NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Daily GPI | NGI All News Access

Columbia Cutting Customers Some Slack in Storage Operations

Columbia Pipeline Group (CPG) is allowing its customers to keep more natural gas in storage and has increased the maximum amount of gas they are allowed to inject in April, according to the company’s most recent operations update.

Meanwhile, CPG and another major Northeast pipeline and storage operator, Dominion Transmission Inc. (DTI), reported that the amount of gas it had in storage was down sharply at the end of this year’s extreme winter compared to what was on hand last year and in 2012.

In a 36-page presentation to customers conducted on March 26, Houston-based CPG said it had extended the maximum monthly injection quantity (MMIQ) for its customers in April to 20% of storage contract quantity (SCQ), up from 15%. MMIQ as a percentage of SCQ was forecast to remain unchanged from May through August (20%), in September (13%) and in October (7%).

CPG also waived the requirement that its customers not exceed a maximum 25% SCQ in storage on April 1, and it rescinded a maximum daily injection quantity (MDIQ) cap on inventory transfers and injections, also beginning on April 1. But the company retained maximum limits of 60% and 85% of SCQ effective June 30 and Aug. 31, respectively.

Those moves are interpreted as a sign that the company is trying to get a jump on storage refill for next winter, but Wei Chien, an analyst with Genscape Inc., told NGI that this was not the whole picture.

“We remain skeptical of how this [25% SCQ] waiver may impact the reality of the gas shortage. We question the existence of shippers that have more than 25% of their storage contract quantity in the ground,” Chien said Friday. She said the MDIQ cap change “[aims] to promote shippers to be proactive in injecting gas by utilizing the transfer capability.”

Chien added that the increase in MMIQ to 20% “is viewed as a positive sign for [the] pipeline to work with shippers to ensure there [is] enough gas [put] into the ground in this injection season.

“Interestingly, Columbia is still maintaining the storage inventory limit for end of June to be 60% and for end of August to be 85%. We see those limits to be arbitrary numbers that are more for the purpose of maintaining operational integrity of the storage facility rather than a constraint for the shippers. At current level of deficit, ratchet limit should not be a concern.”

Chien said the bigger takeaway was CPG’s binding request for proposals for an operational transaction rate adjustment (OTRA) — issued on the same day, March 26 — for packages of gas totaling 5,000 to 10,000 MMBtu, with delivery from May 1 through Aug. 31. CPG said Wednesday that Columbia Gas Transmission Corp. (TCO) would collectively sell 245,070 MMBtu, while three pipelines — ANR, Panhandle and Texas Eastern — would collectively buy 199,900 MMBtu.

“They’re doing that to incentivize people to make gas available to storage facilities in Northern Ohio,” Chien said. “That would actually have more of an impact to TCO’s inventory system, and that will allow them to put enough gas into the ground. I definitely think the OTRA change will help Columbia to ensure that there is enough gas in the ground [for next winter].”

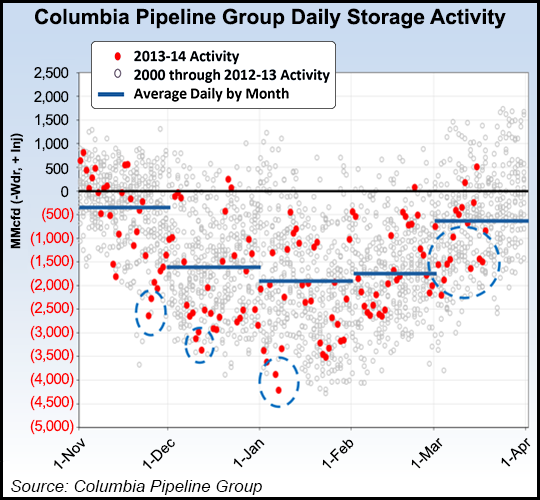

According to CPG’s presentation, withdrawal activity exceeded or was near 3.0 Bcf/d on at least five occasions last December, and exceeded or was near 4.0 Bcf/d on two occasions in January. The cold winter lingered into March, when the pipeline company saw withdrawals exceed or approach 1.5 Bcf/d at least eight times.

The company identified five peak days on its transmission system — Jan. 6 (7.4 million Dth), Jan. 7 (7.7 million Dth), Jan. 27 (7.3 million Dth), Jan. 28 (7.8 million Dth) and Jan 29 (7.4 million Dth).

CPG said it started the winter with an inventory short of what it typically has and saw “significant and numerous daily withdrawals” from its system. That in turn drove storage reservoir pressures down and lowered deliverability from storage. Because of the continued cold throughout the winter, augmented with periods of extreme cold, there was very limited or “no” time for pressure to rebound. Actual degree days exceeded the monthly norms from November through March.

Despite the increased restrictions required due to the high load, the company “met firm obligations under extreme operating conditions.” Columbia said its employees worked 10,000 hours of overtime in January and February.

Storage inventory fell by double digits, compared to 2013 levels, in three of CPG’s operating areas. Through March 17, inventories in Northern Ohio fell from being 28% full in 2013 to being 15% full in 2014, a loss of 13%. During the same time frame, the Ohio operating area fell from 28% to 16% full, and South Central Pennsylvania fell from 16% to 6% full, losses of 12% and 10%, respectively.

CPG reported that it had 32 Bcf in storage on March 28, this year, down from the 56.3 Bcf it had on March 29, 2013, and the 103.3 Bcf in storage on March 30, 2012.

By comparison, DTI reported that it had 29 Bcf in storage through gas day March 27. That mark was 64.2% lower than the 81 Bcf it had in storage on March 28, 2013, and it was down 80.9% from March 29, 2012, when it had 152 Bcf.

Last February, officials with units of Columbia and Dominion both testified before the Public Utilities Commission of Ohio, informing them that a loss of pressure at two regulator stations caused nearly 3,600 customers to temporarily lose gas service during two record cold snaps in January, which were brought on by the polar vortex (see Daily GPI, Feb. 21).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |