cents to settle at $4.647. The May contract expires April 28.

The big news on the week occurred Wednesday where Rockies and West Coast markets were briefly rattled when a fire and explosion at the Opal gas processing plant in southwest Wyoming forced the evacuation of a nearby town. A Rocky Mountain producer thought the effect would be minimal and did not have to shut in any wells that deliver to Colorado Interstate Gas (CIG), a major carrier into the Opal plant. “I spoke with one fellow who said most of the gas has found another home, and Ultra Resources is saying it won’t impact them,” said a Denver-based producer. He added that a lot of his company’s gas goes south on Southern Star pipeline into Kansas.

Market points affected by as much as 1 Bcf/d from the plant on Thursday included CIG, down 11 cents at $4.49, while Northwest Pipeline Wyoming for Friday delivery rose 7 cents to $4.66. Transwestern San Juan rose 9 cents to $4.71, and packages at the Cheyenne Hub rose a penny to $4.63. Malin, a major destination for gas out of Opal, rose a stout 18 cents for Friday delivery to $4.85, and Kern River Deliveries were quoted at $4.88, up 10 cents.

In a Friday update, A limited number of personnel from Williams Partners LP were working to secure and evaluate operations at the plant. It may take weeks before the cause of explosion, which occurred Wednesday around 2 p.m. MT, is known, said Williams. About 40 employees escaped uninjured, and the nearby town of Opal was evacuated overnight. Residents returned home Thursday. The fire still was burning on Friday at the Lincoln County facility in southwestern Wyoming; it was being allowed to burn out.

Genscape Inc. told NGI that some of the shuttered gas was being rerouted to the Pioneer Processing Plant nearby in Sublette County, WY, operated by Enterprise Products Partners LP. Pioneer’s two units are able to process up to 1.35 Bcf/d net.

Thursday’s storage report caught more than a few people by surprise. The Energy Information Administration in its 10:30 AM release of storage data reported a build of 49 Bcf for the week ending April 18, well above industry estimates. One school of thought had it that the week’s report was ripe for a revision, suggesting that the actual figure may could come out above industry estimates, which were hovering around 40 Bcf.

Last year 30 Bcf was injected, and the five-year average was for a 47 Bcf build. A Reuters poll of 21 traders and analysts revealed an average 42 Bcf with a range of 25-61 Bcf, and United ICAP calculated an increase of 35 Bcf. Ritterbush and Associates, which last week came about as close as anyone with a 27 Bcf estimate, was projecting a build of 50 Bcf for the report.

Some were thinking that the EIA would be reporting a larger number than what people were thinking because the EIA will adjust the numbers. “Many analysts we spoke to this week expect a bigger build than perhaps their respective numbers would have it or than our consensus might reflect,” said John Sodergreen, editor of Energy Metro Desk (EMD).

“How’s that? Simple. Given the big misfires coming out of EIA these past few weeks, there is a big expectation for a sort of true-up of sorts. EIA is fairly predictable in this; give the market two bombshells and on the third week after, we see a build that more or less sets things right.” The EMD survey came in at a 44 Bcf build, not far from the actual figure of 49 Bcf.

Inventories now stand at 899 Bcf and are 831 Bcf less than last year and 1008 Bcf below the 5-year average. In the East Region 17 Bcf were injected and the West Region saw inventories up by 10 Bcf. Inventories in the Producing Region rose by 22 Bcf.

The Producing region salt cavern storage figure increase by 13 Bcf from the previous week to 89 Bcf, while the non-salt cavern figure rose by 9 Bcf to 304 Bcf.

Futures traders see short-term negative price action. “We put in a new high for the move Thursday [$4.805], but there was no follow through,” said a New York floor trader. “This is unfavorable price action, which means we will probably drift lower again. I look for a weak expiration to May on Monday. Overall though, I am still positive on the market.”

Longer term, however, analysts see far greater risk to higher prices than lower ones. “From here, we expect some price consolidation between about [Thursday’s] $4.67 lows and the approximate midpoint of [Friday’s] range, roughly $4.74. Although our long-stated $4.80 target was achieved this morning, we will look for another run at this level by next week,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments to clients Thursday. “In short, we continue to advise working this market strictly from the long side while allowing for occasional price pullbacks of as much as 2.5-3% from most recent highs.”

Ritterbusch had estimated Thursday’s inventory build at 50 Bcf, just north of the 49 Bcf reported by the EIA. “[Thursday’s] stock draw was only a couple Bcf larger than five-year averages and kept the supply deficit north of 1 Tcf. We will continue to emphasize that upside price risk will continue to exceed that to the down side by at least a two-to-one ratio until sustainable deficit contraction against averages is seen. In the meantime, we will continue to suggest acceptance of profits out of any long positions on advances to above $4.80 while at the same time, advising fresh long positions on a scale down within the $4.60-4.70 zone in referencing the June futures.”

It may be spring, but natural gas injections may be a little more challenging as heating loads are expected to be above normal. WeatherBELL Analytics in a Friday morning report said nationally in the six- to 10-day period, 41.9 heating degree days (HDD) can be expected, more than last year’s 34 and more than the 30-year average of 36.7. In the 11- to 15-day time frame 33.7 HDD are on tap versus 27 for last year and a 29.6 average.

One weather model is projecting winter-like conditions. “The front five days has the strong trough diving through New England, [and] a major chill overtakes the Great Lakes into the Northeast, including the threat of snows into southern New England,” said Joe Bastardi, a WeatherBELL meteorologist. “The GFS [Global Forecast System] is most ambitious, developing an accumulating snow in an area where people will have to be pumping their heating systems because of the wind and chill. This is more like something seen in March than the last weekend of April.”

Market technicians versed in Elliott Wave and retracement suggest standing aside the market for now. Brian LaRose, an analyst at United-ICAP, said the market is “still stuck in neutral territory. Bulls need to breach $4.757-4.782-4.794 to open the door for further upside. Bears need to break $4.624-4.607 to signal a top is in place. Clear resistance, expect a march to $4.966-5.087-5.089. Take out support, expect a dump to $4.425-4.390 minimum. [We] suggest the sidelines until resistance can be exceeded or support can be broken.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |