Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

‘Marcellus Bounty’ to Benefit Leading Operators for Years, Moody’s Says

The Marcellus Shale’s earliest and most active operators will continue to see their fortunes rise as more infrastructure is built, markets expand and rising production gives them a seat atop the U.S. natural gas market, according to a report issued Tuesday by Moody’s Investor Service.

Moody’s analysts said they believe their advantageous outlook applies not just to some of the exploration and production companies that became the play’s earliest adopters, but also the midstream operators that risked it big in rushing to the play early on to serve them.

“Technological advancements since the early 2000s have allowed U.S. natural gas producers to reshape the industry largely through the development of the Marcellus,” said analyst Michael Sabella, who authored the 11-page report. “The Marcellus has emerged as one of the most profitable regions in the U.S. for producing natural gas, so even if prices return to the weak levels of 2012, producers there will be rewarded.”

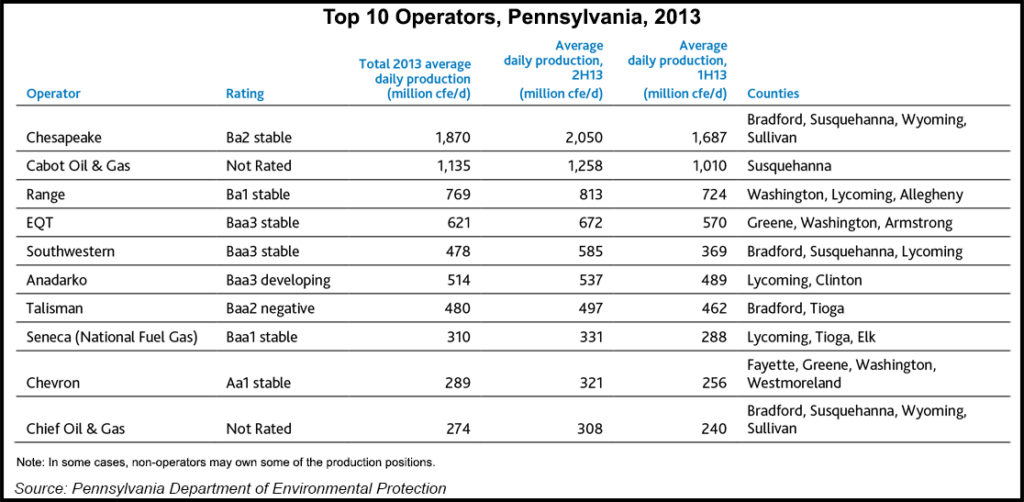

Moody’s noted that growth in the Marcellus has coincided with declining natural gas prices, which have weakened the credit quality of some producers that explore outside of the Appalachian Basin, such as Exco Resources Inc., Forest Oil Corp. and Quicksilver Resources Inc., while independent operators in the Northeast such as Range Resources Corp., Chesapeake Energy Corp. and EQT Corp. have seen their activities accelerate and their credit ratings either improve or stabilize.

The report also highlights how production in the Marcellus has disrupted the domestic natural gas market, with throughput to the Northeast on major interstate lines dropping; contracts rolling off; prices declining and the displacement of coal in power generation, which has largely prompted pipeline reversals and new projects that would benefit Marcellus operators (see Shale Daily, March 12).

“Pipeline reversals and exports of liquefied natural gas (LNG) will create additional investment opportunities for Marcellus producers, even while offering only marginal benefits for gas producers outside the region,” Sabella said. “Marcellus producers will remain competitive in the fledgling U.S. LNG industry, and production growth will receive another boost once these projects come online.”

While longer laterals, shorter hydraulic fracturing (frack) stages and pad drilling have reduced costs and increased efficiencies in the Marcellus, the play’s economics would be further aided by the natural gas liquids (NGL) transmission projects that began in earnest this year with the Appalachia-to-Texas Express (see Shale Daily, Dec. 5, 2013) and others expected to come online in the coming years (see Shale Daily, Aug. 12, 2013; Oct. 25, 2013; Dec. 5, 2013).

Midstream operators such as MarkWest Energy Partners LP (see Shale Daily, Feb. 3) and Sunoco Logistics Partners LP (see Shale Daily, Feb. 1, 2012; Sept. 8, 2011), which aggressively entered the Marcellus early, “are beginning to see benefits” as they complete processing facilities and pipelines, and as growing production in the region boosts their earnings and cash flows, according to the report.

However, long-haul natural gas pipelines, including Boardwalk Pipelines LP’s Texas Gas Transmission LLC , have seen throughput volumes decline in recent years and contract terms weaken (see Shale Daily, Oct. 28, 2013; March 28). Unlike the companies that have focused more intently on the Northeast, other midstream operators that are exposed to gathering and processing in weakening supply regions, such as Atlas Pipeline Partners LP and DCP Midstream LLC, have “been forced to find new roles for their assets in a changing landscape.”

Moody’s said the play’s close proximity to the Northeast has aided development in a way that has allowed it to unfold more quickly in comparison to other gas plays such as the Haynesville Shale in East Texas/North Louisiana. Delineation efforts under way in central Pennsylvania could also turn about two-thirds of the state into core producing regions, beyond those already in the northeast and southwest parts of the state, the report said.

Moreover, if New York were to move forward by lifting its moratorium on high volume hydraulic fracturing and horizontal drilling, 40 Tcfe of the the play’s estimated 141 Tcfe of recoverable reserves would also be in play and give operators more investment opportunities, Moody’s said.

Moody’s identified Chesapeake, EQT, Range, Antero Resources Corp., Southwestern Energy Co., Cabot Oil and Gas Inc. and Anadarko Petroleum Corp. among some of the play’s leading companies poised for the most growth.

The report also noted how late-comers such as Magnum Hunter Resources Corp., Rex Energy Inc., WPX Energy Inc. and Consol Energy Inc. have struggled to date, but added that they could see substantial growth opportunities in the future as a result of their acreage positions in Pennsylvania and West Virginia.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |