Bakken Shale | E&P | NGI All News Access

Production to Be Slowed by State, BLM Rules, North Dakota Official Says

Continued production growth in oil and natural gas is forecast, but the rate of growth will be slowed somewhat by upcoming state and federal Bureau of Land Management (BLM) regulations, North Dakota’s top oil/gas regulator said Friday while reporting a production slowdown due to harsh winter weather.

In noting that new rules from the North Dakota Department of Mineral Resources (DMR) are due to go into effect in June and BLM hydraulic fracturing (fracking) rules should be out by the end of this year, DMR Director Lynn Helms said both will cut the state’s oil/gas production, perhaps by up to 30,000 b/d.

Since the first of this year, Helms has been predicting slowdowns in the state’s production after several years of record-breaking growth (see Shale Daily, Jan.15).

On a longer time frame, BLM also is pursuing new rules on flaring of gas on federal lands (see Shale Daily, May 17, 2013) and will hold a hearing in North Dakota May 9, which DMR will be participating in very closely, said Helms. Drilling and production activity on the federal Fort Berthold Reservation make up a “significant” portion of the state’s activity, he said.

Under new rules designed to cut the state’s high percentages of flared associated gas at the wellhead, Helms said there are going to be mandated production reductions for wells that have no gathering system connection and for wells that do have gathering connections but are still flaring some percentage of their production (see Shale Daily, April 4).

“If we were to implement the current production restriction rules as of June 1, we’re facing an estimated 80,000 b/d drop in production,” Helms said on a webcast Friday. “I tend to think it will turn out to be less than that, but [whatever the number turns out to be], it will be significant and measurable,” he said.

For production curtailments that might eventually be ordered to reduce flaring, Helms said he is estimating production drops in the 15,000-30,000 b/d range. “We haven’t really quantified it because we haven’t really defined what [the final rules] will look like, but we have looked a lots of different models,” he said. DMR has looked at the potential impact from existing mandated curtailment rules and those would have “a very large impact economically,” he said.

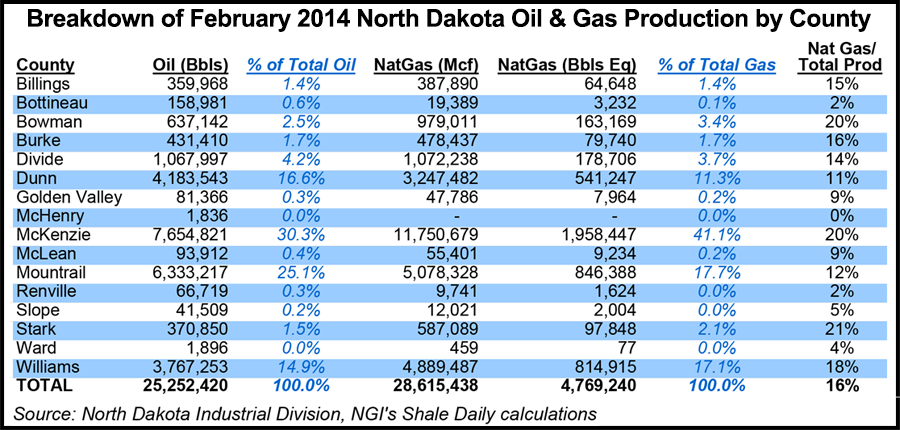

Gas flaring is an issue across all of North Dakota, but the problem appears to be more pervasive in some counties than in others. Natural gas accounted for 20% of total February oil and natural gas production in McKenzie County and 18% in Williams County. On the other hand, natural gas represented just 12% and 11% of total February production in Mountrail and Dunn Counties, respectively. Overall, natural gas production accounted for 16% of North Dakota’s total output for the month.

The enforcement of rules to cut flaring will be through the DMR’s existing monthly auditing of production well operations. “If someone is exceeding a production restriction, a field inspector will visit the well site and tell the operator he has to choke the well back,” Helms said.

“We’re hoping to get a reduction of between 10% and 15%, or in other words, we are hoping that the number of wells that are connected this fall will bring us down below 25% for flaring.”

Helms said the volume of flared gas in February was 10.95 Bcf.

He said he is looking forward to North Dakota hitting the 1 million b/d mark, adding that will put the state in a “pretty exclusive club.” The U.S. portion of the Williston Basin in North and South Dakota and eastern Montana already produced more than 1 million b/d, according to Helms. The vast majority comes from North Dakota, but Montana has 60-70,000 b/d and South Dakota has 4-5,000 b/d, Helms said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |