Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Storage Data Sends Bulls on A Run

Physical gas for Friday delivery all along the Eastern Seaboard fell by double digits in Thursday’s trading, but the resounding declines were offset by more modest losses elsewhere as well as gains in Rockies, San Juan and Permian basin delivery points.

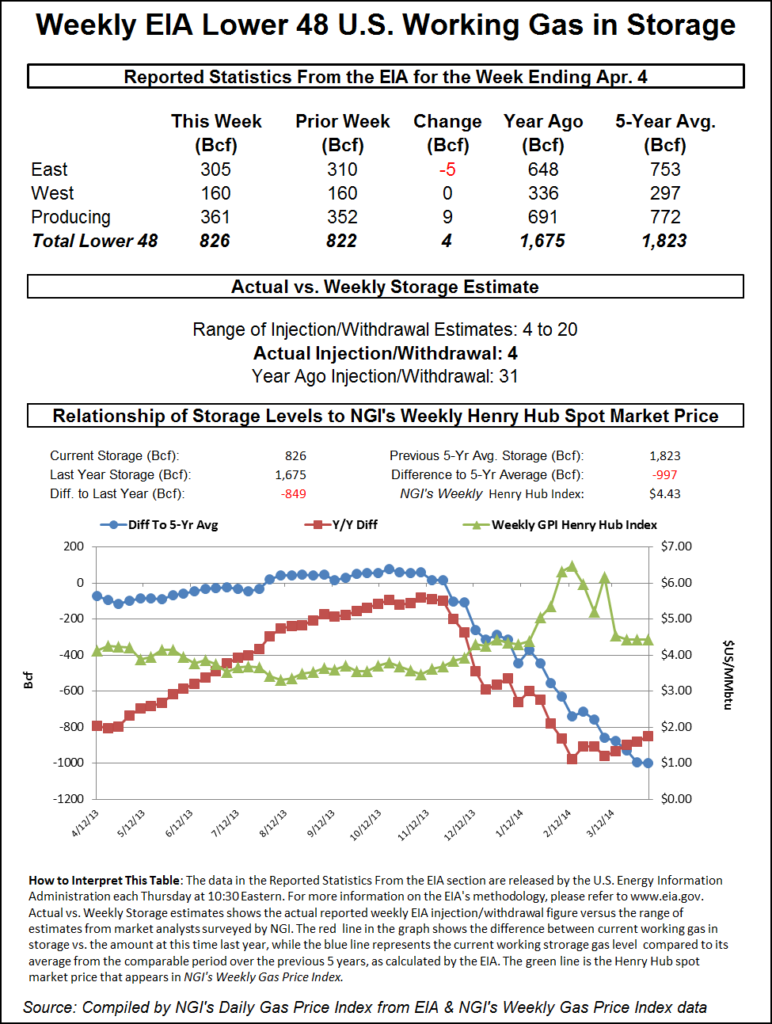

The Energy Information Administration (EIA) reported a modest build of 4 Bcf in its Thursday inventory report, much less than what the market was expecting, and prices advanced. At the close, May was higher by 6.9 cents to $4.655 and June had gained 7.8 cents to $4.671. May crude oil fell 20 cents to $103.40/bbl.

Mid-Atlantic, Marcellus and Northeast points led the charge lower as temperature forecasts called for readings well above normal into the weekend. Wunderground.com forecast that the high Thursday in Boston of 59 would rise to 63 on Friday and ease to 60 on Saturday. The seasonal high in Boston is 54. Albany, NY’s 63 high on Thursday would reach 64 Friday and 69 Saturday. The normal high for mid-April in Albany is 56. New Haven, CT, was forecast to see its 53 maximum on Thursday rise 10 degrees for both Friday and Saturday, well above the normal high of 54.

The National Weather Service in southeast Massachusetts reported that for the next few days, “a weak cold front will move across the region Friday into Friday night. A wave of low pressure will likely bring a period of showers…mainly to southeast New England Friday night. Dry and unseasonably mild conditions are expected this weekend and especially Monday. A slow-moving front will bring a soaking rain sometime Tuesday and/or Wednesday.”

Marcellus and Mid-Atlantic points took some heavy hits. Deliveries to Transco-Leidy fell 37 cents to $3.78, and gas on Tennessee Zone 4 Marcellus shed 30 cents to $3.77. Gas bound for New York City on Transco Zone 6 tumbled 27 cents to $4.22, and deliveries to Tetco M-3 dropped 23 cents to $4.25.

Appalachia and New England also fell into the loss column. Gas on Dominion South fell 24 cents to $4.06, and packages on Columbia Gas TCO lost 6 cents to $4.48. At the Algonquin Citygates Friday parcels were seen 36 cents lower at $4.62, and deliveries to Iroquois Waddington skidded 27 cents to $4.67. Gas on Tennessee Zone 6 200 L changed hands 31 cents lower at $4.69.

A few Permian Basin and San Juan Basin locations scored modest gains. Gas on El Paso non-Bondad added 2 cents to $4.47, and gas on Transwestern San Juan rose a penny also to $4.48. El Paso Permian parcels changed hands a penny higher also at $4.46.

Industry consultant Genscape reported storage gains at numerous locations totaling close to 1.5 Bcf/d. In a Thursday morning report it said, “East Texas storage injection increased by 0.2 Bcf/d week-on-week, going from 0.1 Bcf/d of withdrawal to 0.3 Bcf/d of injection, and California storage rose by 0.5 Bcf/d, going from 0.6 Bcf/d of injection to 1.1 Bcf/d of injection.” It also said Midwest storage operators increased their injections by 0.4 Bcf/d week-on-week, going from no injections to 0.4 Bcf/d of injection, and Louisiana storage injection increased by 0.2 Bcf/d week-on-week, going from 0.1 Bcf/d of injection to 0.3 Bcf/d of injection.

Futures market technicians see the current period of low volatility about to change. “When you look at the daily chart of the front month contract, you have had a massive contraction back in the Bollinger Bands. We had an earlier volatility blowout and the market has gone mostly sideways through March,” said David Thompson, vice president of Powerhouse LLC, a Washington DC-based trading and risk management firm.

“We see this pinches and squeezes in volatility that tend to lead to the next explosion in price. The first pinch was back in January; then we had the big launch of volatility. One again it looks like the perfect setup for a volatility pulse that for the moment looks to be moving higher,” he said.

“My RSI [relative strength indicator] on the front month contract has crossed from below to above the 50 level, and in my view that is the bulls gaining control of the market.”

Temperatures may be on the rise and it is officially spring, but traders and analysts won’t be fully convinced until the injection season is under way in earnest. Those on the supply side say the builds can’t start soon enough.

“The consensus this week is for a build, the first build of the year,” said John Sodergreen, editor of Energy Metro Desk (EMD) prior to the release of government storage figures. “The experts tell us that we’re not completely done with the cold, but we are done with the draws. Nonetheless, we’ll wait a couple more weeks before we call the winner to our end-of-season storage tally competition; 822 Bcf appears to be the final low point, but we’ll ping EIA for the final, final low point in U.S. underground inventories.”

Sodergreen is optimistic that refill will go smoothly, with ample gas in inventory by the end of October. “The next eight-10 weeks of inventory builds will largely set the tone for the rest of the year. It remains our belief that we will get very close to record tallies by the end of the season in November. EIA tells us that production is up a few points but demand is up far less.” Sodergreen’s EMD poll showed an average 15 Bcf build.

Others see about the same. A 15 Bcf increase would compare to last year’s 25 Bcf pull and the five year injection pace of 9 Bcf. ICAP calculated a build of 14 Bcf, and a Reuters poll of 23 traders showed an average 13 Bcf with a sample range of +4 to +20 Bcf. Tradition Energy calculated an increase of 18 Bcf.

Before their release, analysts saw storage figures as having the capability to surprise.

“[Thursday’s] storage report could provide some fireworks to gas prices today because of the fact that anything can happen as the industry transitions from the winter withdrawal season to the refill season,” said Alan Lammey, analyst with WeatherBELL Analytics. “Storage data during this changeover can often be very different from market expectations because model adjustments and recalibrations that are made along with the switch over — and some storage facilities are not ready for injections until later April.”

Others weren’t so optimistic about a timely refill. Lammey said, “In their most recent release of the monthly ‘STEO’ (Short Term Energy Outlook) [see Daily GPI, April 8], the EIA is projecting that the summer storage refill will be able to lift gas stocks up above 3.4 Tcf by the end of October. While it might be a far distance from the more comfortable five-year average, it is still well above the crucial 3 Tcf winter benchmark. However, if the 2014-2015 winter is anything similar to the winter of 2013-2014, then the U.S. may have a problem on its hands. That, of course, remains to be seen. But with the development of the El Nino, which [WeatherBELL] Chief Meteorologist Joe Bastardi has been repeatedly mentioning — it does give the market some underlying nervousness of what could lie ahead.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |