Shale Daily | E&P | NGI All News Access

North Montney Seen as Liquids-Rich, Then Gas-Rich, Too

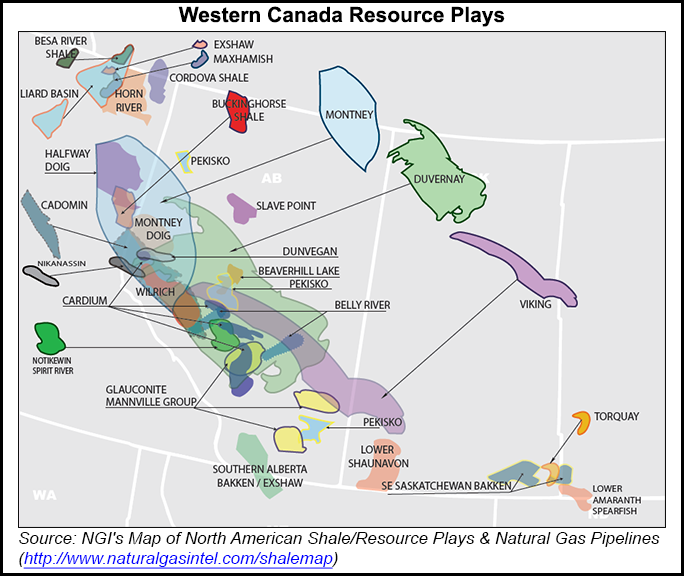

Producers have found a sweet spot, steeped in liquid byproducts, to sustain years of trials and adaptations of horizontal drilling and hydraulic fracturing on Canada’s gas and oil “Near Frontier” in northern British Columbia (BC), according to the country’s top energy transporter.

Wells into the North Montney Shale formation, along the southern leg of the Alaska Highway in the Dawson Creek-Fort St. John area, are wet enough to contribute significant support for a new pipeline for the natural gas left over after extracting their liquids, the National Energy Board (NEB) is being told.

The new pipeline’s sponsor — TransCanada Corp.’s supply grid in BC and Alberta, Nova Gas Transmission Ltd. (NGTL) — disclosed that producers in the region are pumping out 10-15 b/d of liquids with every 1 MMcf of North Montney gas.

Provided wells average at least the 13 b/d mid-point of their performance range to date, production would more than double to 21,500 b/d by 2016 from the current 9,400 b/d, NGTL said in fresh evidence submitted in support of its NEB construction application.

Barring unexpected discoveries of tight limits on the drilling sweet spot, North Montney liquids production will keep on growing and nearly double again to the 40,000 b/d-plus level in the 2020s, NGTL said. The prediction is based on an “understanding” of confidential information garnered from transportation service customers that have booked capacity on the proposed BC pipeline, the North Montney Project, NGTL said.

Progress Energy, the Canadian arm of Malaysian conglomerate Petroliam Nasional Berhad (Petronas), is the chief customer for the proposed addition but not the only one behind the C$1.7 billion (US$1.5 billion) project.

NGTL is seeking approval to install 305 kilometers (190 miles) of jumbo pipe, 42 inches in diameter, across the North Montney deposit. The project schedule said service requests call for deliveries to start in 2016 and grow to 2 Bcf/d as of 2019.

The new NEB filing said, “It is NGTL’s understanding that Progress Energy and other customers will construct several gas plants or work with current operators to upgrade existing plants. Approximately 14 gas plants will be required to process the gas expected to be produced by 2020. The customers are also in discussions with midstream companies to secure the sale and transport of NGLs [natural gas liquids] associated with increased gas production.”

NGTL said new plants will be built along with additions to existing processing sites in the region, which has a production pedigree dating back to the 1950s as the industry’s Near Frontier, as opposed to the far one along the Mackenzie River in the Northwest Territories.

NGTL’s statement to the NEB stands out as practical confirmation of a recent assessment of the Montney shale by the BC Oil and Gas Commission, BC Ministry of Natural Gas Development and Alberta Energy Regulator.

The earth sciences report rated the potential of the 130,000-square kilometer (52,000-square-mile) formation as astronomical: 449 Tcf of natural gas, 14.9 billion bbl of natural gas liquids and 1.1 billion bbl of oil.

Although the North Montney Project is designed to enable gas to flow to any markets, the primary target remains the Petronas-Progress proposal for a liquefied natural gas (LNG) terminal on the BC coast. The project, Pacific NorthWest LNG, has an NEB license for exports of up to 2.7 Bcf/d and aims to make a formal construction decision this year.

To ensure regulatory paperwork keeps up with the race to build LNG terminals on BC’s Pacific coast, the federal cabinet in Ottawa has ratified the NEB’s latest batch of four gas export licenses.

Along with the Petronas-Progress project, the final approvals went to Woodfibre LNG (proposed by Singapore energy trading conglomerate Pacific Oil & Gas Ltd.), WCC LNG (Imperial Oil and affiliate ExxonMobil), and Prince Rupert LNG (BG Group).

In Canada, cabinet ratification of NEB regulatory decisions is normally a formality and seldom even announced. But newly appointed Natural Resources Minister Greg Rickford used the occasion to affirm federal support for LNG exports, which are also eagerly supported by the provincial government in BC as a major economic growth opportunity.

The official statement pointed to “strategic importance of these approvals.” The natural resources ministry said, “Market diversification for Canada’s natural gas remains a top priority for the Government of Canada. Canada has an abundance of natural gas and the potential to become a major global supplier of LNG. The growing economies of Asia are obvious markets due to the short shipping distance from the British Columbia coast.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |