NGI Data | NGI All News Access

Futures Bulls Trump Bears And Bunnies In Weekly Pre-Holiday Trading

At the end of the abbreviated trading week ended April 17, physical traders must have been more focused on Easter eggs and chocolate bunnies than trading natural gas as all regions of the country posted small changes ranging from a loss of a couple of pennies to gains of just over a dime. Nationally the NGI Weekly Spot Gas Average gained a nickel to $4.60.

Of the actively traded market points Algonquin Citygates rose the most posting a gain of 73 cents to average $5.46 and SoCal Citygates saw the greatest decline, dropping 4 cents to $4.85. Most individual points nationally managed to make it into the black by a few pennies.

California was the only region to show a loss, easing 2 cents to average $4.77, but a number of other regions only managed to add a couple of pennies.

Both South Texas and East Texas added 2 cents to $4.49 and $4.55, respectively, and South Louisiana and the Rocky Mountains both managed gains of 2 cents to average $4.56 and $4.45, respectively.

The Midwest managed to tack on 8 cents to $4.86 and the Northeast rose by 9 cents to $4.44, while the Midcontinent gained 11 cents to average $4.56.

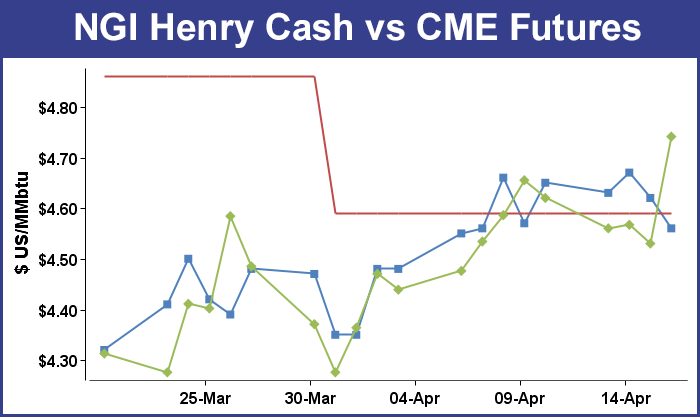

For the four trading sessions May futures rose 12.1 cents to $4.741, aided by the fact that the storage injection season is starting more sluggish than normal, which is increasing concerns that storage will be refilled before the winter heating season comes around.

The Energy Information Administration (EIA) reported a storage build of 24 Bcf for the week ending April 11, well short of market expectations, and as soon as the number hit trading screens it was off to the races for the bulls. At the close Thursday May futures had advanced 21.1 cents to $4.741 and June was higher by 20.5 cents to $4.754.

Physical prices may have moved little but futures bulls following the 10:30 a.m. EDT Energy Information Administration (EIA) storage report got more than a few chocolate bunnies in their Easter baskets. Traders were expecting a build generally in the 40 Bcf area, and analysts admit that forecasting the weekly storage numbers has been a tough row to hoe. Thursday’s miss was no exception.

Prior to the release of the data, analysts were looking for a build just below 40 Bcf. A Reuters survey of 22 traders and analysts revealed an increase of 34 Bcf with a range of 22-44 Bcf. IAF Advisors of Houston forecast a build of 38 Bcf, and Ritterbusch and Associates anticipated an injection of 27 Bcf. Bentek Energy’s flow model calculated a gain of 35 Bcf. Last year, 25 Bcf was injected, and the five-year average increase for the week is 37 Bcf.

“I had heard a number of around 34 Bcf, and I can tell you that just before the number was released the market jumped from $4.52 to $4.64; as soon as we are looking up and we see the market rallying, boom, the number comes out,” said a New York floor trader soon after the report was released. “The volume in the spot May contract jumped by 40,000 contracts in the last 15 minutes.”

Tim Evans of Citi Futures Perspective called the figure “a bullish surprise. It was also less than the 37 Bcf five-year average, adding to the year-on-five-year average storage deficit. It’s not clear whether it was stronger demand or weaker supply behind the number, but it’s possible that late-season heating demand is holding up better than expected.”

Ritterbusch at 27 Bcf came closer than most and sees less production in play. “I look at about 7 to 8 variables, and I just don’t see the production growth I thought we were going to see. I factor in CDDs and other items as well,” he told NGI. He admitted that his forecasting “would be hot for a few weeks and then cold.”

He said that the pace of new production was “slow, and we need to reverse the trend of gas-directed rigs. We are flaring too much gas and we are not getting the associated gas I thought we would see. We will just see elevated pricing for a while.”

Those in the physical side of the business remain concerned over the low pace of injections. A Michigan marketer said storage was “the biggest wild card in our business right now. The longer it gets delayed, the months of August, September and October are going to get bid up, and you will see the pipelines full. You better hope it doesn’t get cold. This storage report has got me on edge. The builds people are talking about are way short of the 100-plus Bcf weekly that is going to be needed. It’s very frustrating.”

Inventories now stand at 850 Bcf and are 850 Bcf less than last year and 1010 Bcf below the five-year average. In the East Region 6 Bcf was injected and the West Region saw inventories up by 8 Bcf. Inventories in the Producing Region rose by 10 Bcf.

The Producing region salt cavern storage figure increased by 8 Bcf from the previous week to 76 Bcf, while the non-salt cavern figure rose by 2 Bcf to 295 Bcf.

In Thursday’s trading packages of physical natural gas for the extended holiday period fell hard and fell often. Not one market point traded in positive territory as weekend temperature forecasts turned mild and buyers saw no need to extend themselves by making purchases of gas they may have to turn back on Monday.

The average overall decline was about a quarter with the greatest declines seen at Northeast and eastern points, and California and the Rockies were hit with stout double-digit declines as well.

The California Independent System Operator forecast that peak power loads Thursday of 29,096 MW would give way to 27,093 MW Friday.

Gas for the extended weekend and Monday at Malin shed 13 cents to $4.44, and deliveries to PG&E Citygates fell 9 cents to $5.00. Gas at the SoCal Citygates dropped 18 cents to $4.71, and parcels at SoCal Border points were seen 13 cents lower at $4.55. Gas on El Paso S Mainline skidded 13 cents to $4.60.

The day’s greatest declines were seen at New England locations. Gas at the Algonquin Citygates tumbled $1.26 to $4.29, and parcels on Tennessee Zone 6 200 L were off $1.00 to $4.49. Deliveries to Iroquois Waddington lost 40 cents to $4.70.

In the Mid-Atlantic gas for the extended weekend fell almost a dollar. Gas bound for New York City on Transco Zone 6 dropped 92 cents to $3.61, and gas into Tetco M-3 Delivery was seen 82 cents lower at $3.70.

The National Weather Service in New York City was expecting a series of high-pressure systems. “High pressure slowly retreats to the northeast through Friday night. Another area of high-pressure system move slowly southeast across the region Saturday through Monday. Low pressure will move toward the area Tuesday then east of the area Wednesday followed by another high pressure system.”

The Marcellus region was hard hit by declines as well. Deliveries on Millennium fell 57 cents to $3.67, and gas on Transco Leidy was off 99 cents to $3.13. Deliveries to Tennessee Zone 4 Marcellus were off 85 cents to $3.25.

Cold, at least near term, doesn’t seem to be an issue. WeatherBELL Analytics in it morning 20-day forecast predicts below-normal heating requirements. In the six- to 10-day period it forecasts national heating degree days (HDD) will reach 42, well below last year’s 56 HDD, and also short of the 30-year average of 44.8. In the 11- to 15-day time frame; however, it is looking for 38.6 HDD, more than last year’s 27.3 HDD and more than the 30-year average of 29.3 HDD.

With futures still more or less floundering in a narrow trading range, technical analysts are in something of a quandary. “Until resistance can be exceeded or support can be broken, we will be stuck in a technical no mans land,” said Brian LaRose, analyst at United ICAP. “To have us entertaining a long position, $4.749-4.757-4.794 will need to be exceeded. To have us entertaining a short position $4.324-4.292 will need to be broken. [We] suggest sitting on our hands or using this opportunity to sell front-month strangles or iron condors,” he said in closing comments to clients.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |