Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

January Gas Output Hits New Record Despite Freeze-offs, Says EIA

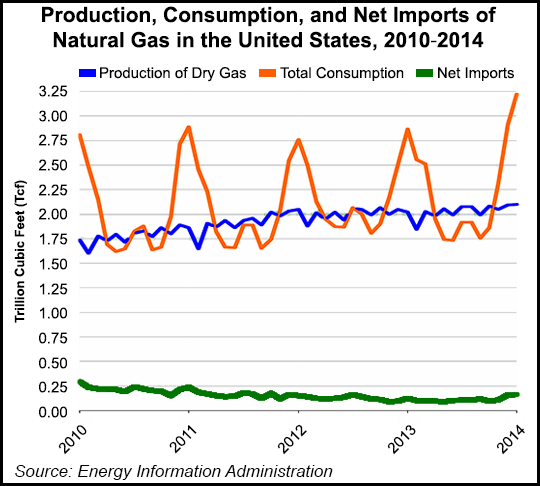

Freeze-offs and colder-than-usual temperatures across the United States failed to squash U.S. dry natural gas production in January, with total output of 2.098 Tcf, breaking December’s record volume of 2.092 Tcf, the U.S. Energy Information Administration (EIA) reported. Gross withdrawals in the Lower 48 increased to 2.640 Tcf, up from a revised December figure of 2.631 Tcf.

The preliminary EIA-914 production survey, issued late Monday, is based on reports of production and consumption rates in all 50 states. The December number in the Lower 48 states was revised upward by 0.14 Bcf/d, mostly because of an increase in gas production of 0.11 Bcf/d in Texas, which also led all of the states in January production. December totals initially had indicated that production rose 4% year/year to a high of 2.630 Tcf (see Shale Daily, March 3).

Marketed gas production climbed to to 2.215 Tcf from 2.208 Tcf in December. Net storage withdrawals for January totaled 967 Bcf, versus 714 Bcf in December. Net gas imports in January rose month/month to 161 Bcf from 156 Bcf.

January gas consumption was at its highest level ever at 3.219 Tcf, topping 100 Bcf/d for the first time, EIA said. Deliveries to residential (33.6 Bcf/d), commercial (18.5 Bcf/d) and industrial (23.4 Bcf/d) consumers each were the largest ever reported.

The report came as a surprise to some analysts who follow the market, particularly since there were two weeks in January at or below 10-year record cold temperatures.

“We would not have been surprised if production was down sequentially” on freeze-offs and pipeline shut-ins because December output had fallen 1 Bcf/d from November, said Tudor, Pickering, Holt & Co.

On a volumes basis, Texas output was by far the most of any state, rebounding to November levels and up 0.5 Bcf/d to 22.7 Bcf/d. Gas production in Texas had fallen in December because of inclement weather. Maintenance work on Texas infrastructure was completed over the period, which was a major reason for the production rebound, according to EIA.

In New Mexico, gas output in January climbed by 2.6% from December to 3.5 Bcf/d. It had declined in December by 3.7% from November.

In the Other States category, including the Marcellus and Utica shales, output reportedly was off 0.5% from December to 28.8 Bcf/d, but that’s 20% higher than in January 2013, EIA said.

Louisiana gas production rose slightly by 0.2% from December to 5.6 Bcf/d; however, output was down more than 23% year/year (7.4 Bcf/d). Gulf of Mexico gas production continued to decline in January to 3.2 Bcf/d, versus year-ago output of 4.1 Bcf/d.

The reported production growth was significantly higher than pipeline flow estimates, which had indicated that output would fall almost 0.7 Bcf/d from December, said Barclays Capital analysts Biliana Pehlivanova and Shiyang Wang.

“Pipeline flow estimates, of course, have poor visibility into the intrastate flows in several states, most notably in Texas,” they said in a note.

Meanwhile, gas production in New Mexico increased 0.09 Bcf/d from December, while output in Oklahoma, Wyoming and Louisiana was relatively flat. Withdrawals from the Federal Offshore Gulf of Mexico declined 0.14 Bcf/d month/month.

“The year/year growth looks much higher than that of the previous month’s report (plus 1.1 Bcf/d) for 2013, as the EIA has revised the 2012 historical data lower,” said the Barclays analysts.

“While we believe freeze-offs continued to affect natural gas production in February, the February report should indicate a moderate recovery in Lower 48 gross withdrawals due to the increase of average temperatures from the previous months,” said Pehlivanova and Wang “By the end of March, production should recover completely, despite much colder-than-normal temperatures. Overall for 2014, we expect natural gas production to exhibit robust growth,” which is a forecast that several analysts have made.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |