NGI Archives | NGI All News Access

Lower 48 Operations, Market Activity ‘Increasingly Positive,’ Says Nabors

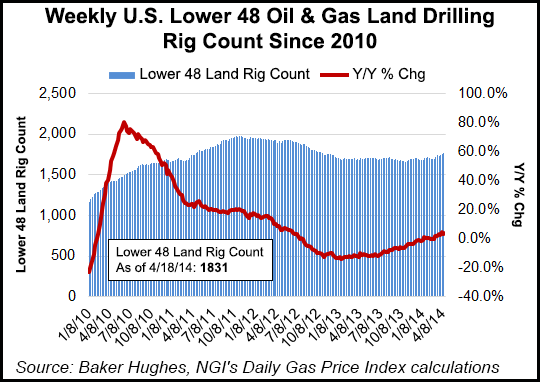

The outlook for the Lower 48 states is “increasingly positive” in all regions, with land operations, market activity and pricing strengthening on higher-than-expected cash flows and incremental rig demand, Nabors Industries Ltd. management said Wednesday.

The oilfield services company’s management team discussed 1Q2014 results during a conference call. Nabors operates the largest land drilling rig fleet in the world, with about 500 rigs (490 land rigs) working in more than 25 countries and nearly every significant oil and natural gas basin, including the offshore, Alaska and in North America. It also has one of the largest completion services, and workover and well servicing rig fleets in North America, its biggest market.

Increasing demand in North America is reflected in the latest rig count of 199, “which represents a 30-rig increase since the beginning of the fourth quarter, including eight which were previously receiving standby revenue but not working,” said CEO Tony Petrello. “Spot-market price increases now appear to be accelerating in selected areas.”

Nabors today has 286 rigs running in the Lower 48, including 172 high-tech alternating current (AC) rigs and 88 silicon-controlled rectifiers (SCR) with walking systems. Thirteen of the domestic onshore rigs have moving systems. In addition, 26 mechanical rigs remain in operation in the U.S. onshore. There are 64 rigs active in Canada, with 17 AC and 40 SCR, along with 19 onshore in Alaska, including five AC and 12 SCR rigs. Fifty rigs operate in the offshore.

Like all North American operators, quarterly results were pressured by the winter onslaught.

“As expected, weather-induced interruptions in our completion services segment overshadowed what was otherwise relatively good performance by our various drilling operations,” Petrello said. The completion and production services unit lost $3 million in the period as a long-term contract rolled off and from “protracted downtime resulting from the series of winter storms.” However, he said, “the monthly trend has been positive since bottoming in January.”

Seasonal increases in Canada and Alaska, along with higher third-party sales in subsidiary Canrig Drilling Technology Ltd., partially offset the sharp reduction in completion results, Petrollo said. Canrig provides most rig services for Nabors. Activity increased by four rigs, but the average margin was lower because of the “mix shift to shallower rigs and a more competitive environment.

“Completion services results reflect not only the weather delays experienced across the Rocky Mountain, Bakken and Appalachia operations, but also the expiration of a significant long-term contract for two spreads in late fourth quarter,” Petrollo noted. In addition, there was “moderated activity” for hydraulic fracture (frack) crews.

“The weather in the northern regions has abated and first-quarter exit rates indicate a restoration of profitability in the second quarter. Industry fundamentals appear to be strengthening, evidenced by the emergence of higher underlying industry utilization in the fourth and first quarters.

“This increase in activity, in the face of moderating frack crew productivity, is leading to higher industry utilization and correspondingly higher maintenance expenditures. These factors are, in turn, exerting upward pressure on pricing.”

Operational interruptions in 1Q2014 and “producers’ ensuing difficulty in meeting oil and gas production targets appear to be generating significant pent-up demand in the northern regions. Coupled with the increased demand associated with the rapid conversion to horizontal completions in West Texas [i.e., Permian Basin], this may be a catalyst for improving industry returns.”

Within Nabors’ production services unit, “demand for truck and rig services appears to be increasing. As a result, the company anticipates higher pricing in light of the relatively high industry utilization and the diminishing supply of viable inventory that can be reactivated to meet the increased capacity requirements.”

Nabors secured four new term contracts for Lower 48 activity using the specialized Pace-X rigs, designed for multi-pad drilling, that were rolled out last year. Management had decided to step up construction of the technology wizards, and the latest contracts “validates our strategy to commence construction of the X rigs…ahead of signing contracts,” said Petrello.

“We are seeing continuing interest in the Pace-X rig. We installed the first one a year ago and now we have 21 in the field…” Nabors deployed five X rigs in U.S. onshore during the first quarter, and it has another 13 set to deploy this year — seven already under contract.

The X rigs perform particularly well on “higher density pads,” said the CEO, and customers are seeing strong results particularly in the Permian Basin and Eagle Ford Shale. The company also is “realizing broad, moderate increases on rigs as contracts roll over.”

Deployment of a new large deepwater platform drilling rig also is expected to lead to improved results in the Gulf of Mexico offshore operations beginning late this year, he said.

Net income from continuing operations in 1Q2014 was $49 million (16 cents/share) from $92.2 million (31 cents) in the year-ago period and $128.5 million (42 cents) in 4Q2013. Completion services recorded a loss of $3 million, mostly on the poor weather in North America and contract roll-offs. Operating revenues and earnings from unconsolidated affiliates totaled $1.59 billion, compared with $1.54 billion a year ago

“Notwithstanding the weak performance of our completion services operations in the first quarter and the dampening impact the Canadian breakup usually exerts on our second quarter, I am increasingly confident in the near and intermediate-term outlook for all of our segments,” Petrollo said. “My confidence is driven by the prospects for improvement in rates and utilization across most of our operations and the progress we are making on our numerous business improvement initiatives.”

Tudor, Pickering, Holt & Co. analysts said Wednesday Nabors has framed the North American oilfield service landscape “more conservatively (and accurately) than many of its peers over the last 12 months, so its conservative outlook commentary…shouldn’t fall on deaf ears…Accelerating spot U.S. land drilling rig dayrate increases, strong well servicing fleet utilization, better frack fleet utilization of late., etc., are all good.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |