Marcellus | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

U.S. Onshore Well Count Rises Year/Year, Drops 3% Sequentially

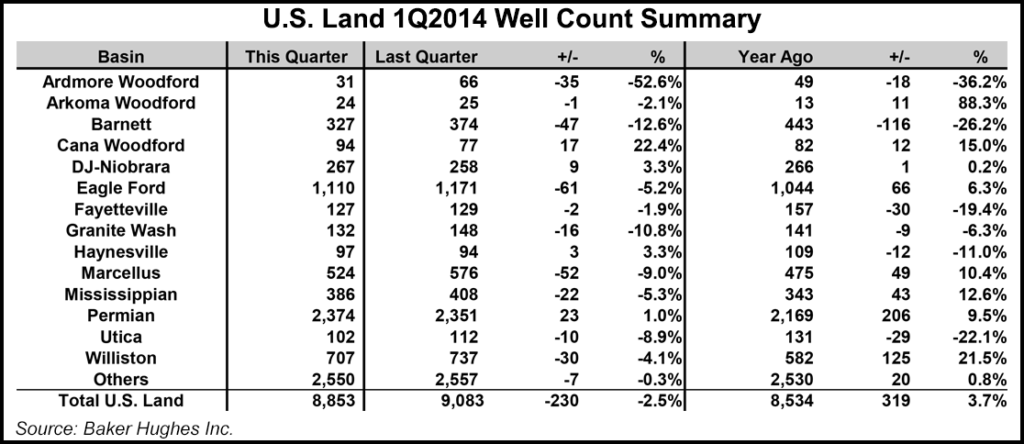

The U.S. onshore well count rose 4% year/year in 1Q2014, but it was down by 3% sequentially, with the biggest declines in the Marcellus and Barnett shales, Baker Hughes Inc. said.

Improved well designs, however, led domestic onshore drilling rigs to produce more wells than they did during the year-ago quarter.

“Due to improved drilling efficiencies, the average U.S. onshore drilling rig now produces 3% more wells compared to the same quarter last year,” Baker said. “The average U.S. onshore rig count for the first quarter 2014 was 1,724 rigs, up 27 rigs from fourth quarter 2013, and up 18 rigs from first quarter 2013.

“On average, the U.S. onshore rig fleet produced 5.14 new wells during the quarter, which represents a 3% improvement in drilling efficiencies compared to the same quarter in 2013,” Baker said.

The onshore well count climbed to 8,853 between January and March, 319 (4%) more wells than in 1Q2013. Compared to the final three months of 2013, the well count declined 3%, or 230 wells, in part due to severe winter weather.

The noticeable exception to the sequential decline was in the Permian Basin, which had 23 (1%) more wells more than in 4Q2013, despite freezing temperatures and heavy snow.

Sequentially, the well count in the Barnett fell by 47 wells (13%), while the Marcellus well count dropped by 52 (9%). There also was a 5% drop in the well count in the Eagle Ford Shale, which had 61 fewer wells than in 4Q2013, and in the Williston Basin, which had 30 fewer wells, a 4% decline.

For the final period of 2013, Baker had reported an onshore well count of 9,056 wells, 19 fewer than in 3Q2013 when there were 9,075 wells (see Shale Daily, Jan. 10).

The Baker Hughes well count is an extension of its weekly rig count. The index provides domestic onshore well count data to the industry, capturing the number of wells spud in each major U.S. basin. The well count is published quarterly; historical data may be revised, Baker said. The U.S. Energy Information Administration last year also launched a drilling productivity report to better correlate well numbers with rigs (see Shale Daily, Oct. 22, 2013). In addition, Raymond James & Associates Inc. in 2013 began to publish a well count index (see Shale Daily, Sept. 25, 2013).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |