NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Daily GPI | Markets | Natural Gas Prices | NGI All News Access | NGI Data

Cash, Futures Firm, But Traders Mull Uncertain Refill Season

Physical gas for Friday delivery traded higher Thursday as a strong futures open hinted at further gains in both the cash and futures arena. Advances were seen at nearly all market points, and overall the physical market added about a nickel.

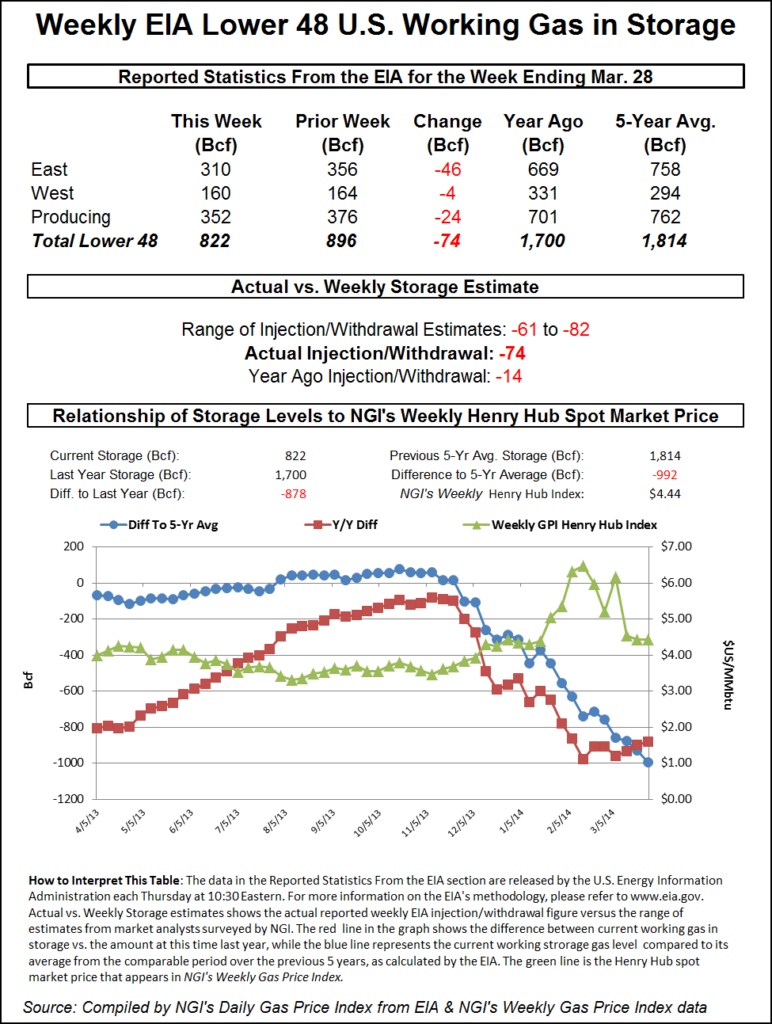

California and Gulf locations made double-digit gains. May futures opened floor trading a nickel higher, and the subsequent storage report by the Energy Information Administration of an on-target 74 Bcf withdrawal at first knocked futures down a couple of pennies, only to be followed by a healthy advance. At the close May had risen 10.6 cents to $4.470 and June was up 10.3 cents to $4.499. May crude oil rose 67 cents to $100.29/bbl.

Although it’s a little early for air conditioning load, next-day gas prices did rise as temperatures on the West Coast were seen riding a rising trend along with drier conditions. Wunderground.com forecast that Los Angeles’ 66 high Thursday would ease to 65 on Friday before rising to 70 on Saturday. The normal high in Los Angeles this time of year is 71. Burbank, CA’s 68 high on Thursday was seen sliding a degree to 67 Friday before jumping to 73 on Saturday. The normal high in Burbank in early April is 72. San Francisco’s Thursday high of 63 was predicted to fall to 60 on Friday but rebound to 65 on Saturday.

The National Weather Service in San Francisco called for “a weak front [to] move across the area tonight [Thursday] into Friday and bring a chance of light rain showers to the Bay area. Dry conditions will return for the upcoming weekend, and a significant warming trend is forecast from Saturday through early next week as high pressure builds along the West Coast.”

Gas for Friday delivery at Malin gained 6 cents to $4.51, and at the PG&E Citygates next-day gas came in at $5.03, up 8 cents. SoCal Citygate was quoted at $4.79, up 8 cents, and deliveries to SoCal Border points rose 10 cents to $4.62. At El Paso S Mainline Friday parcels changed hands at $4.65, up 13 cents.

Gulf points were also strong. Deliveries to ANR SE rose by 8 cents to $4.40, and gas on Columbia Gulf Mainline added a dime to $4.39. At the Henry Hub Friday packages jumped 13 cents to $4.48. On Tennessee 500 L gas for Friday delivery came in at $4.41, up 7 cents, and on Transco Zone 3 gas was quoted at $4.43, up 8 cents.

Futures traders were not all that impressed with the day’s gains. “We’ve been trading in this range from $4.15 to $4.60, and now we are getting back up towards $4.50, but I think we will find some sellers once we get up to $4.60 to $4.65,” said a New York floor trader. “The last couple of times up there you found some sellers.”

With the day’s 74 Bcf withdrawal the last storage report of the traditional November-March heating season, traders will be keeping a close eye on presumed upcoming injections to see if the industry can “fill the cupboard” and minimize the impact that a repeat 2013-2014 polar vortex season might bring.

“If we can bring inventories back to 3.8 Tcf, we will do something the industry has never done before,” said Tom Saal, vice president at INTL FC Stone in Miami. “I think in 2003 we put in an average of 77 Bcf per week, and that was the most we ever put in,” he told NGI.

“People say there is more pipe around, but is the pipe in the right location? Most of the recent expansions were for long-haul gas, and it wasn’t to put it into storage. As a futures broker, you look at the risk, and we will have to do something not done before. We may not be able to do that, and the market is not providing any financial incentive to store gas by the lack of forward carry.

“With 30 weeks in the injection season it will take injections averaging 100 Bcf per week to get back to 3.8 Tcf. The industry may question whether we need all that much gas in storage, but consumers and utilities will plan for a winter like we just had. I don’t think people will feel very comfortable going into next winter with only 3.5 Tcf in the ground,” Saal said.

For all intents and purposes, refilling storage to last year’s 3.8 Tcf will require some heavy lifting. Surveying the storage landscape, Teri Viswanath, commodity strategist at BNP Paribas, said, “With the injection season now officially under way, it appears that the market is decidedly polarized about the pace of restocking ahead,” she said. “This lack of consensus has resulted in range-bound trading for U.S. natural gas prices over the past month, with the front of the curve vacillating between $4.25 and $4.50/MMBtu.”

She added that the current debate on whether equilibrium can be restored this injection season has launched the recent “tug-of-war” for gas prices. “For our part, we remain constructive on prices based on the expectation that the combination of limited infrastructure additions and merchant ‘decontracting’ will ultimately curb the build in inventories.”

The analyst said with prices now trading at the upper level of the recent range, reliability concerns might be re-emerging. “The question remains on whether these investors remain steadfast during the stout injections that normally take place at the start of the season,” she said.

With the traditional withdrawal season wrapped up, analysts at Tudor, Pickering, Holt & Co. Inc. (TPH) said “the path to 3.6 Tcf” by the start of the next heating season from the current 822 Bcf is possible but will require certain factors to fall in place. “We see it as a challenge, but one that the gas market can accomplish given normal weather and $4.50/Mcf gas prices through injection season. We’re expecting $4.50/Mcf gas to incent[ivize] 3-plus Bcf/d of gas power gen demand switching back to coal, exceeding the modeled 2 Bcf/d needed to get to 3.6 Tcf of storage.”

On the supply side, TPH expects production to grow 2 Bcf/d year over year, but that growth is largely back-end weighted. “Notably, we are not showing a return to November 2013 peak production until July 2014,” TPH said. “Net imports are forecasted down y/y, dropping 0.5 Bcf/d (less from Canada, more to Mexico)…partially offsets production growth.”

Forecasting demand, TPH believes that the 2.8 Bcf/d balance of the year decline over April to December last year is driven by gas-to-coal switching (-2 Bcf/d), and an assumed return to normal winter weather (-1.4 Bcf/d) (2013 was 7% colder than 10 yr. avg). “An increase in industrial demand provides a partial offset with an expected 600 MMcf/d y/y increase balance 2014. Note that the modeled -2 Bcf/d of power gen gas-to-coal switching is conservative vs. our expectations. At $4.50/Mcf natural gas prices, we actually see switching levels above 3 Bcf/d…we will be watching this piece closely.”

Going into the storage report Bentek Energy’s flow model was looking for a 75 Bcf withdrawal in the 10:30 a.m. EDT release of the figures. This would be well above the five-year average of 8 Bcf and less than last year’s stout 95 Bcf pull.

It said total demand for the week ended March 28 peaked at 91 Bcf/d. “The increase in demand week over week was largely due to higher population-weighted heating degree days in all three EIA regions,” Bentek said. “Average temperatures in the Northeast and Midwest fell to 36 and 31 degrees, respectively. Withdrawals followed suit with the increased demand, especially within the Producing Region, which reported a total sample withdrawal of 9 Bcf for the week, 8 Bcf stronger than the previous week. Salt-dome facilities such as Pine Prairie, Egan and Southern Pines all reported significant withdrawals from the previous week.

Other estimates of the withdrawal included IAF Advisors at 81 Bcf; Ritterbusch and Associates calculated a reduction of 80 Bcf, and a Reuters poll of 24 traders and analysts showed an average of 74 Bcf with a range of 61-82 Bcf.

Inventories now stand at 822 Bcf and are 878 Bcf less than last year and 992 Bcf below the five-year average. In the East Region 46 Bcf was withdrawn and in the West Region 4 Bcf was pulled. Inventories in the Producing Region fell by 24 Bcf.

The Producing Region salt cavern storage figure decreased by 5 Bcf from the previous week to 60 Bcf, while the non-salt cavern figure fell by 18 Bcf to 293 Bcf.

MDA Weather Services in its morning six- to 10-day outlook said, “Another round of warmer changes are in place for the period, primarily during the middle to later parts of the period. Lingering cool air trended slightly cooler over the Midwest to the East at the onset of the period downstream of the strong western ridge. This ridge remains on track to break down with an active northern storm track helping to pull some of the warmth eastward.

“A more marginal shift to Alaska ridging combines with the ongoing active pattern and a more noteworthy +AO [Arctic Oscillation]/+NAO [North American Oscillation] set up to support more sustainable warmth from the central to the eastern US mid to late period.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |