E&P | NGI All News Access | NGI The Weekly Gas Market Report

Goodrich Gathering Pace in the TMS

Goodrich Petroleum Corp. is gaining momentum in the Tuscaloosa Marine Shale (TMS) of Louisiana and Mississippi. TMS well results released Monday garnered enthusiastic notes from analysts, who wrote that better things are likely to come.

“…[T]he wells are getting better and, we add, are also getting much cheaper to drill…” said BMO Capital Markets analyst Dan McSpirit.

Goodrich shares climbed sharply on the positive well results to close Monday at $23.99, up more than 30% in heavy trading.

Goodrich has just completed its Blades 33H-1 (66.7% working interest) well in Tangipahoa Parish, LA. It achieved a peak 24-hour average production rate of 1,270 boe/d, composed of 1,250 bbl of oil and 115 Mcf of gas on a 14/64-inch choke from a 5,000-foot lateral. The well landed in the company’s lower target, was drilled and completed under budget and was hydraulically fractured (fracked) with 20 stages using composite plugs that were drilled out prior to flowback, Goodrich said.

With the latest Blades well, Goodrich said it tweaked its completion methodology from what it’s done with previously completed wells.The well was drilled on a portion of the 185,000 net acres the company acquired last August from Devon Energy (see Shale Daily, July 23, 2013) and is about 48 miles southeast from the company-operated Crosby 12H-1 well in Wilkinson County, MS, and five miles east of a horizontal well previously drilled on the acquired acreage.

McSpirit noted that the Blades well is in an area on the “far opposite side of the play” where Goodrich had some earlier success with a well about 50 miles away. “…[S]uch a long distance between wells means greater derisking of the leasehold,” he said, adding that the successful Blades well follows the successful CMR 8-5H 1, which had initial production of about 950 boe/d (see Shale Daily, March 25).

The recent results provide “…more evidence drilling/completing issues are behind the company and the path to success is a clearer one,” said McSpirit, how noted that Goodrich TMS laterals are getting longer and drilling times are being reduced.

Wells Fargo Securities analyst Gordon Douthat was also impressed by the latest well.

“In our view, the Blades result goes a long way towards addressing issues with drilling out plugs and to the extent that composite plugs and drilling in the lower target resolve these issues going forward, a very positive development, in our view,” Douthat said in a note Monday.

Last December Goodrich reported that a TMS well frack job in Mississippi had gone bad (see Shale Daily, Dec. 27, 2013).

On Monday, Goodrich also said that it has drilled its C.H. Lewis 30-19H-1 (81.4% WI) well in Amite County, MS, in 36 days, with 6,600 feet of usable lateral. The well landed in the company’s lower target and has 26 planned frack stages using a modified completion design. Fracking operations are expected to begin by the end of April. McSpirit noted the lateral length and 36-day drilling time: “Again, efficiency.”

Goodrich is currently drilling the Nunnery 12-1H-1 (91.2% WI) well in Amite County, the Beech Grove 94H-1 (66.7% WI) well in East Feliciana Parish, LA, and the SLC, Inc. 81H-1 (66.7% WI) well in West Feliciana Parish, LA. All wells are planned to be drilled in the lower target with a minimum of 6,000-foot laterals and use the company’s modified completion design.

The company has more than 300,000 net acres and three rigs running in the TMS, with the plan to go to five rigs by the end of the year pending continued success.

Last month, fellow TMS player Halcon Resources Corp. said it had made the TMS the company’s third core area (see Shale Daily, Feb. 27).

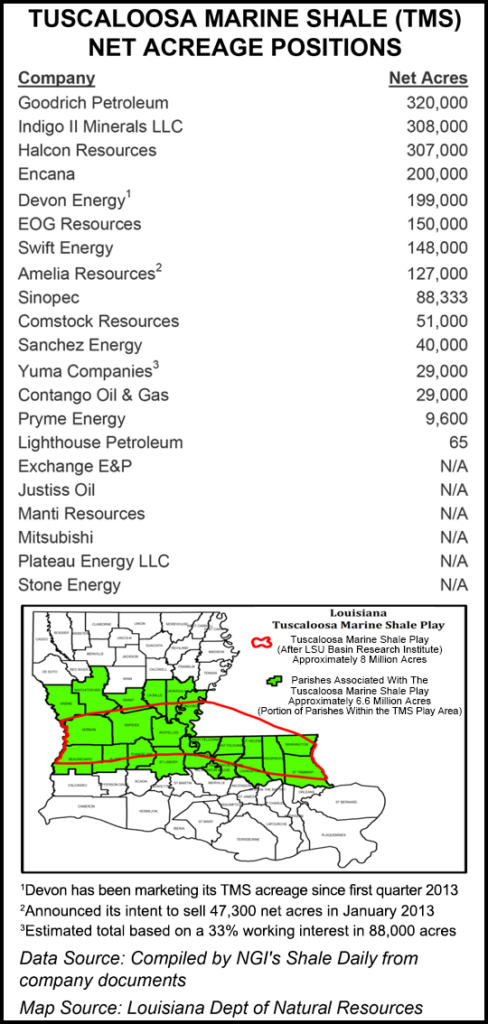

Goodrich is the largest leaseholder in the TMS, according to company records and NGI’s Shale Daily calculations. Other companies with major holdings include Indigo II Minerals LLC (308,000 net acres), Halcon (307,000 net acres), Encana (200,000 net acres) and Devon (199,000 net acres).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |